-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How SIPs became the most popular mode of investing in mutual funds?

May 26, 2022

3 min

4 Rating

We all must remember our childhood days when we would collect our pocket money or loose change in our piggy banks. It is this ‘gullak’ which would become our treasure box – slowly and steadily building, and broken only to buy something very special.

SIPs have become the modern-day version of our childhood ‘gullak’. A Systematic Investment Plan (SIP) is a mode of investing in which you regularly put aside pre-determined sums of money, periodically – to be invested into mutual funds of your choice. Just as every child has probably had a gullak in their younger days, most investors today are adopting the SIP mode.

Investors flocking SIPs

Just as we have our monthly utility payments or CC payments on auto debit; SIPs too are quickly becoming one such auto-debit!

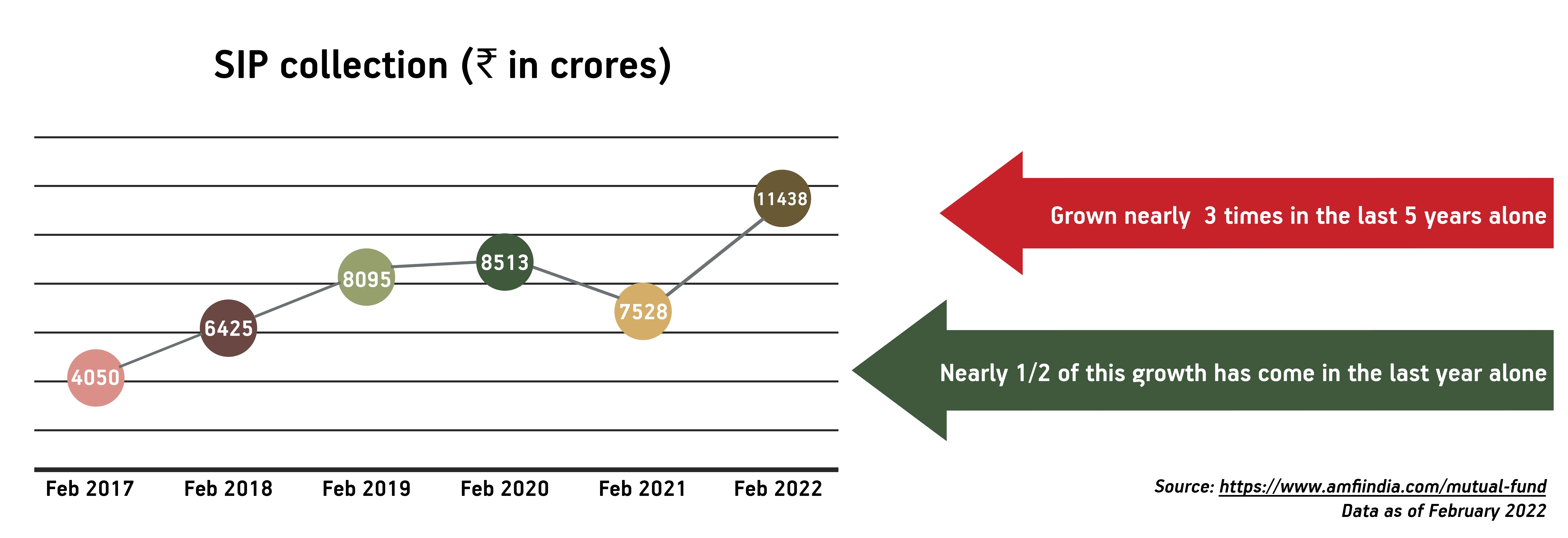

Since their inception in 1993, SIPs have grown considerably.

But what has made SIPs so popular?

Let’s say you have a monthly in-hand income of Rs.80,000 each month. Out of this if you wish to put away 2 months salary worth, to invest in mutual funds each year. At the outset it may not seem feasible to carve out 2 months salary. How will you run your expenses for those 2 months? But, convert this into a monthly program of ~Rs13,500 per month and it may seem much more doable!

But there is much more to investing in SIPs than just simple convenience of investing, that has led to its increasing popularity:

The obvious features

Matching investment timing with your income periodicity

SIPs allow you to invest at time intervals of your choice to match the timing of your outflows with the timing of your inflows. A salaried professional for example may opt for a monthly SIP, a restaurant owner making a daily income may opt for a weekly SIP and so on.

Financial discipline

Setting up one or more SIPs inculcates financial discipline. It ensures you invest each month, keeping you on track with your financial plan. Most investors in fact set up an auto debit facility for their SIPs to ensure no instalments are missed.

The lesser-known advantages that are actually the winners!

Rupee cost averaging

Markets tend to be volatile and keep oscillating between upswings and downswings. SIPs by investing on fixed dates each month/week, result in accumulation of more units when prices are low and fewer units when prices are high. Eventually averaging out the cost of your investment.

This not only helps investors to benefit from volatility but also eliminates the need to time the market as well as the anxiety that accompanies it.

Compounding feature

A fundamental maths principle of ‘compounding’ is the next big advantage of SIP investing. By staying invested through SIPs, investors earn returns not only on their principal but also earn returns on returns. This compounding effect can ultimately helps amass a greater corpus.

In fact, the longer you stay invested the more effective is the impact of this compounding.

Add-on features for added convenience

SIPs also offer several add-on features like Top up SIP , Multi SIP, Pause SIP and so on. These features make investing more convenient and can actually even compound their benefits.

Remember, SIPs give you a single gate access to a plethora of investments. Whether you want to invest in equity, debt, hybrid or multi asset funds – or a combination of these; SIP investments can be set up for each category.

All-in-all, these array of benefits have made SIPs today synonymous with mutual fund investing. So, look no further and begin your investing journey with this convenient and effective investing tool – SIP in mutual funds!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000