-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Lumpsum Vs SIP

Jan 29, 2020

3 mins

5 Rating

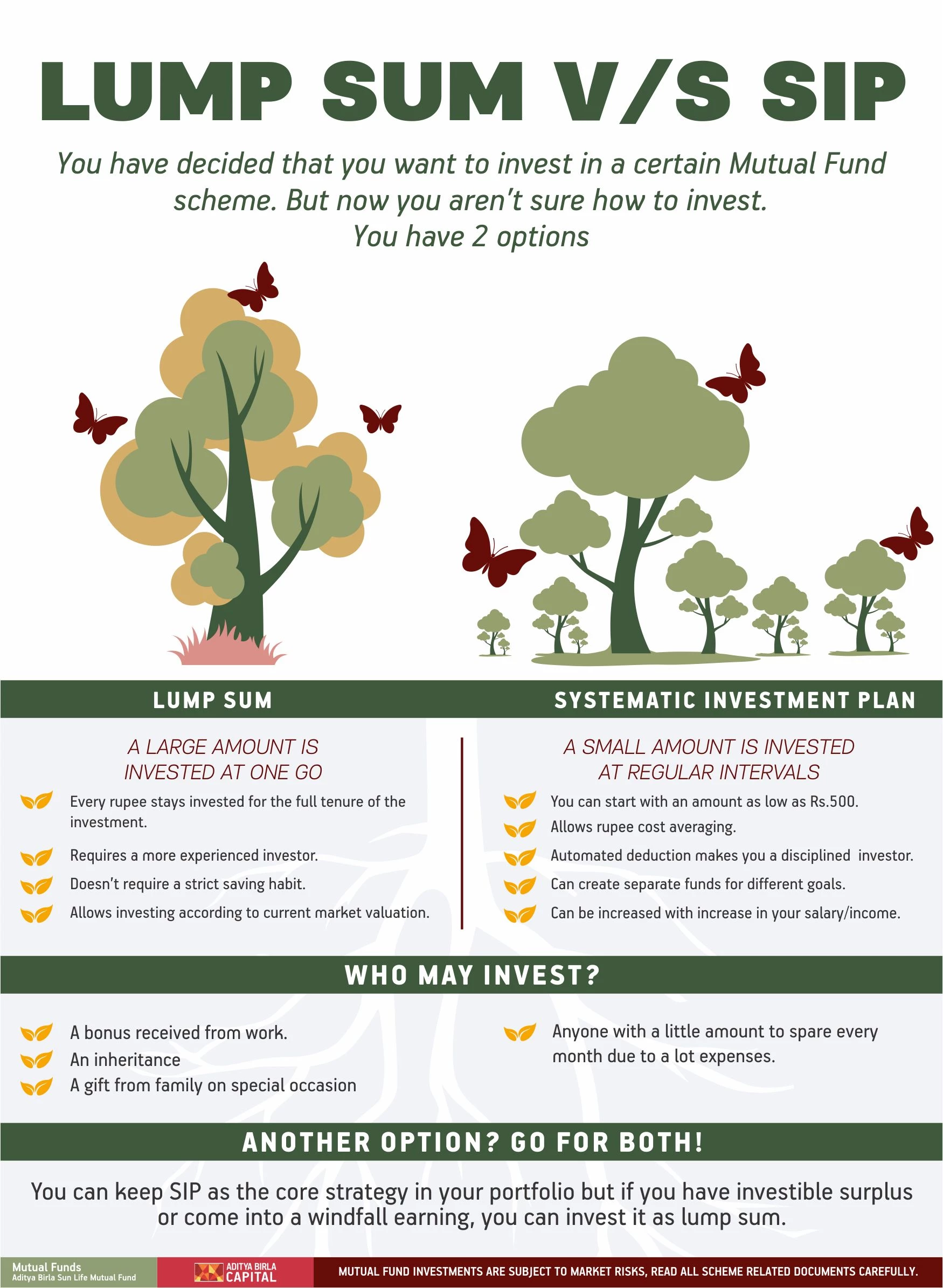

You have decided that you want to invest in a certain Mutual Fund scheme. But now you are not sure how to invest. You have two options:

Lumpsum: A large amount is invested at one go

Every rupee stays invested for the full tenure of the investment

Requires a more experienced investor

Doesn’t require a strict saving habit

Allows investing according to current market valuations

Who may invest?

A bonus received from work

An inheritance

A gift from family on a special occasion

Systematic Investment Plan: A small amount is invested at regular intervals

You can start with an amount as low as Rs.500

Allows rupee cost averaging

Automated deduction makes you a disciplined investor

Can create separate funds for different goals

Can be increased with increase in your salary/income

Who may invest?

Anyone with a little amount to spare every month due to a lot of expenses

Another Option? Go for Both

You can keep SIP as the core strategy in your portfolio but if you have investible surplus or come into a windfall earning, you can invest it as a lumpsum.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000