-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How SIPs are taxed?

Mar 13, 2019

7 mins

4 Rating

Anita has been investing through an SIP (systematic investment plan) since September 2017. At the time of investment, Anita's financial advisor told her that her returns would be tax free as equity funds were exempt from long term capital gains (LTCG) tax. However, government re-introduced LTCG on equity funds in the 2018 budget. Now Anita is in a tizzy. She wants to withdraw her SIP but is unsure of her tax liability.

Also learn about : What is ELSS Fund?

SIPs have seen an exponential growth in their popularity in the last few years. Post the change in tax law, many investors like Anita are unsure about how to calculate the tax on their SIP returns. So let us look at SIPs from the tax angle.

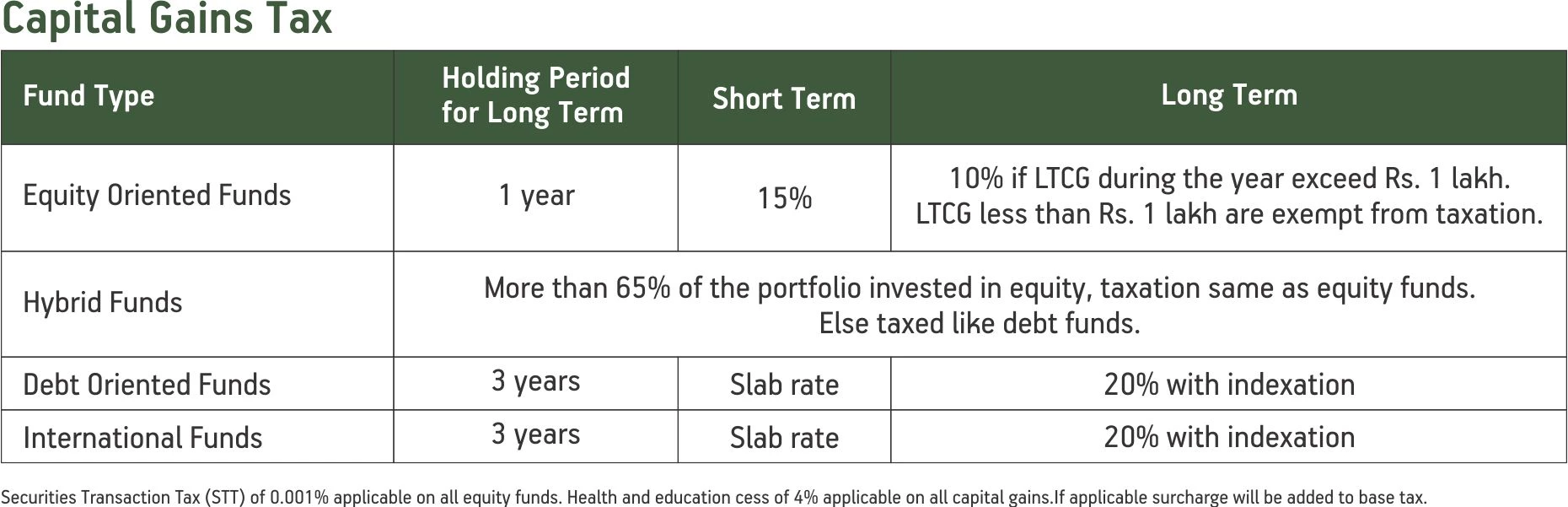

The tax on SIPdepends on whether the investment is made in equity or a non-equity fund as they have separate tax rates.

While both SIP and lump sum investments made in a scheme are taxed at the same rate, the tax calculation is bit more elaborate in case of SIP.

How is SIP taxation different?

