-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Make the Best of Debt in Rising Interest Rates

Sep 07, 2018

5 mins

5 Rating

When was the last time you looked at your portfolio and really pondered about whether your money was working hard enough for you? With interest rates rising, you are already paying an elevated EMI on your loans. The only way to counter that is to have your money work harder and use the same higher rates to your advantage.

But, why have the rates gone up? We saw both the debt & equity markets go through unusual levels of volatility these last few quarters. It is an interesting juncture for all of us as, while the Micro factors (like corporate earnings, leverage levels in corporate, etc) seems to be getting better by the month, Macros Key parameters on Macro Economic scenario seems to be deteriorating a bit, primarily on account of Crude which has been in an upswing since July 2017. Since then, owing to crude prices rising steeply, there has also been an upside risk to inflation, fiscal deficit, slowing growth and currency depreciation led by justifiable fears of global trade wars.

The 10 year Government Bond has gone up from 6.45% in July 2017 to as high as 8% in June 2018. Global interest rates have also seen a similar trajectory resulting in Emerging markets (including India) experiencing massive volatility in their currencies resulting in impact on local interest rates in a big way as the respective central banks move to protect their currencies. Local developments in India, especially on political front have also affected the market sentiment. The government has announced a massive MSP hike in run up to its election campaign, though this could prove to be inflationary in nature. Some of these factors have already led RBI to hike repo rate by 25 bps twice in a row.

However, bond market seems to have discounted all the negatives ahead of RBI rate hikes and taking positive cues from change in RBI stance over the last few policy announcements. It is likely that the markets have already priced in about 75 bps rate hikes across 3 hikes for this calendar. Equity markets are also enthused with corporate earnings and potentially resurging growth in the Indian economy shrugging off the post demonetization blues and sort of rebounded in July post 6 months of sharp volatility. Banking sector which has been bearing the brunt of the NPA cycle has seemingly started to recover with NPAs coming down across the industry and some signs of credit offtake appearing as capacity utilization across economy seems to be in range of 72-74%. While large caps are still out performing, mid & small cap companies are delivering higher growth, with valuations now close to fair in selective cases.

We believe, that this volatility is good for SIPs as it will help accumulate more from the markets from a long term perspective. While we remain very confident in the long term for both equities & fixed income markets, the key risks still looming in the system could potentially come from oil spikes to 78-80 per barrel and rupee dollar rates goes beyond 70-71. As of now, it appears that all potential risks have been captured in the bond yields and equity valuations. Given that, we believe that this mouth watering opportunity for debt may not sustain for very long and investors would do well to have a decent allocation to debt funds, perhaps as much as 50% of portfolio for which solutions are available in the fixed income funds from short term liquidity parking to long term investing as well.

Why Fixed Income now?

- Historically we have seen that whenever interest rates are near 8-9% p.a., debt funds generate great experience to investors due to the funds’ ability to recoup any short term MTM losses through higher coupon accrual. For We feel that markets will not give up their volatility entirely for the next few quarters. While it will benefit the long term investors, fixed income allocation in the portfolio will provide investors the much wanted cushion to provide stability. Investors should have fixed income as an essential part of their asset allocation. Asset allocation at this hour is a must, we believe.

- Currently even high quality debt portfolios (with over 80% in AAA or similar) are experiencing very high portfolio yields, in range of 8% or higher. Credit portfolios (lower credit quality oriented) are experiencing even higher portfolio yields in range of 9% or higher. FMPs are providing you the benefit of indexation & LTCG along with fixed return orientation at higher rates.

