-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to factor inflation in your retirement planning?

Jun 06, 2022

4 Min

4 Rating

We all have probably heard several dinner table anecdotes of our grandparents who are aghast at prices of today. They boast of cinema hall tickets in the 1970s costing barely Rs.5 which today cost nothing less than several hundred rupees. This is nothing but the result of plain and simple ‘inflation’.

Inflation occurs everywhere and impacts everything

There is probably no expense or cost that is spared from the clutches of inflation. From Roti to Kapda and Makaan and everything in between…. Inflation affects all. In fact, the government releases official inflation figures –across several product and service baskets.

As the years pass by, the impact of inflation just gets compounded. So of course, the longer duration financial goals are likely to be impacted the most. Which is your further financial goal…. Most likely to be retirement planning!

The inflation gap in investments

Plain vanilla, traditional fixed-income investments may offer fairly low returns. Consider tax cost and the post-tax returns are even lower. Compared with inflation, this simply does not suffice.

So, on real terms you end up losing money on such investments rather than gaining wealth!

This calls for an investment plan that can give you better returns but without sacrificing the relative safety needed for a critical financial goal like ‘retirement planning’.

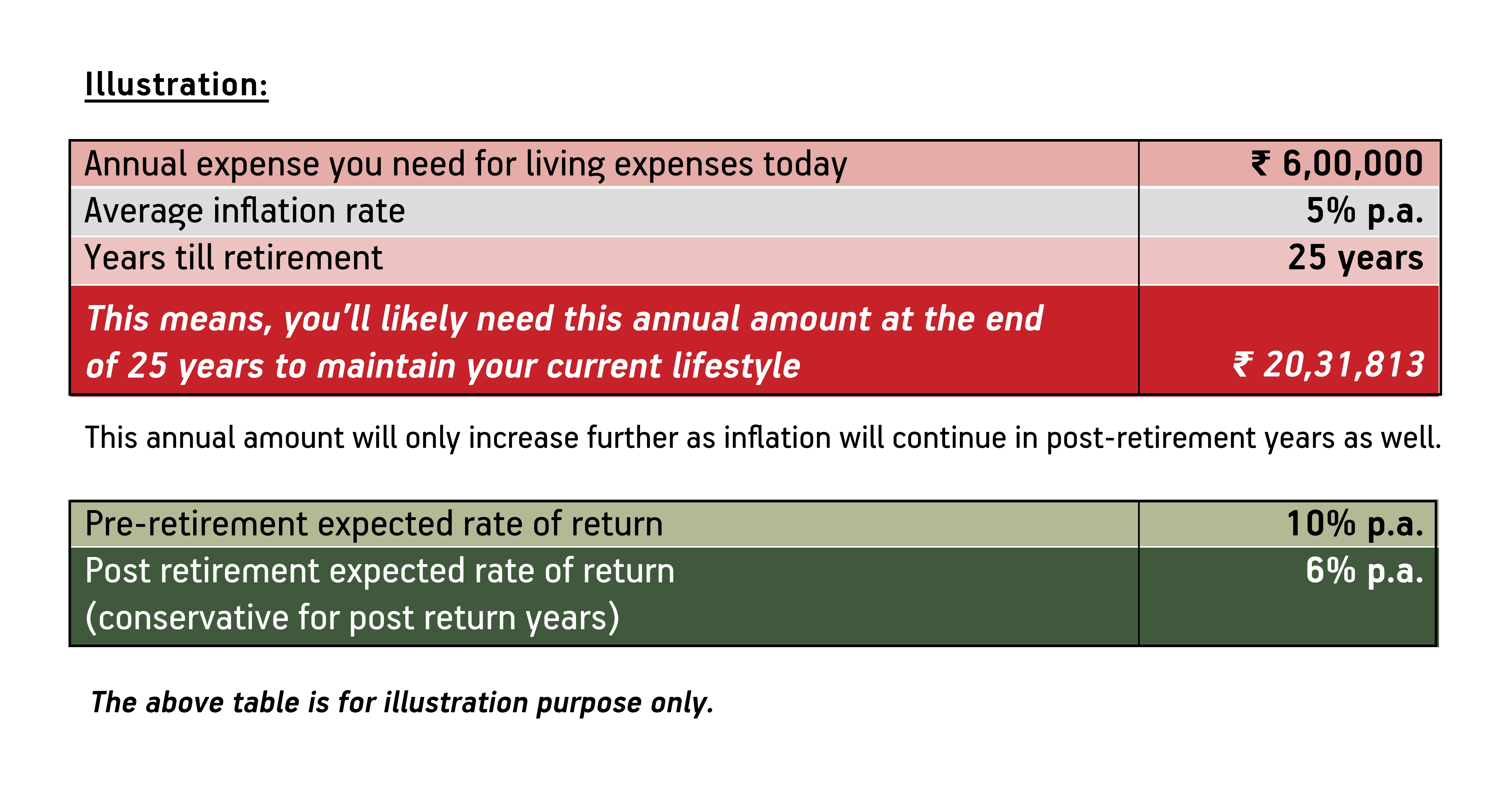

Let’s begin with some number crunching:

The first in your retirement planning steps

What you need today and what you’ll need tomorrow?

You can use any free online retirement income calculator to know the retirement corpus that you will require. In our example the retirement corpus needed will be Rs.3,67,33,237.

Considering a post retirement rate of return of 10% and 25 years in hand to accumulate, this calls for an SIP of Rs. 31,100.

This may look like a herculean task today! Before you start panicking, there are ways to achieve this target but with a lighter pressure on your wallet today.

Start early

The first and most important step to retirement planning is to start early. The more years you have to accumulate a corpus the lower can be your SIPStep up SIPs

One of the best ways to accumulate your corpus is using step-up SIPs. This basically allows you to start small and steadily increase your investments as your income grows to achieve the same end result.

In our example, if we simply commit to step up the SIP annually by 5% you can begin with an SIP of Rs.20,500 as against the current SIP of Rs.31,100. Commit to an annual step up of 10% and this amount further reduces to 12,400 and so…

This seemingly minor change actually has far reached effect over the years.Solution oriented retirement plans

Another good way to achieve your retirement goals while managing inflation is to opt for specific retirement plans. These plans work on the premise that they begin with higher allocation to equity in early years slowly and steadily moving to more stable debt investments. So, let’s say you start out in your late 20s, your retirement plan will begin with higher equity allocation as you have a higher risk appetite at a younger age. As you grow older, the retirement plan too starts switching over to less risky debt investments to align with your risk appetite.

This can provide the benefit of higher returns in earlier years, effectively to try and stay ahead of inflation.

You may also read about : what is sip

Sit down with a pen and paper and do some number crunching to re-work your retirement investment plan now considering inflation. Be proactive to enjoy a stress-free retirement!

Click here to learn about -

How to Beat Inflation

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000