-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How to calculate your net worth?

Aug 12, 2019

6 mins

5 Rating

You may often read industrialists and bankers being ranked in terms of their net worth. Even the size and strength of companies are gauged with reference to their net worth. The question is does the concept of net worth have relevance to an individual? The answer is - definitely yes! Understanding your personal net worth can have significant relevance in your financial planning.

Net worth is the monetary value of assets you own or that are due to you less the value of what you owe to others. If you have valuable assets to your name, you may believe that you are steadily progressing towards your goals. However, you need to also factor in what you owe to know your true net worth.

So while companies maintain regular accounts and can gauge their net worth just by assessing their financial statements, how does the concept of ‘net worth’ work for an individual?

Well you need to begin with making a comprehensive list of all assets that you own and all dues that you owe and assign monetary values to them. Take a total of the value of the assets and subtract the total value of liabilities to arrive at your net worth.

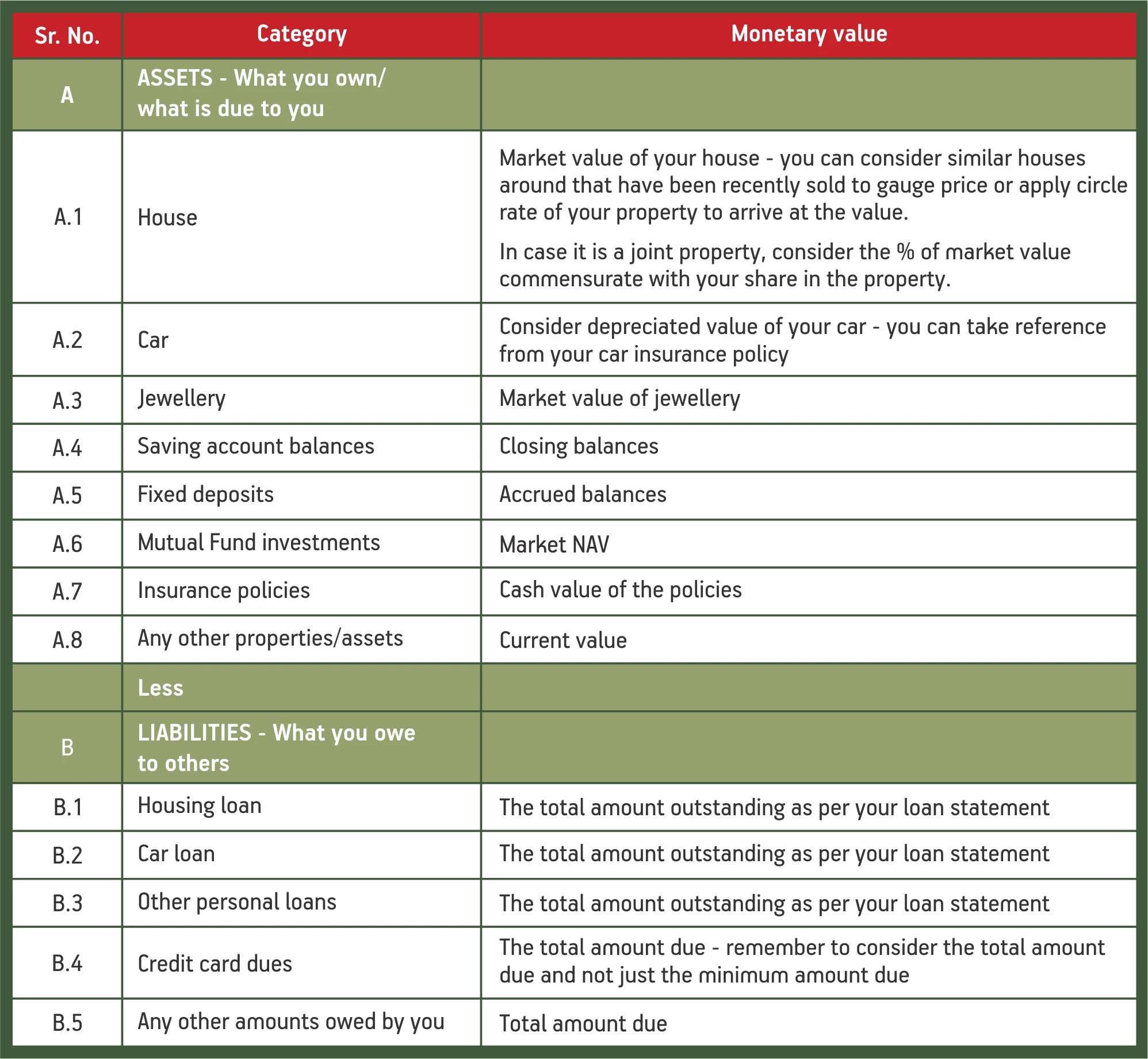

Calculation of Net worth

We have compiled a template of most common assets and liabilities and how to calculate their monetary value:

Significance of net worth

Net worth serves as a snapshot of an individual’s personal wealth. It gives you a macro vision of your financial health. So how can assessing your net worth help you?

-

Gets you organised about your financial condition

It may often happen that while moving towards achieving your financial goals and amassing tangible assets, one may lose sight of what they have cost in terms of building liabilities. Undertaking the exercise of calculating your net worth gets you organised with your finances and gives you a clear picture of what you have and what you owe.

-

Gets you to reflect on your goals

This financial snapshot helps you assess your progress towards your longer term goals. If you have high value assets yet reflect a low net worth you can make changes in your budgeting – like modify your spending habits to save and invest more.

-

Can identify good debt and bad debt

Can help you identify high interest carrying debt which are not reflected by commensurate assets such as credit card debt and personal loans, so that you can prioritise your repayments.

Though the extensive exercise of charting down all your financial details may seem like a daunting task, it is a one-time exercise which you can simply update each year to know your financial health and re-assess your financial planning.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000