-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight - May 2018 - I

Jun 22, 2018

5 mins

4 Rating

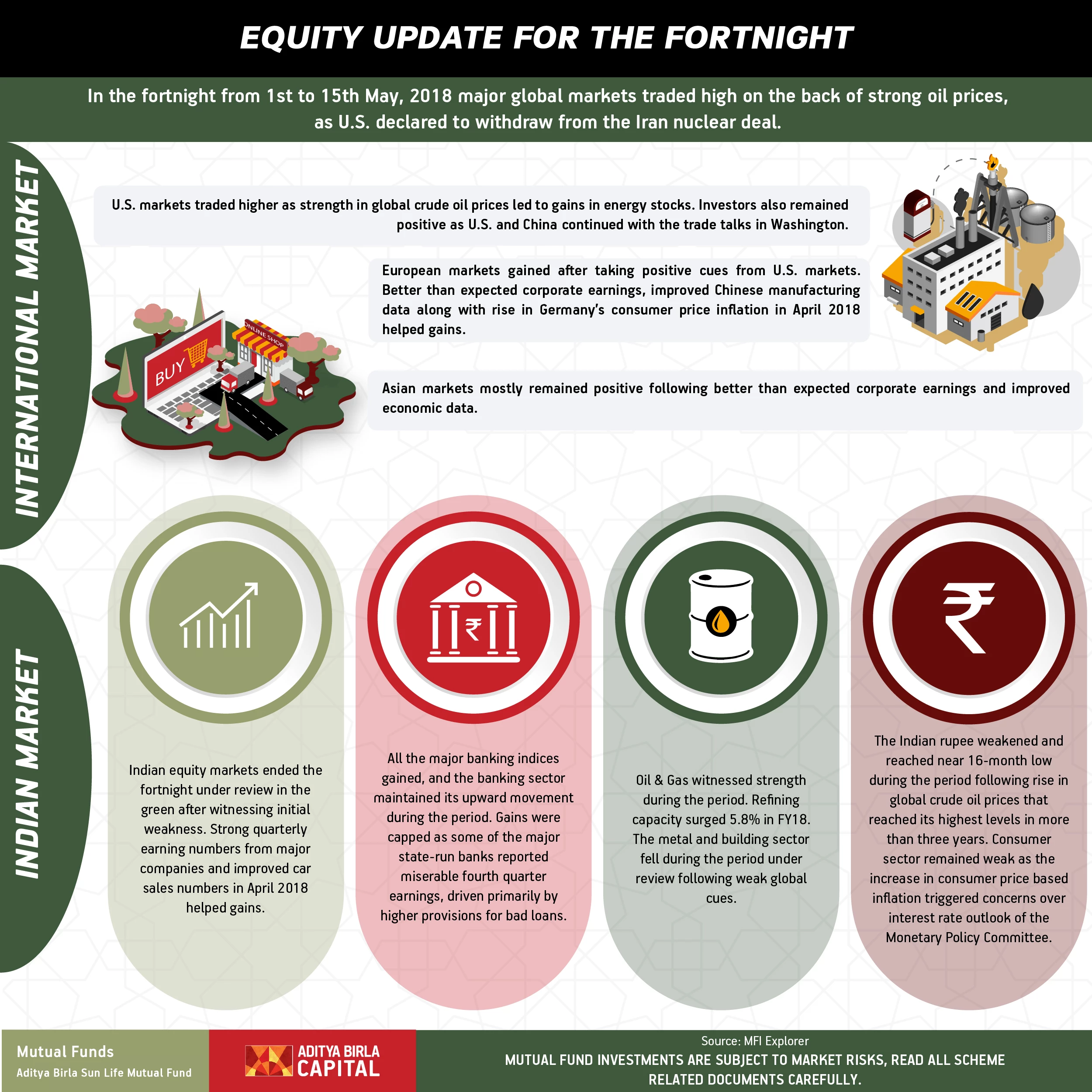

In the fortnight from 1st to 15th May, 2018 major global markets traded high on the back of strong oil prices, as U.S. declared to withdraw from the Iran nuclear deal.

International Market

U.S. markets traded higher as strength in global crude oil prices led to gains in energy stocks. Investors also remained positive as U.S. and China continued with the trade talks in Washington.

European markets gained after taking positive cues from U.S. markets. Better than expected corporate earnings, improved Chinese manufacturing data along with rise in Germany’s consumer price inflation in April 2018 helped gains.

Asian markets mostly remained positive following better than expected corporate earnings and improved economic data.

Geopolitical concerns are easing as U.S. is optimistic of curbing North nuclear ambitions, further contributed to the upside. Manufacturing activity expanded in Japan, China and Singapore.

Indian Market

Indian equity markets ended the fortnight under review in the green after witnessing initial weakness. Strong quarterly earning numbers from major companies and improved car sales numbers in April 2018 helped gains.

All the major banking indices gained, and the banking sector maintained its upward movement during the period. Gains were capped as some of the major state-run banks reported miserable fourth quarter earnings, driven primarily by higher provisions for bad loans.

Oil & Gas witnessed strength during the period. Refining capacity surged 5.8% in FY18. The metal and building sector fell during the period under review following weak global cues.

Consumer sector remained weak as the increase in consumer price based inflation triggered concerns over interest rate outlook of the Monetary Policy Committee.

The Indian rupee weakened and reached near 16-month low during the period following rise in global crude oil prices that reached its highest levels in more than three years.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000