-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

How not to skip SIPs in a festive month?

Sep 12, 2018

5 mins

5 Rating

Now is the time of celebration, the festive season is setting up starting up with Ganpati, Navratri, Dussehra, Diwali, Christmas. Festivals bring with them a plethora of fun, excitement, fiesta & soaring expenses. We all like to indulge in the auspicious Gold buying, Cars, House Repairs, Handsets, and Electronics etc. There are mega discounts & easy EMI deals everywhere with throw away prices that tempts our mind to indulge into purchase.

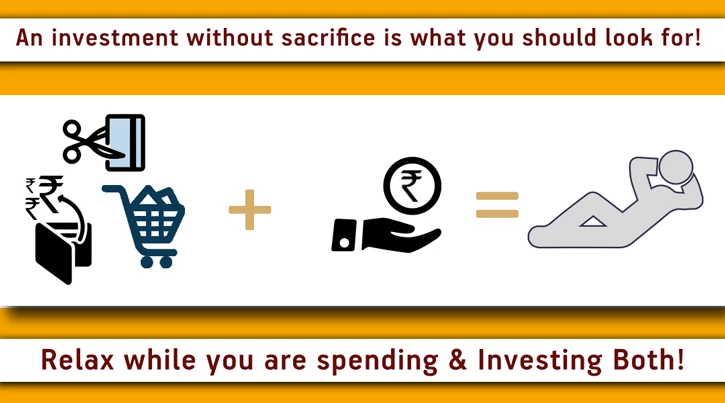

During this, we must have to ensure that our spending is within our budget to avoid the debt trap or missing out on necessary investments.

Below are some steps to keep in mind while enjoying the festive season and being prepared for them as well.

Evaluate last year’s purchase:

We have a lot of gifts that are nice and stashed away in the garage. We plan to use them, but we end up buying new every year. It also has insights on what we think are useful but turn out to be storage items. Talk to your family on these and ensure that this year there is no more expenses that go into the garage.

Plan your Budget:

Budgeting is vital. Planning a budget means you have control over expenses as well as investments. List down the expenses and investments and accordingly work towards the same. Also plan the amount you want to spend for the festivals and celebration. You will not be burdened in case the expenses are more. Planning will help you save in advance for your needs. Initiate savings first from the income and then plan the expenses.

Prioritise and Reduce the Outflow:

A large part of your income goes towards necessaryfixed expenses and investments on SIPs should be included in these expenses. Cut down on the ‘I Want’ expenses. For instance, you usually dine out 4-5 times a month, you can reduce to once or twice to help balance the extra expenses you incurred during the festive season. Anyhow, festival season is all about meeting friends and families at our freshly done up homes, right?

Avoid impulse shopping & EMIs:

Festive season is the best for all businesses and brands and they come up with bumper offers intended to indulge you. EMIs make many things affordable. But its wise to plan your cost of EMIs – they make things at-least 20% more expensive due to the charges and interests. Keep all your no- essential EMIs to less than 20% of your monthly income for next 6 months. This excludes your housing loan EMI but includes your car loans.

Allocate Savings & Bonus:

Make sure you save some amount of income from your salary for festivals or gifting. The big bonus that is received throughout the year can be saved along with the incentives. You may park them in short term debt funds. If you are the few lucky ones who get festival bonuses, prepay your high interest EMIs and Credit Card outstanding. This money can further be utilised for fulfilling your expenses during festivals or pay for SIPsif you go overboard with your expenses.

Look for Offers:

While shopping expensive items like electronics, gold, cars etc. go for good deals and offers available during Flash Sale etc. Buying in offers is a good idea, helps you get good discounts and save some amount but getting lured in the offers is a bad idea. Luring in offers will make you shop more and your money management will go for a toss.

Plan a Second Income:

Never rely on one source of income. Always think of second source of income apart from your salary etc. This can be done by making investments, trying to earn higher incentives, working part- time or consulting to earn more. Side hustles or gig economy is making it ever easier to do so. Upwork, FlexingIt, Freelance.com are some popular sites where your hobbies or subject matter expertise can earn you more at your own pace.

Income Hacks:

Plan your reimbursements like LTA encashment during festivals. It will be tax effective if you have already incurred these expenses. But even with tax out go, claiming these will help you to manage any large purchase or upgrades that are necessary for your festive fun.

Following these points will help you not skip your instalments for SIPs and also enjoy the festive season. Spend in an organised way and reduce the burden of your expenses.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000