-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Gold Funds: A Secure Hedge Against Inflation with ABSLMF

Oct 24, 2024

5 min

4 Rating

For ages, when a crisis has occurred, gold has stood out as an investors' best friend. It has been a lifesaver to investors who have suffered heavy losses in other investment options.

One of the biggest challenges of investment is beating inflation. Therefore, if an investment does not offer inflation-beating returns, there is a major chance that the investment will not leave enough for the retirement years of the investor. However, gold has always performed well during inflation periods.

With Aditya Birla Sun Life Mutual Fund’s gold funds, investors can tap into the power of gold without the hassle of storing it in a physical form. A gold fund is simply a type of mutual fund or ETF that is primarily invested in either gold or gold-related assets, unlike fixed-income schemes and bonds that falter in times of inflation. Due to the inherent value and limited supply of gold in several cultures, gold funds continue to stay promising.

Gold Funds: A Secured Hedge

As discussed, a mutual fund that indirectly or directly invests in gold reserves is referred to as a gold fund. Investments are typically made in gold stocks, generating, and allocating syndicates, mining company stocks, and physical gold. It is an easy method to invest in gold without purchasing it physically.

These are open-ended investments, which are based on the units offered by the gold exchange-traded fund. Gold funds are also used as a hedge to protect investors against any economic shocks. Often, investors diversify their investment portfolio with 10% to 20% investment towards gold funds to secure themselves against fluctuations in the market.

Understanding Gold Hedging

Gold hedging is a process in which an investor employs gold derivatives or physical gold to shield their investments from the depreciation of other assets or securities. It is a technique through which an investor requires gold to protect themselves from any possible inflation in multiple underlying assets.

Gold is the most well-known element that is used as a valuable possession. It stands as a symbol of wealth and currency. In the present financial systems, gold is widely used by investors as a hedging tool, especially during inflation and economic instabilities.

Why Invest In Gold Funds During An Inflationary Period?

Gold funds are the optimal investment option for investors who are willing to diversify their portfolio and reduce the investment risk. These funds are regulated by the Securities and Exchange Board of India (SEBI), which reduces the risks that are associated with investing in mutual funds.

The fund gets primarily invested towards gold bullion, a physical asset that is highly independent of any fluctuations in the financial markets. This is why investing in gold funds during an inflationary period is a wise decision for investors. The primary purpose of gold fund investment is to create a cushion against any collapse in the market. The returns generated by gold funds might even go above this precious metal's actual price, creating a lucrative opportunity for gold fund investors.

Moreover, if any investor chooses a long-term gold ETF, they will receive returns calculated based on the present market gold price. Hence, it can offer substantial returns if gold prices increase during redemption.

Benefits Of Investing In a Gold Fund

There are multiple benefits of investing in gold funds. Some of the major ones include:

Highly Liquid Investment

The major advantage of a gold mutual fund is that it is liquidated in a brief period and without any challenges. It is easier to trade these funds than liquidate other kinds of assets, which makes them an ideal financial cushion for protection against unforeseen incidents. Furthermore, there is no minimum limit on redeemable amounts, allowing investors to redeem based on their financial needs.

Flexible Investment Amount

Gold funds offer greater convenience than physical gold by allowing investors to purchase amounts that suit their needs. One can begin an investment with as little as Rs. 500, which lets investors with lower income invest in such funds. Rather than purchasing physical gold, which comes with an inflated cost, it provides better flexibility to an investor.

Investment Portfolio Diversification

Gold mutual funds are an amazing investment option to diversify the investment portfolio and minimise overall market risk. Being a physical asset, gold prices are not directly related to company stocks. Investors can reduce market risk by providing potential returns even when other assets perform poorly.

Safer Investment Avenue

Gold funds are among the safest investment options as the SEBI regulates these. The Securities and Exchange Board of India periodically analyses and reports on the performance of these funds, which helps investors measure and predict their returns. Furthermore, gold is a haven for investors. Investors flock to gold during geopolitical, economic, or financial crises. With this demand, the price of gold increases, eventually protecting investors from any losses in the different assets.

Conclusion

When the market is unstable, investors turn towards gold as it is a safer option against inflation. It protects them from the losses they have encountered via other assets. Gold has always stood out as an amazing investment and performed well during any financial crisis. Hence, hedging helps companies and investors reduce financial risk by crafting buffers against any price fluctuations in other investments.

For investors willing to invest in gold funds that offer beneficial returns and want to invest with as little as Rs. 500, access the Aditya Birla Sun Life Gold fund as a secure hedge against inflation and minimise your risks to the best potential.

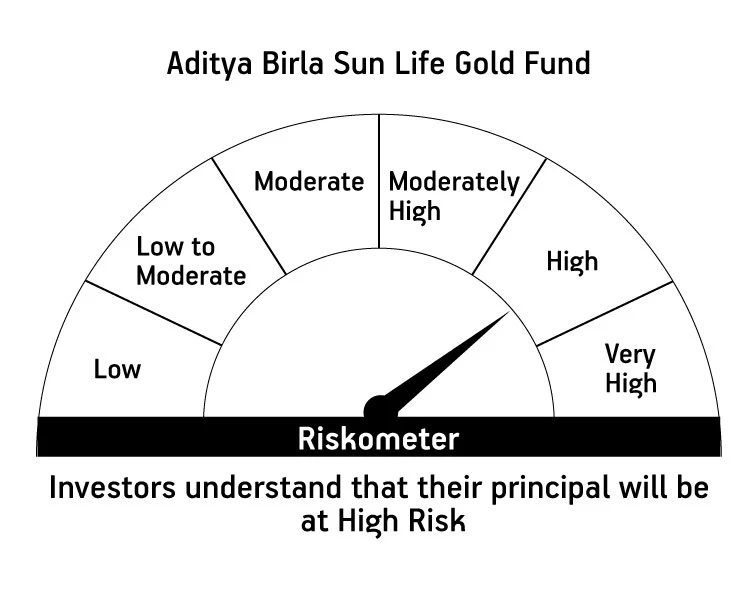

| Aditya Birla Sun Life Gold Fund | ||

| (An open ended fund of funds scheme investing in Aditya Birla Sun Life Gold ETF) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000