-

Our Products

Our FundsTop Performing Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How markets have benefited from Election years?

Mar 06, 2019

6 mins

5 Rating

Equity based investments, in short term are impacted by various news which are unpredictable. Mutual funds are a part of this investment bucket. Stock Markets are influenced by earnings of companies, economic indicators, geo-political factors amongst others. And if its a democracy, then the constant political noise can have an impact, especially during election season.

India is world's largest democracy and elections are integral to its continuity. Given its diversity, elections in india are also a platform for the multitudes of opinions, ideologies, interest groups, local, regional & national parties. Manytimes, these myriad voices are not easy to decipher. This often unnerves the markets which react to emotions in the short term and they turn volatile.

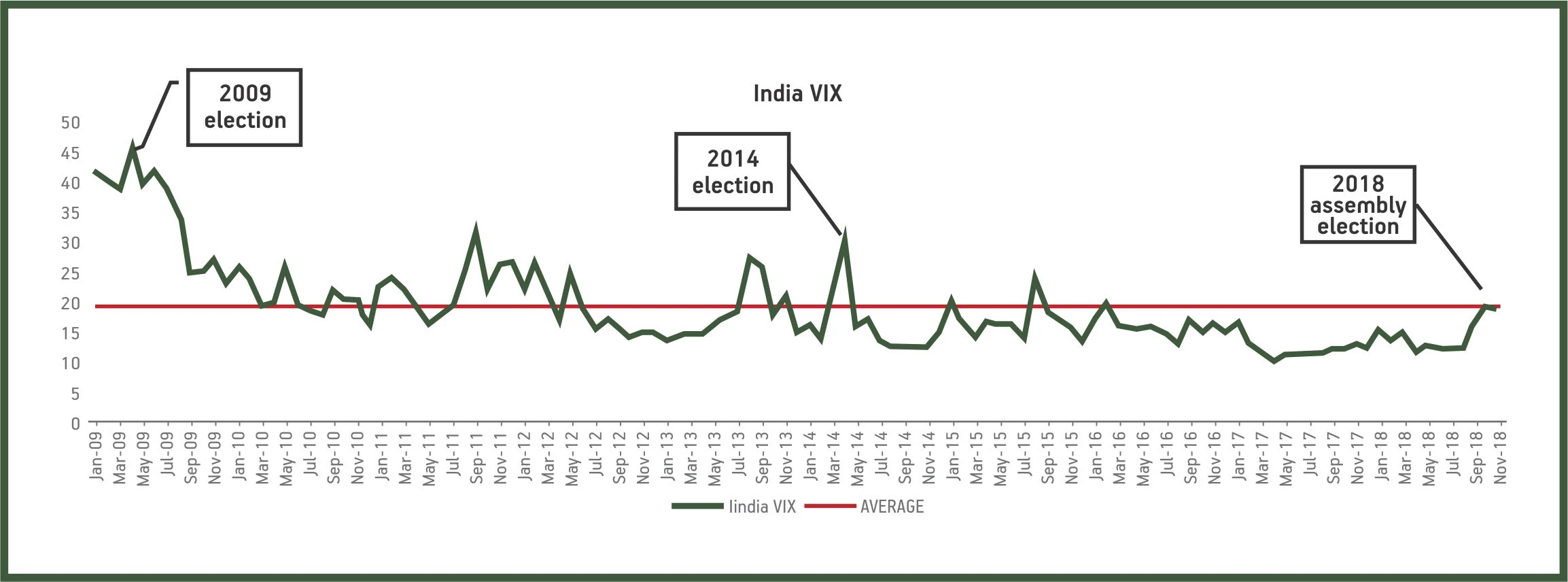

Volatility Index (VIX) is a key measure of market volatility. When market moves sharply up or down frequently, the volatility index tends to rise.

