-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Get Liquid: Investing for Short-Term Goals with Liquid Funds

Apr 24, 2023

4 min

4 Rating

Looking to take a much-awaited international vacation with family?

Buying that car you have been admiring for a while?

Planning to buy the jewellery piece you always wanted to gift someone special?

If you have short-term goals like these to fulfil then liquid funds are for you!

And not just that, you can even plan to build a contingency fund to meet unforeseen future expenses with the help of liquid funds.

That being said, let us understand more about liquid funds.

What are liquid funds?

Liquid funds are open-ended debt mutual funds that park your money in high-quality debt and money market instruments such as term deposits, commercial papers, certificates of deposit, treasury bills, call money and so on with tenures of up to 91 days.

As the name suggests, liquid funds invest in highly liquid instruments of very short tenure that enable you to have access to cash at short notice.

Liquid funds are perceived to be a safe investment category. The primary objective of liquid funds is to provide reasonable returns at a high level of safety and liquidity through judicious investments in high-quality debt and money market instruments.

Also Read – What are Open-Ended Schemes?

Why should you invest in liquid funds?

Liquid funds offer the following benefits:

-

Low risk

Liquid funds are considered low-risk funds that primarily focus on providing high levels of safety and reasonable returns. Liquid fund interest rate risk is relatively low because of their high liquidity and investments in high-quality securities. The value of a liquid fund is relatively stable regardless of the prevailing interest rate in the market.

-

Relatively Safe investment

Liquid fund investments are tied to high quality debt and money market securities that have a short holding period of 91 days which gives confidence to investors that their investment will not be negatively affected by any unexpected changes. Owing to low duration high-quality securities, the Net Asset Value (NAV) of liquid funds does not fluctuate much. These funds demonstrate stability regardless of the market environment.

-

Easy access to cash

Liquid funds allow you to instantly liquidate your investments and redeem cash within minutes in case of an emergency. Quick redemption ensures handy access to your money. And, you don’t even have to pay any penalty for withdrawing money from a liquid fund since there is no minimum lock-in period requirement. You can even sell the fund units without paying any exit load if you redeem after seven days.

You may also Read about - What is Liquidity?

Also Read - Exit Load in Mutual Fund: Meaning, Types, and Calculation

Key takeaways

Liquid funds have a place in almost every investor's mutual fund portfolio. They are ideal for investors who want to park their surplus cash for a short period. Investors who seek reasonable returns with high levels of safety and convenience of liquidity over the short term may also consider investing in liquid funds.

Looking to invest in liquid funds? Check out Aditya Birla Sun Life Liquid Fund which helps you park your funds for a very short term while ensuring the safety of capital. It is a money management solution for risk-averse investors who seek reasonable returns.

To know more about Aditya Birla Sun Life Liquid Fund, click here or contact your financial advisor today.

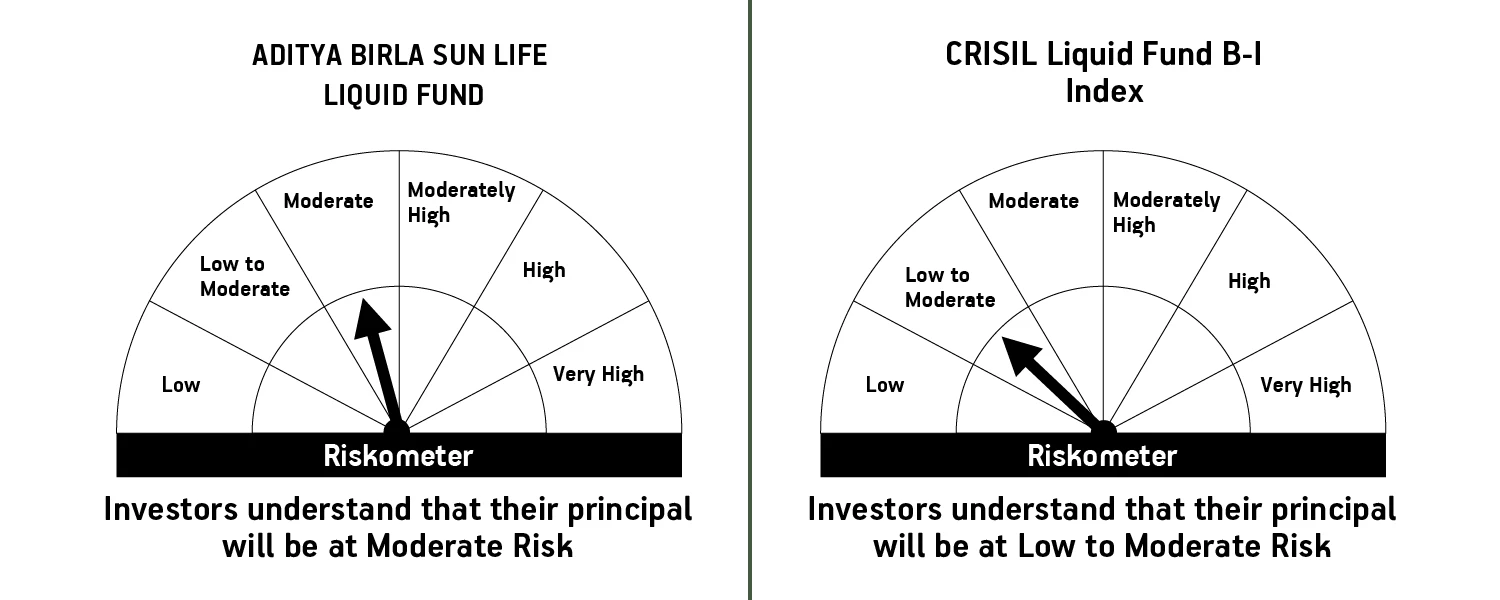

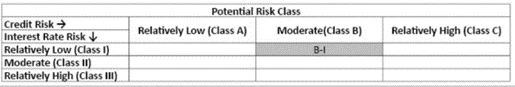

Aditya Birla Sun Life Liquid Fund

(An Open-ended Liquid Scheme)

This product is suitable for investors who are seeking*

- reasonable returns with high levels of safety and convenience of liquidity over short term

- investments in high quality debt and money market instruments with maturity of upto 91 days

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000