-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Equity Update for the Fortnight June'18 - II

Jul 13, 2018

5 mins

4 Rating

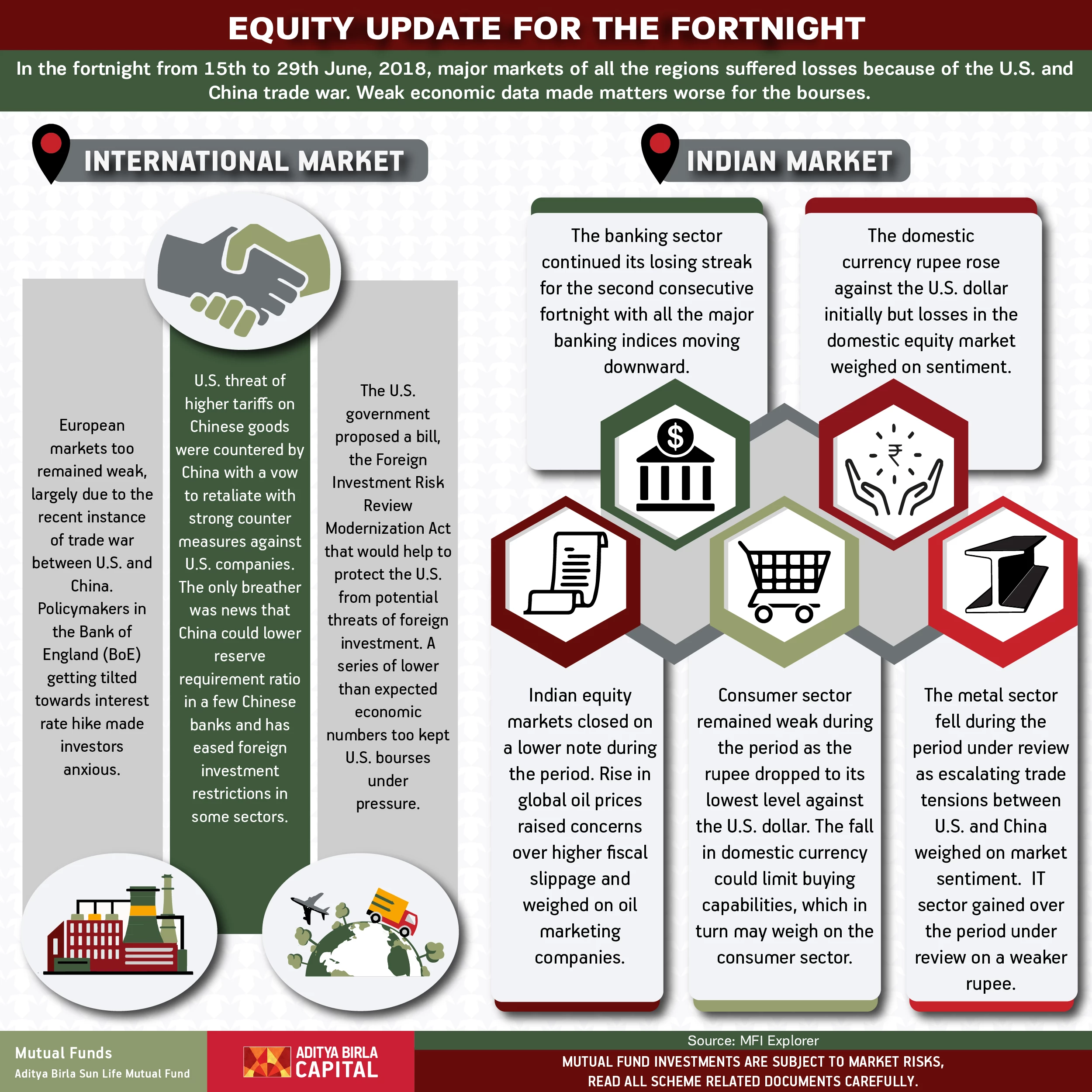

In the fortnight from 15th to 29th June, 2018, major markets of all the regions suffered losses because of the U.S. and China trade war. Weak economic data made matters worse for the bourses.

International Market

The U.S. government proposed a bill, the Foreign Investment Risk Review Modernization Act that would help to protect the U.S. from potential threats of foreign investment. A series of lower than expected economic numbers too kept U.S. bourses under pressure.

European markets too remained weak, largely due to the recent instance of trade war between U.S. and China. . Policymakers in the Bank of England (BoE) getting tilted towards interest rate hike made investors anxious.

U.S. threat of higher tariffs on Chinese goods were countered by China with a vow to retaliate with strong countermeasures against U.S. companies. The only breather was news that China could lower reserve requirement ratio in a few Chinese banks and has eased foreign investment restrictions in some sectors.

Indian Market

Indian equity markets closed on a lower note during the period. Rise in global oil prices raised concerns over higher fiscal slippage and weighed on oil marketing companies.

The banking sector continued its losing streak for the second consecutive fortnight with all the major banking indices moving downward.

Consumer sector remained weak during the period as the rupee dropped to its lowest level against the U.S. dollar. The fall in domestic currency could limit buying capabilities, which in turn may weigh on the consumer sector.

The metal sector fell during the period under review as escalating trade tensions between U.S. and China weighed on market sentiment. IT sector gained over the period under review on a weaker rupee.

The domestic currency rupee rose against the U.S. dollar initially but losses in the domestic equity market weighed on sentiment.

Source: MFI Explorer

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Similar Articles

1800-270-7000

1800-270-7000