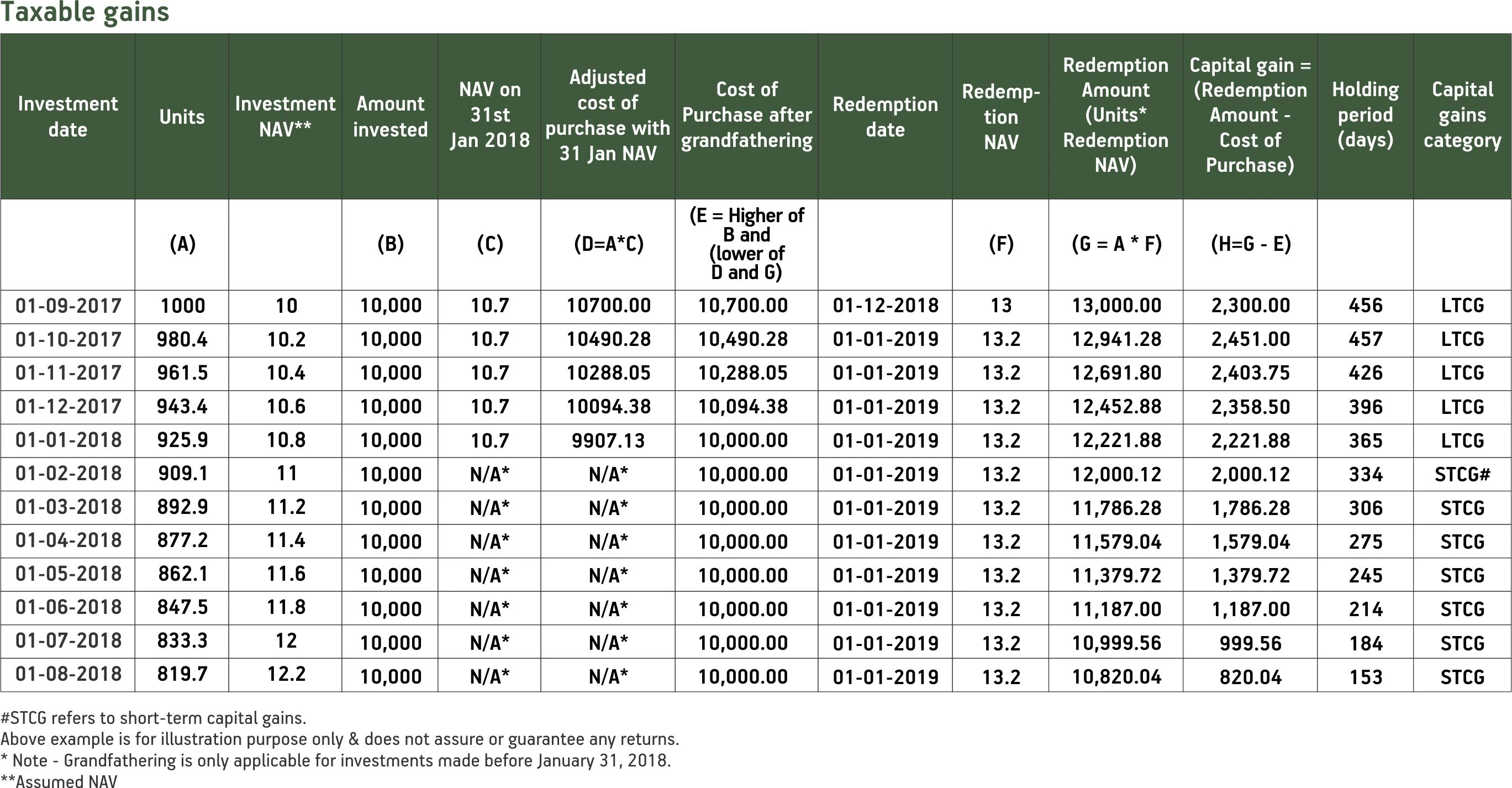

Unlike lump sum investments where a there is a single investment, SIP investments are made over multiple dates. While we may think of a one-year SIP as one investment. For tax purposes each instalment is considered as a fresh investment.Accordingly, the holding period for each instalment is calculated.

For e.g. I start a monthly SIP in an equity scheme on 1st January 2017. On 2nd January 2018, I decide to redeem the entire investment. In this case, only capital gains on the units purchased from my first instalment (invested on 1st January 2017) will be long-term capital gains as I have held them for a period greater than one year. For the remaining units,the holding period is lower than one year. Hence, the gains will be taxed at short-term rates.

The first in first out rule is followed for determining how long the units were held. First in first out means that the units bought first will be redeemed first.

Calculation

In simple terms tax on the total SIP investment is the sum of tax payable on each instalment. To calculate the tax on the SIP we need to individually calculate tax on each instalment.

Here is the step-by-step process

-

Classify whether the fund is equity or non-equity

-

Compute the holding period to identify whether the gains are short-term capital gains or long-term capital gains

-

Note the cost of purchase of units for each instalment

-

In case of equity funds check whether grandfathering clause is applicable (i.e. for investments prior to 31 st January 2018, cost of purchase will be considered higher of

Original purchase value and

Lower of adjusted cost of purchase using NAV as on 31 st January 2018 and full value of consideration received or accruing as a result of the capital asset.

-

In case of debt funds if LTCG are applicable, adjust for indexation.

-

Calculate applicable tax for each installment

-

Bucket short-term and long-term gains separately.

-

Apply appropriate tax rates to arrive at tax payable.

