-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How First Jobbers can save more to earn more?

Oct 24, 2019

4 mins

5 Rating

Aakash, working as a Management Trainee with a large multi-national company, waited for the budget actively, glued on the latest news for hours before the budget was finally announced. Mr. Mehta shocked by this behavior of Aakash, was tempted to ask him. “Neither do you have a considerable saving nor do you have a portfolio, why wait so anxiously then?”. With a shy smile, Aakash showed him the message he had received the previous day. “Rs. XXXXX has been credited to…”, Aakash was 22 and this was his first job. He said, “I just wanted to see which bracket I belong to?”. Mr. Mehta was a proud father. It was a shift of the mindset he had heard of but never experienced himself. In a family of ancestral legacy business, his son was the first in the family to be employed in the corporate world. The change was evident: the priority had shifted from tax evasion to tax relief.

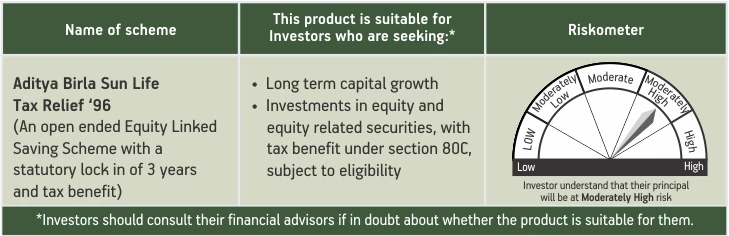

He opened his drawer and with a bit of searching, gave Aakash a soiled envelope. “Aditya Birla Sun Life Tax Relief ’96 (An open ended Equity Linked Saving Scheme with a statutory lock in of 3 years and tax benefit)”, Aakash read along. Mr. Mehta said, “My colleague gave this to me few years back. I wasn’t aware of ELSS and opted for other options, but from a very long time I have saved this for you”. The duo had a long conversation about ELSS, managing finances, looking for tax reliefs and long-term capital gains tax that evening.

Why Equity Linked Savings Scheme [ELSS]?

ELSS funds qualify for tax exemptions under 80C of the Income Tax Act,1961 where investments of up to ₹150,000 can be claimed as tax deduction in each financial year. It serves the twin objectives of tax savings as well as capital appreciation over the long term. Furthermore, all capital gains earned through ELSS funds are classified as Long term capital gains (LTCG) which attract 10% (plus applicable cess) tax on gains over ₹ 1 lakh.

Why Aditya Birla Sun Life Tax Relief ’96?

Apart from being one of the early private sector mutual funds, it has had a journey of 2 decades. It has created a wide base of loyal customers during this long run. It is well-known for its dual purpose - acting as a Tax relief scheme and striving for wealth creation over the long term, by efficient portfolio positioning:

It is an open ended equity linked savings scheme (ELSS) with the objective of long term growth of capital through a portfolio with a target allocation of 80% equity, 20% debt and money market securities.

It has a well-diversified portfolio spread over various sectors.

It follows a combination of top-down & bottom-up approach for stock selection based on comprehensive research and assessment.

It aims to maintain its portfolio quality by investing in stocks which have reasonable return ratios and a strong balance sheet.

Why is it the ideal investment option for first jobbers?

There are a lot of factors which could make it an investing option for new investors:

It is an ELSS fund, thus is covered under Section 80C of the Income Tax Act, 1961, where investments up to INR 1,50,000 can be included in tax deductions. The twin objectives of tax savings as well as capital appreciation motivates first jobbers to save & invest, who often have difficult time saving their hard-earned monies.

Early habits die hard. A good investing habit at the beginning, has a promise of going a long way. First jobbers could start investing with as small as Rs. 500 per month via SIP. The amounts can be gradually increased as income rises.

As there is a mandatory 3-year lock-in period on ELSS Funds, the returns earned would come under Long Term Capital Gains and are only taxed at 10% (plus applicable cess).

Because of the 3-year lock in period the first timers will be exposed to the volatility of the equity markets and thus possibly experience the bears and bulls of the market, without facing mental burden, they gain the confidence to start their investment in other equity mutual fund schemes.

Aakash’s first job and first investment came along quite well. He also set an example for his younger siblings – Tax saved is saving earned.

For further details please refer to SID & KIM of Aditya Birla Sun Life Tax Relief ’96 scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000