-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight - June 2018 - I

Jun 29, 2018

5 mins

4 Rating

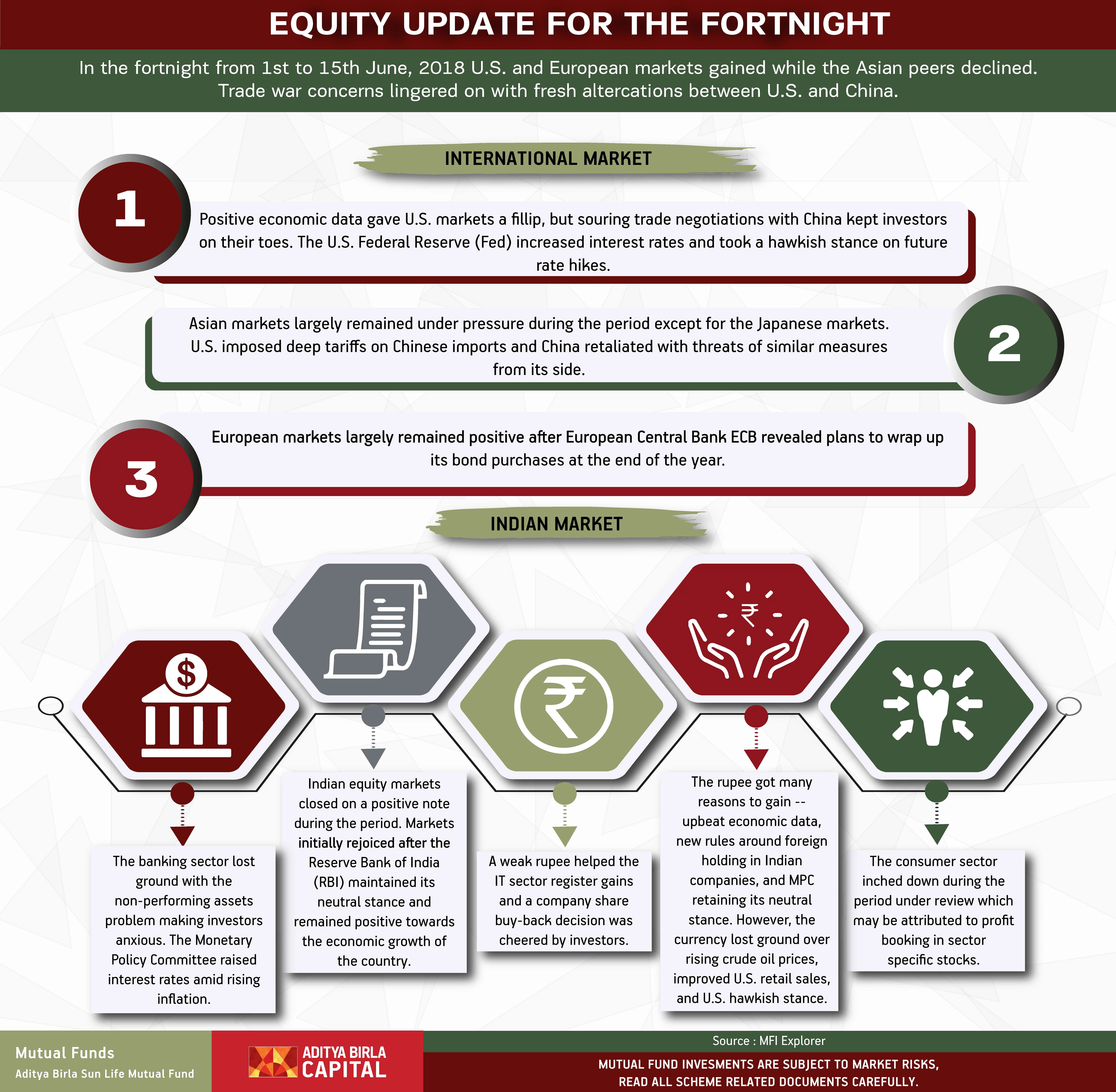

In the fortnight from 1st to 15th June, 2018 U.S.and European markets gained while the Asian peers declined. Trade war concerns lingered on with fresh altercations between U.S. and China.

- International Market

Positive economic data gave U.S. markets a fillip, but souring trade negotiations with China kept investors on their toes. The U.S. Federal Reserve (Fed) increased interest rates and took a hawkish stance on future rate hikes.

European markets largely remained positive after European Central Bank ECB revealed plans to wrap up its bond purchases at the end of the year.

Asian markets largely remained under pressure during the period except for the Japanese markets. U.S. imposed deep tariffs on Chinese imports and China retaliated with threats of similar measures from its side.

- Indian Market

Indian equity markets closed on a positive note during the period. Markets initially rejoiced after the Reserve Bank of India (RBI) maintained its neutral stance and remained positive towards the economic growth of the country.

The banking sector lost ground with the non-performing assets problem making investors anxious. The Monetary Policy Committee raised interest rates amid rising inflation.

A weak rupee helped the IT sector register gains and a company share buy-back decision was cheered by investors.

The consumer sector inched down during the period under review which may be attributed to profit booking in sector specific stocks.

The rupee got many reasons to gain -- upbeat economic data, new rules around foreign holding in Indian companies, and MPC retaining its neutral stance. However, the currency lost ground over rising crude oil prices, improved U.S. retail sales, and U.S. hawkish stance.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000