-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight - December 2018 - II

Jan 15, 2019

5 mins

3 Rating

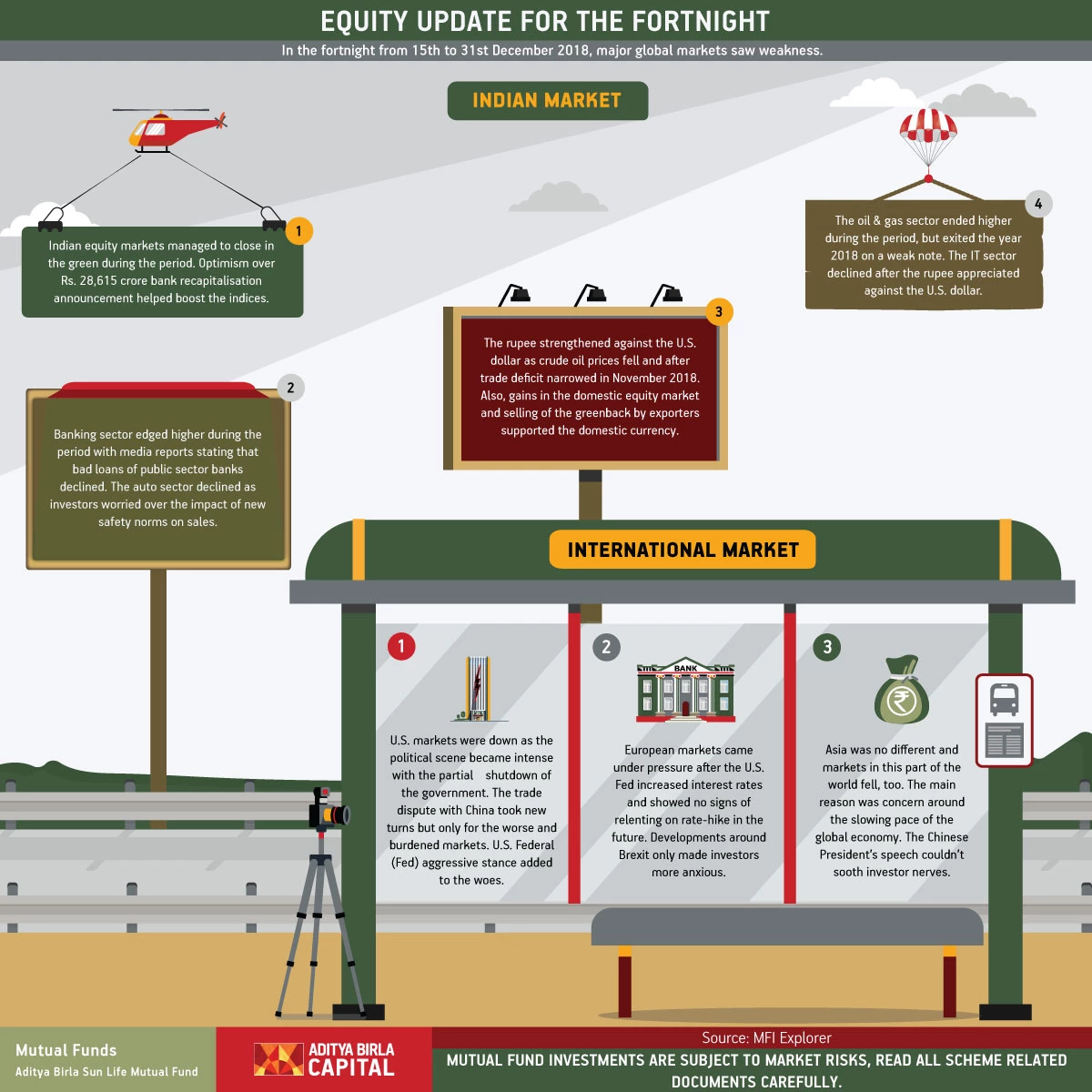

In the fortnight from 15th to 31st December 2018, major global markets saw weakness.

International Market

U.S. markets were down as the political scene became intense with the partial shutdown of the government. The trade dispute with China took new turns but only for the worse and burdened markets. U.S. Federal (Fed) aggressive stance added to the woes.

European markets came under pressure after the U.S. Fed increased interest rates and showed no signs of relenting on rate-hike in the future. Developments around Brexit only made investors more anxious.

Asia was no different and markets in this part of the world fell, too. The main reason was concern around the slowing pace of the global economy. The Chinese President’s speech couldn’t sooth investor nerves.

Indian Market

Indian equity markets managed to close in the green during the period. Optimism over Rs. 28,615 crore bank recapitalisation announcement helped boost the indices.

Banking sector edged higher during the period with media reports stating that bad loans of public sector banks declined. The auto sector declined as investors worried over the impact of new safety norms on sales.

The oil & gas sector ended higher during the period, but exited the year 2018 on a weak note. The IT sector declined after the rupee appreciated against the U.S. dollar.

The rupee strengthened against the U.S. dollar as crude oil prices fell and after trade deficit narrowed in November 2018. Also, gains in the domestic equity market and selling of the greenback by exporters supported the domestic currency.

Source: MFI Explorer

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

1800-270-7000

1800-270-7000