Fixed Income Categories for Investment

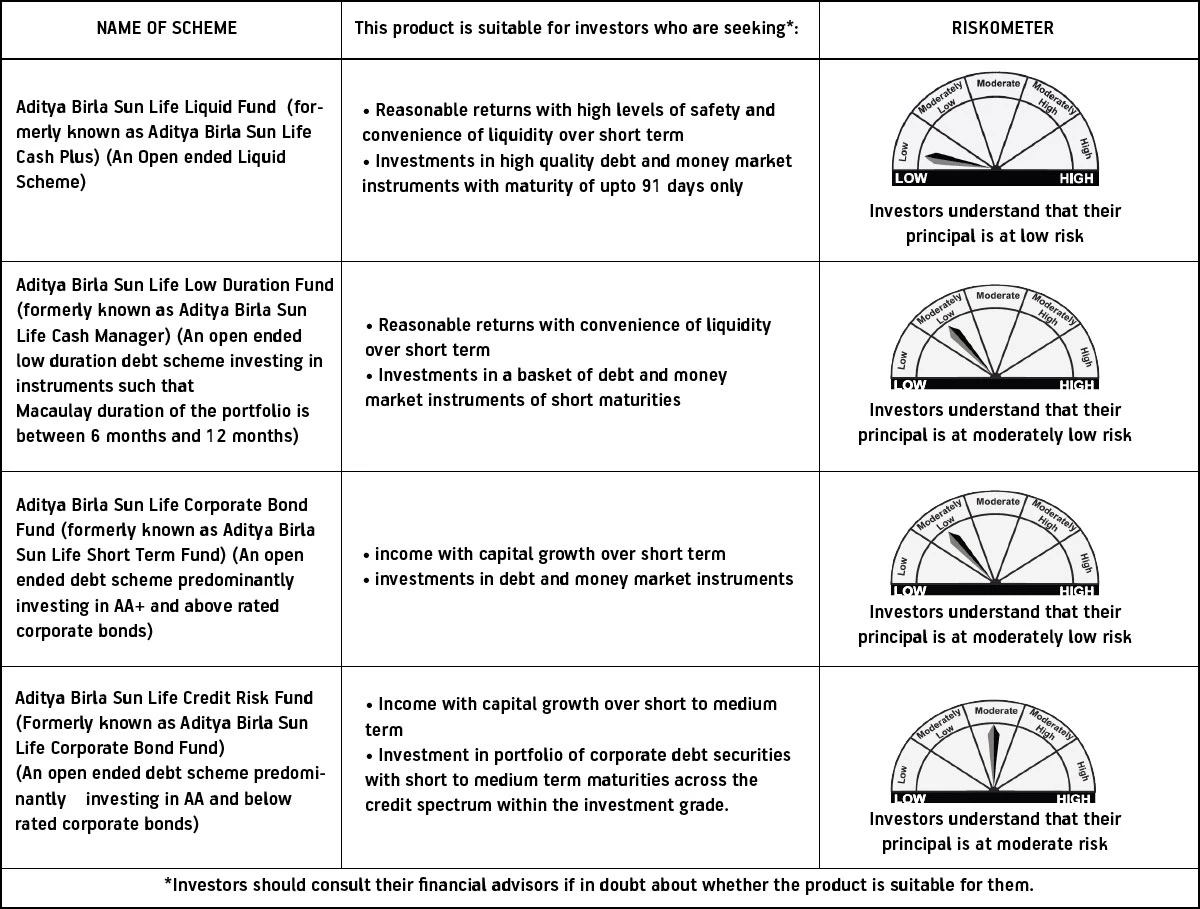

- Liquid & Low Duration Funds (Aditya Birla Sun Life Liquid Fund (An open ended Liquid Scheme) & Aditya Birla Sun Life Low Duration Fund (An open ended low duration debt scheme investing in instruments such that Macaulay duration of the portfolio is between 6 and 12 months)) are best placed for investors seeking short term parking of their surpluses. In fact for investors who would’ve ordinarily left money unattended in Bank accounts or very short term FDs (upto 1 year), it makes a lot of sense to take advantage of elevated short term yields without getting worried about credit or interest rate movements. These funds generate very steady and stable return to investors. Use our Active Account to instantly transfer any balances in your savings account to Aditya Birla Sun Life Liquid Fund (An open ended Liquid Scheme) with a simple finger swipe.

- Accrual funds as mentioned earlier won’t take any aggressive duration bets but will provide you the essence of presently higher interest rates in your chosen credit quality, proving to be a great choice for medium to long term savings (over 1 year).

- Aditya Birla Sun Life Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds) (investing in high quality corporate bonds ranging from AAA to AA rated companies) can be considered for 1-3 years investment horizon.

- Aditya Birla Sun Life Credit Risk Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds) (with more than 65% allocation to AA and below rated corporate bonds) is best suited for longer term (3 yrs & above)savings.

- A key category or opportunity to capitalize while the rates are high is the Fixed Maturity Plans (FMPs). From investors’ point of view, where interest rates are quiet reasonable (compared to bank deposits of similar tenure), they also offer a tax advantage in form of LTCG taxation.

From the credit selection point of view, the careful selection of bonds with built in safety mechanism makes this fund the right choice for medium to long term debt allocation.

Additionally, they come with zero market volatility as they are completely buy and hold products.

As they say, ‘Make Hay while the Sun Shines’. Similarly, make the best of debt while the rates still remain high.

Happy Investing!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000

.jpg?h=403&w=725&la=en&hash=9D8A3BE92C1D1DBB8CD7227660A9ECDF)