-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Why Should You Stay Invested For The Long Term?

Mar 23, 2021

6 mins

5 Rating

There is quite a chance that as an investor in equity mutual funds, you feel a churn in the stomach. Your values are swinging day after day. You can’t take it anymore. You want to sell and get out.

If you have had this feeling or currently have it, here’s one question to answer before you act.

What is one of the biggest rules to build wealth in investing?

Well, it’s COMPOUNDING.

Kudos if you guessed it.

Now, what is the single biggest element to make compounding work? This one doesn’t need a guess.

It’s TIME.

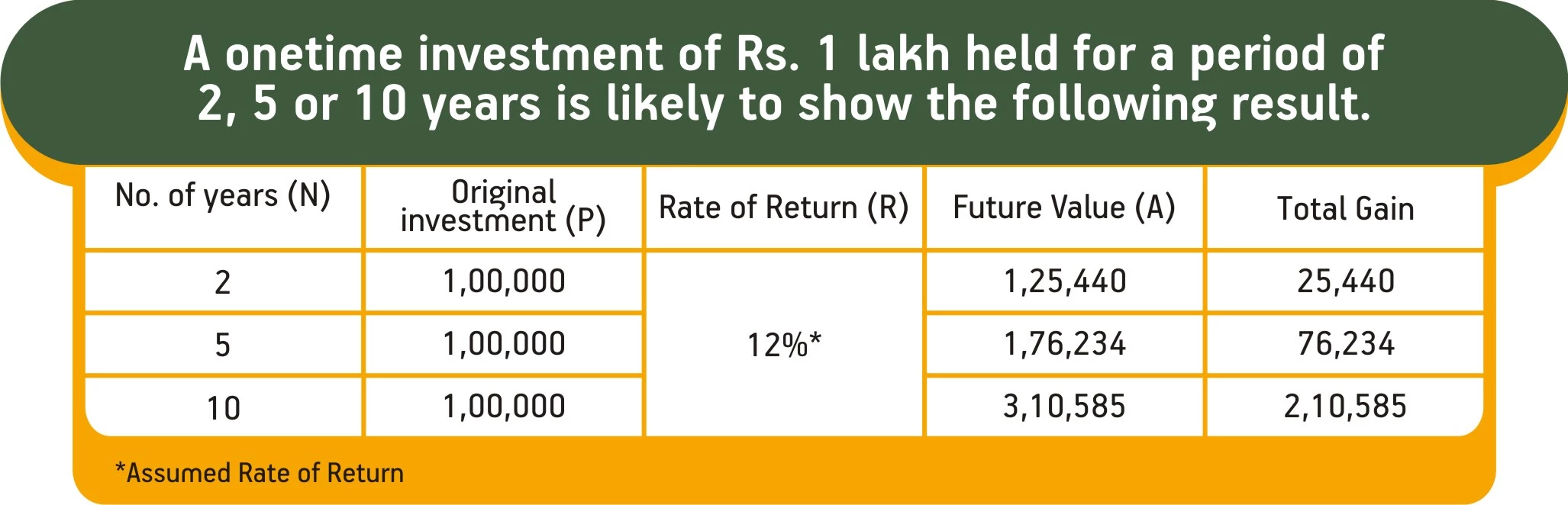

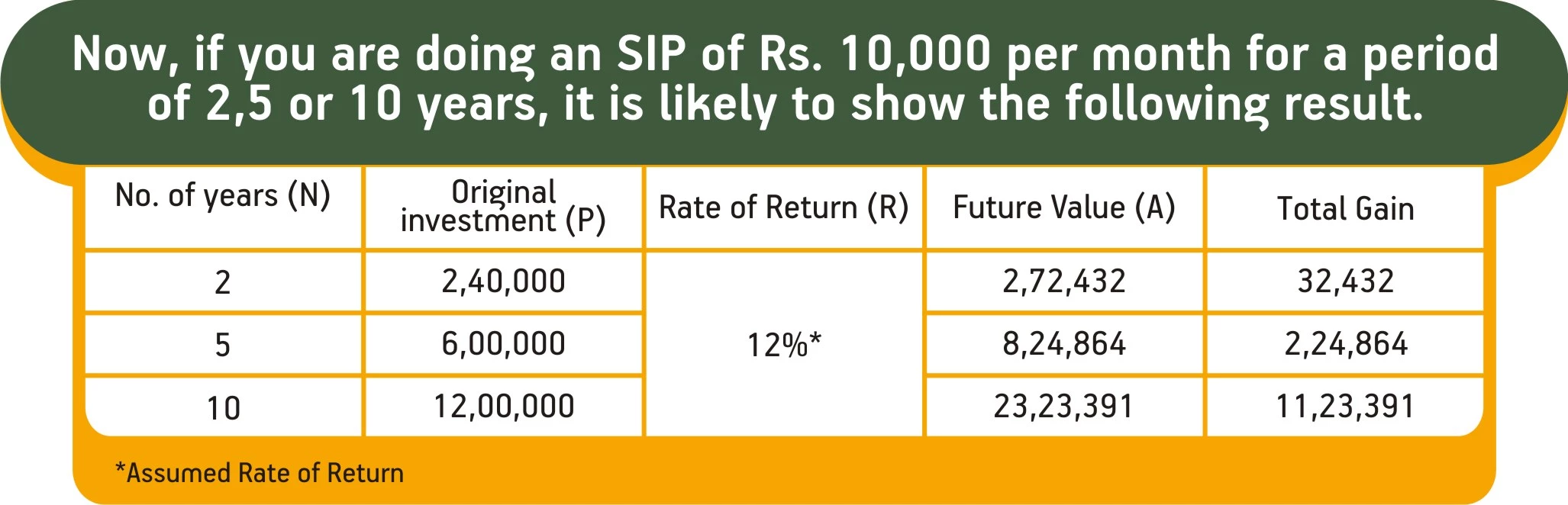

Here’s how the famous wealth builder compounding equation looks like.

A = P * (1 + R) ^ N

The P is the principal or the investment amount.

R is the expected rate of return

N is the TIME.

Of course, A is the final amount that you are likely to receive at the end of your investment period, N. Let's put in some numbers here to see how N works.

Illustration

Do you see the difference time period or N can make?

The longer you stay invested, the higher the likely gains. Put it differently, the lesser you stay invested, the lesser your likely gains.

Time is your best friend here. In fact, more than the rate of return, it is the time that is pushing the gains.

There is a difference though.

