-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

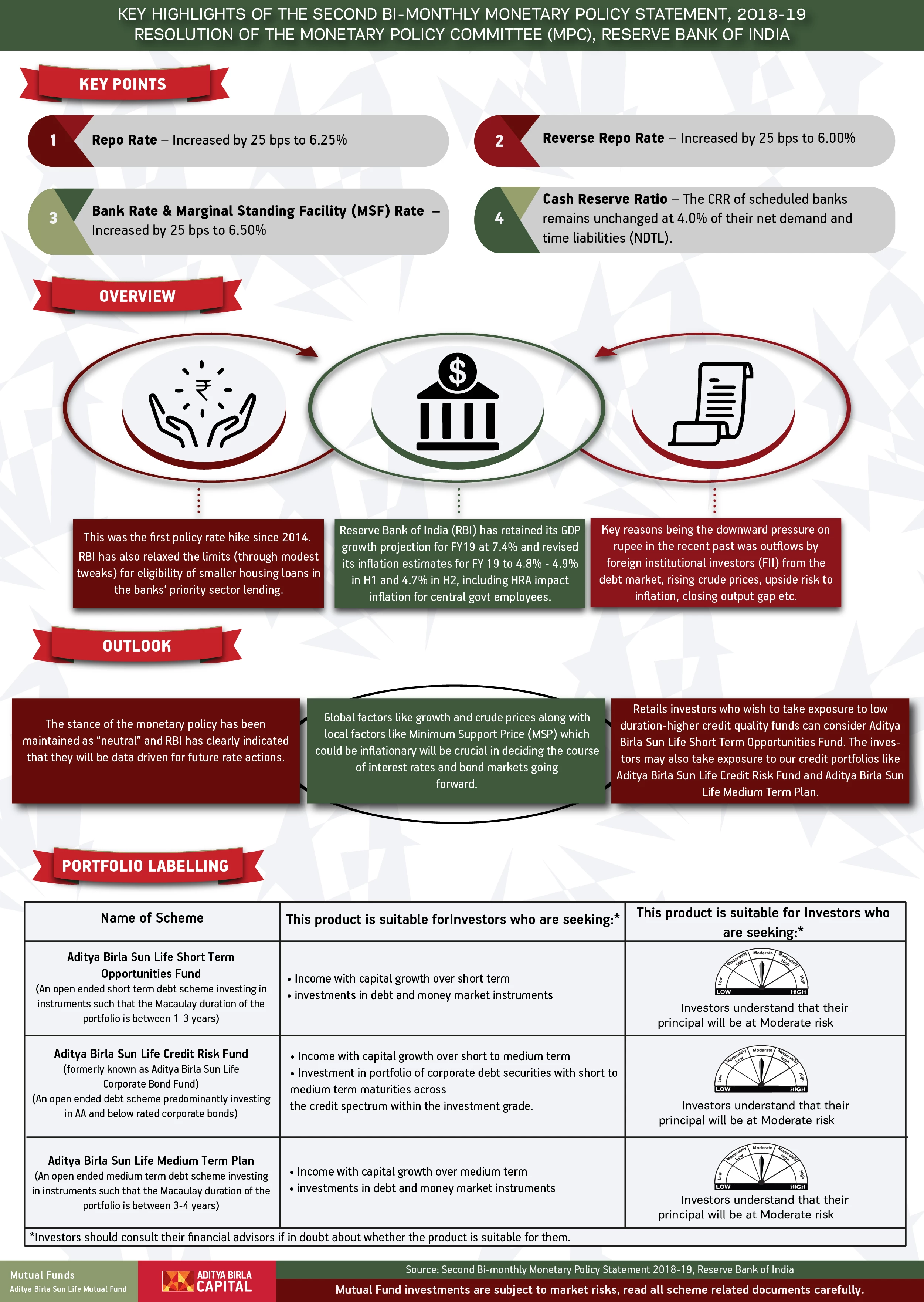

Key Highlights of the Second Bi-monthly Monetary Policy Statement, 2018-19

Jun 14, 2018

5 mins

4 Rating

Resolution of the Monetary Policy Committee (MPC), Reserve Bank of India

Key Highlights of the Policy Statement

- Repo Rate – increased by 25 bps to 6.25%

- Reverse Repo Rate – increased by 25 bps to 6.00%

- Bank Rate & Marginal Standing Facility (MSF) Rate – increased by 25 bps to 6.50%

- Cash Reserve Ratio – The CRR of scheduled banks remains unchanged at 4.0% of their net demand and time liabilities (NDTL).

This was the first policy rate hike since 2014.

Key reasons being the downward pressure on rupee in the recent past was outflows by foreign institutional investors (FII) from the debt market, rising crude prices, upside risk to inflation, closing output gap etc.

Reserve Bank of India (RBI) has retained its GDP growth projection for FY19 at 7.4% and revised its inflation estimates for FY 19 to 4.8% - 4.9% in H1 and 4.7% in H2, including HRA impactinflation for central govt employees.

RBI has also relaxed the limits (through modest tweaks) for eligibility of smaller housing loans in the banks’ priority sector lending.

Interest Rate Outlook

The stance of the monetary policy has been maintained as “neutral” and RBI has clearly indicated that they will be data driven for future rate actions.

Global factors like growth and crude prices along with local factors like Minimum Support Price (MSP) which could be inflationary will be crucial in deciding the course of interest rates and bond markets going forward.

Retails investors who wish to take exposure to low duration-higher credit quality funds can consider Aditya Birla Sun Life Short Term Opportunities Fund. The investors may also take exposure to our credit portfolios like Aditya Birla Sun Life Credit Risk Fund and Aditya Birla Sun Life Medium Term Plan.

Source: Second Bi-monthly Monetary Policy Statement 2018-19, Reserve Bank of India

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000