If we look at the India Volatility Index based on NIFTY 50 since Jan 2009 (refer to table India VIX), we see that the average is 19.5 and the median is 17 for the period January 2009 till December 2018. This is depicted by the orange line. During the last two General Elections in May 2009 & April 2014, we have seen the VIX at 40 & 30 respectively. These are significantly above the average for the period. (Source: NSE)

The India VIX for November was 19.16 - close to the period average. Assembly elections in 5 states seem to have had an impact along with uncertainty of liquidity in NBFC sector. But by Dec’18 it closed at 16 which suggest that markets have factored in the result. You may expect a similar volatility when National Election happens in May 2019.

(https://www.ndtv.com/business/share-market-today-on-november-12-2018-sensex-surges-over-100-points-nifty-hits-10-600-1945812)But what is also evident from the chart is that post an election, the volatility tends to normalize to the period average, post elections. So if you are looking at your mutual fund NAVs during election time, the chances are high that there can be a lot of fluctuation. However, if India VIX is anything to go by, then it may soon return to it its regular trend soon.

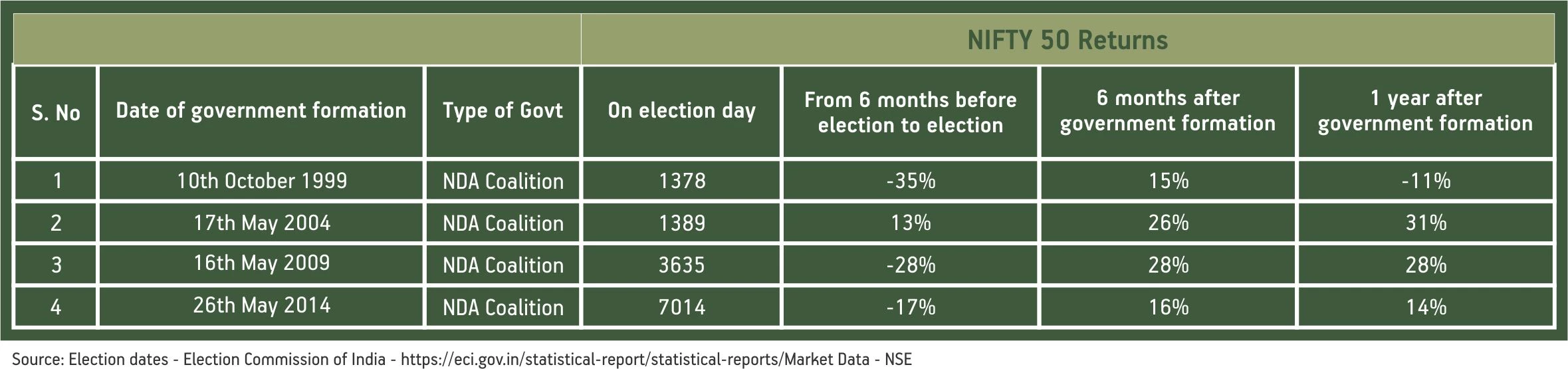

Now lets us look at pre and post election returns.

In the table above, for the last 4 elections we can see that in 3 out of 4 times, NIFTY 50 has given a negative return in the 6 months leading to elections. 4 out of 4 times, it has been a positive return post 6 months of forming of the government. 3 out of 4 times the returns have stayed positive post 1 year of elections. Past is no indicator of future behavior for markets but what we can infer is that usually it is fair to assume that there could be weakness before elections. Post elections, the returns may follow the earnings growth and economy fundamentals / outlook.

If we go by the trend above, pre election could be a good time to start investments or invest in your favorite fund on price dips, if you are doing lump sum investments.

Starting 1991, we have seen continuity in economic policies and growth of Indian economy. Each government has furthered liberalization, infrastructure development and human development indices. In fact, India has emerged as the fastest growing economy. Experts predict it to remain the fastest growing large economy for near future.

(https://www.ndtv.com/business/india-to-remain-fastest-growing-economy-till-2019-20-asian-development-bank-1886292)To summarize, you can expect volatility in markets till the upcoming general elections in May 2019. It’s important that investors realize that equity based mutual fund returns are realized over a longer investment horizon and to achieve that, one needs to learn to ignore short term volatility.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000