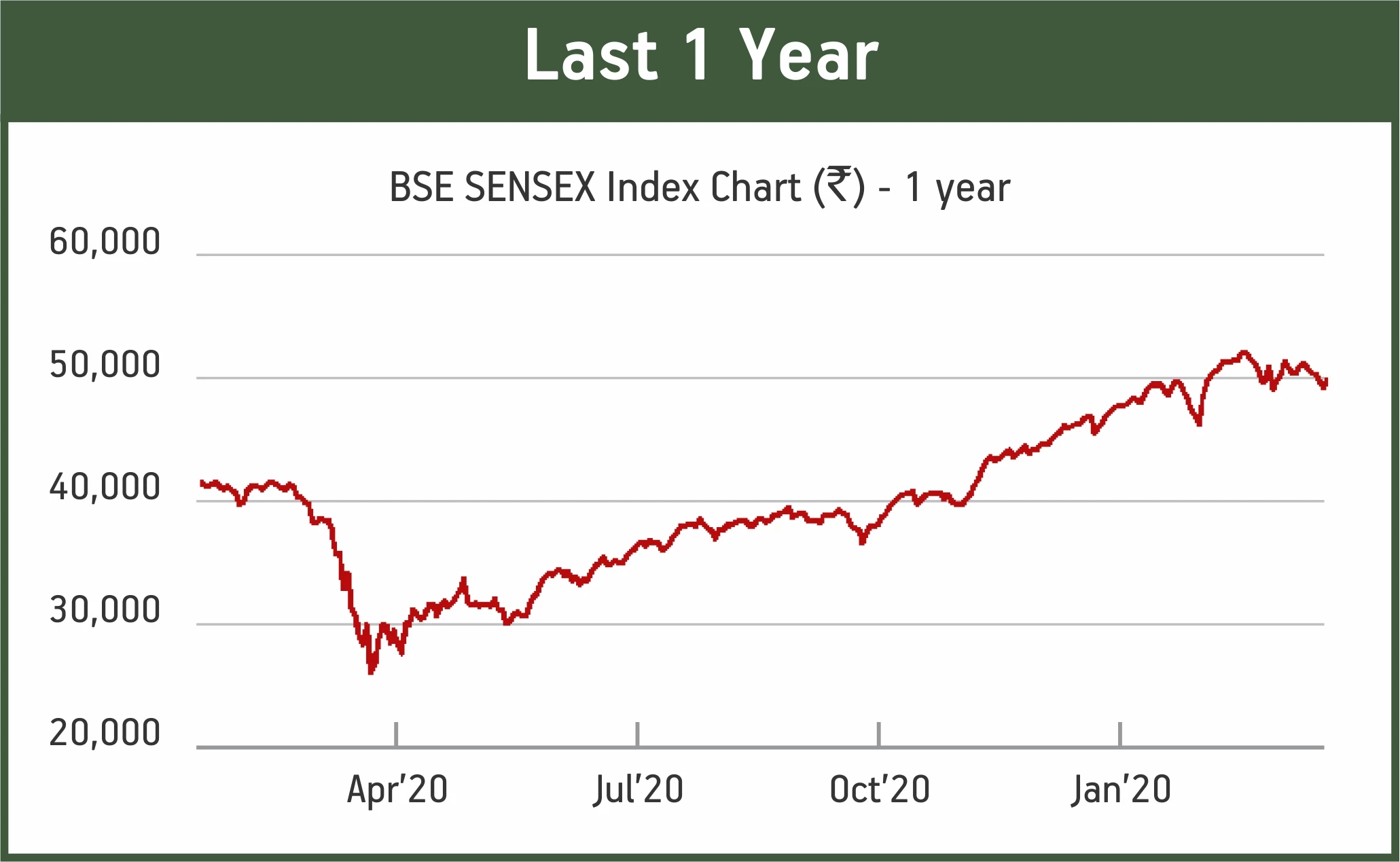

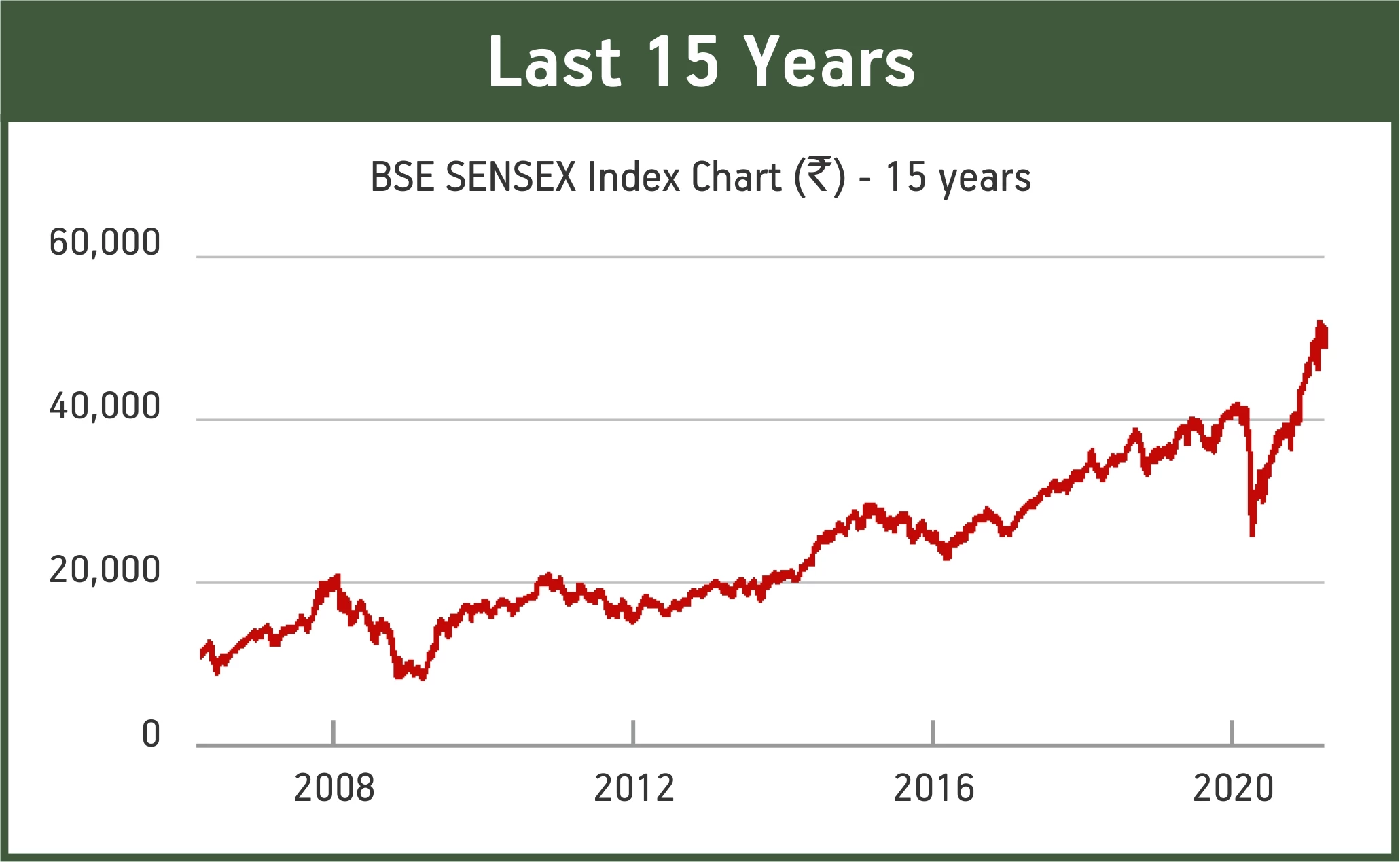

The return in equity is not a straight line. The journey of your investment in an equity fund is more likely to look like this. Let’s take an example of BSE SENSEX returns over last few years:

Source: https://www.equitymaster.com/share-price/BSNX/999901/SP-BSE-SENSEX-Share-Price

As you can see, BSE SENSEX went through the same journey and how the line graph became less volatile and upwards moving during the longer tenures. There are peaks and troughs but it is all taken care of over a period of time.

The lesson remains intact. More the time you are in, the larger your gains are likely to be.

But what about the ups and downs

It is easy to get disturbed with the ups and downs of your investment. You will want to pull out your money and stay away in cash. Well, that can do more harm than good.

Fact is that equity gains come in small chunks. They are not uniformly spread out. It is quite possible that in the time period you are not invested, your money can miss out on the major gains.

It is well known that in a 10 year investing period, the major gains come from about 30 to 40 days. We don’t know which 30 or 40 these days will be. For the rest of the time, you just have to be there invested and waiting for the gains to happen.

You might want to believe that there is some way you can find out what is the right time to get in or get out of your investments. Frankly, there isn’t.

The best of the investors around the world rely on N, time, to make their investments work for them.

So, if you remember how compounding works and the role of time in it, you will stand to gain phenomenally.

What’s your choice?

To help you further think Long Term with your investments, here are some quick rules you can follow.- Know your goals

- Know your appetite for risk

- Choose your asset allocation

- Invest as per asset allocation

- Monitor on a yearly basis

- Rebalance to achieve desired asset allocation

If you think you are not equipped to do this on your own, do reach out to a financial / investment advisor.

Keep Calm. Stay Invested.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000