-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How to do very last minute tax saving?

Feb 19, 2020

5 mins

5 Rating

The month of March is upon us and most of you are thinking of doing last minute tax saving so that you can reduce your tax liability to the lowest possible amount. Hunting tax saving investments, searching for expenses which would allow you tax exemptions, recalculating the taxable part of your salary are some of the common activities which most of you undertake. Here are some tips to aid you in your last minute endeavours of saving tax –

-

Ensure you have utilised the entire limit of Section 80C deductions

Section 80Cof IT ACT, 1961 allows you to claim deductions of up to INR 1.5 lakhs from your taxable income on specific investments and expenses. The first tip to save your tax is to check whether you have utilised the entire amount available under Section 80C. If you haven’t, what are you waiting for? You can consider investing in the various options available under this section.

-

Don’t forget to invest in NPS scheme

Investment in the National Pension Scheme offered by the Government of India allows you an additional tax deduction of INR 50, 000 under Section 80 CCD (2) over and above the deduction available under Section 80C. So, reduce your taxable income by another INR 50,000 by investing in the NPS scheme.

-

Buy health insurance

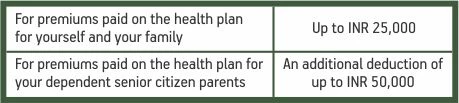

After section 80C and 80 CCD (2), 80D allows you a tax relief if you pay premiums for a health insurance policy. The deduction available is as follows –

So, buy a health plan for yourself and your dependent parents. If you have already bought a health plan for yourself, buy another for your dependent parents and claim an additional deduction from your taxable income.

-

Avail tax relief on your home loan

If you have availed a home loan, you can avail multiple tax reliefs. The principal repayment of the loan is a tax-free expense under Section 80C. Moreover, the interest that you pay for the loan also qualifies as a tax-free expense under Section 24 up to INR 2 lakhs. If you are a first time home buyer, you can claim an additional deduction of INR 50,000 on the home loan interest under Section 80EE.

-

Claim deduction on your savings account interest

If you have a savings account in a bank and earn an interest on that, you can claim a deduction of up to INR 10, 000 on the interest earned under Section 80 TTA.

If, on the other hand, you are a senior citizen, interest earned up to INR 50,000 from savings account and/or fixed deposits with banks and/or post-offices would be allowed as a deduction from your income under Section 80 TTB. -

Claim exemption or deduction for HRA

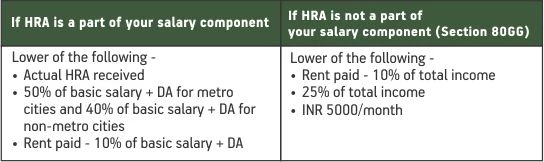

If you are a salaried employee, HRA might be a part of your salary component. You can claim tax exemption on the HRA you receive if you live in a rented house. Even if HRA is not a part of your salary component you can still claim a deduction for HRA under Section 80GG. The available HRA deduction is as follows –

-

Donate

Donations done to recognised charitable institutions also give you tax benefits. You can claim a deduction on 50% of the amount donated or 100% of the amount donated depending on the charity you donate to. However, the maximum donation allowed as deduction should not exceed 10% of your gross total income.

How many of these tips did you already know of?

You can use these tips and reduce your taxable income to bring down your tax liability. Hurry as there is not a lot of time left till the end of the financial year!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000