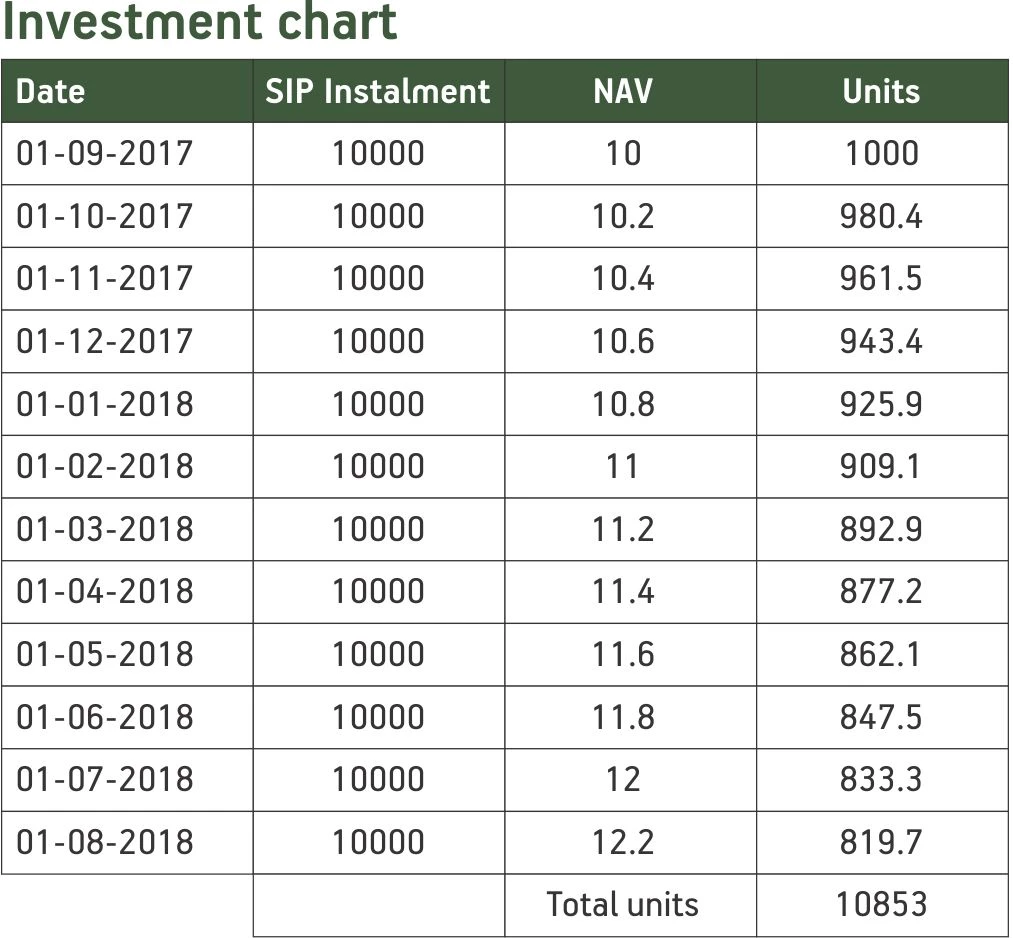

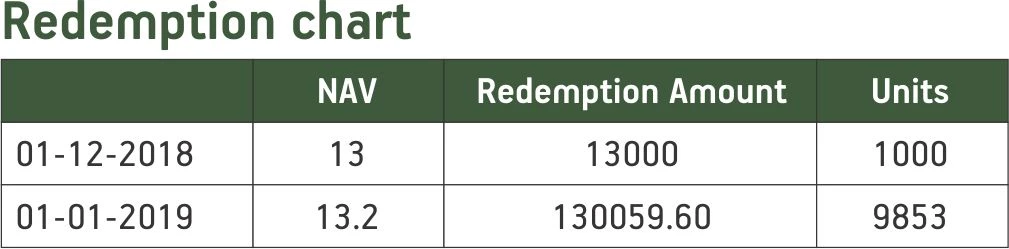

Coming back to Anita's example. Anita did a SIP of Rs. 10,000 every month in an equity fund from September 1, 2017 to August 1, 2018. She withdrew Rs. 13,000 on December 1, 2018 and the remaining amount on January 1, 2019. Let us calculate tax payable by her.

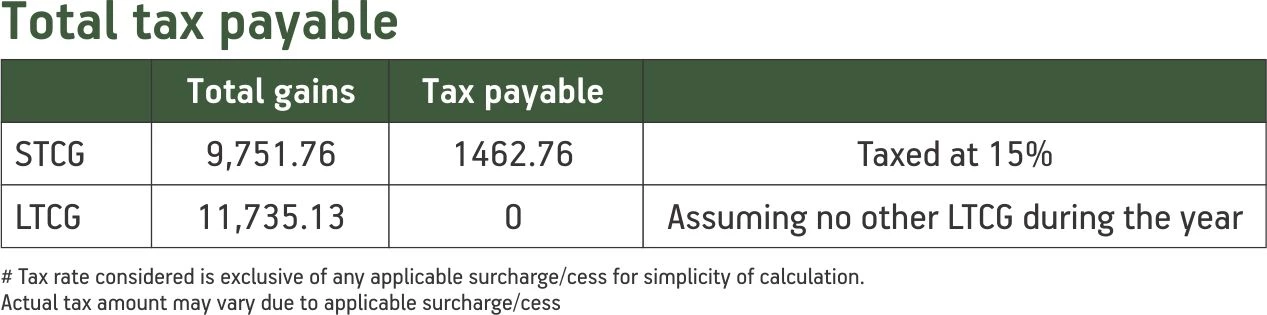

Hence, Anita needs to pay Rs. 1,463 in taxes on the SIP short term gains as her LTCG during the year are less than Rs. 1 lakh and hence exempt.

Just like Anita you too can redeem your SIPs tax free if you plan your yearly redemption in such a way that your LTCG does not exceed Rs. 1 lakh during the year. Hopefully by now all your doubts and worries regarding taxation of SIPs have been cleared. So Happy Investing!

Information and computations mentioned in the working are on a broad level and investors are advised to consult their tax advisors for their individual tax implications.

Also Know What happens if you miss sip payment?

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000