-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

What would your SIP look like if you topped it by 5% every year?

May 31, 2022

3 min

4 Rating

We all must know of the famous ‘rice and chessboard story’ from ancient Indian history. You have probably heard it being narrated to you by your school maths teacher! A learned man asked for a simple rice ‘dakshina’ from the king - starting with a single grain of rice on square 1 of a chess board, keep doubling the grains of rice till the last and 64th square is reached. This is the amount of rice he asked for! A near impossible ask as this amounted to more than 18,000,000,000,000,000,000 grains of rice! These numbers may seem mind blogging, but it is actually the result of a simple mathematical proposition... ‘Compounding’.

While doubling your investments each month or year may not be practical, can you still harness some benefit from this powerful anecdote on the power of Compounding?

Surely, you can through the Top up or Step up feature of SIPs!

A quick recap on what is investing in SIP

SIP, or Systematic Investment Plan as the name suggests is a systematic means of investing in mutual funds. Think of it as an investing plan whereby you deposit pre-determined sums of money, in a pre-decided fund or funds of your choice, at periodic intervals. The main goal is to amass a sizable investment corpus through smaller, more affordable, but regular investment amounts.

Where an SIP of Rs.10,000 can take you…

A monthly SIP of Rs.10,000 towards a retirement corpus, needed 30 years from now can yield you Rs.2.28 crores

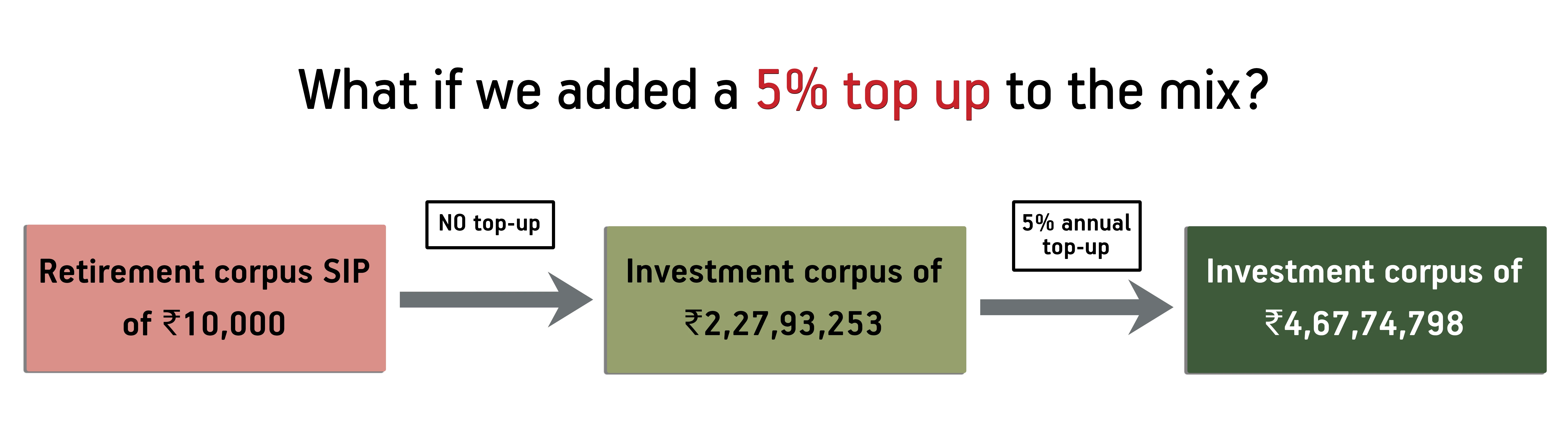

While this does seem attractive? What if we added a 5% top up to the mix?

Past performance may or may not be sustained in the future. The calculations provided above are based on assumed rate of returns and it are meant for illustration purposes only. Assumed rate of return - 10%p.a. Returns greater than 1 year are compounded. CAGR returns are computed after accounting for the cash flows by using XIRR method (investment internal rate of return). Loads are not taken into consideration in the above investment simulation. Neither Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited nor any person connected with them, makes no warranty about the accuracy of the calculations and will not accept any liability arising from the use of the same. The recipient(s) before acting on any information herein should make his/her/their own investigation and shall alone be fully responsible/liable for any decision taken on the basis of information contained herein.

THAT’S ALMOST DOUBLING YOUR RETIREMENT CORPUS WITH A MERE 5% TOP UP EACH YEAR!

Why choose top ups?

Income accretion is natural!

Put it to good use to multiply your wealth creation

Helps cover inflation

In our example, while 2.28 crores may seem like an extremely attractive amount today, it may not be so 30 years down the line.

Maximising your investment top-ups can cover the impact of inflation by providing more for you tomorrow than what you need today!Helps meet other goals

Top-ups can leave you with invested surplus which you can divert towards other goals, even fulfilling dreams you never knew you could fulfil before.

Helps to meet your goal even if your affordability is low today

Top-ups are a good alternative to ultimately reach your financial goals even when your affordability may seem low today

Keys to success!

Keep in a mind that there are a few factors which are necessary to make this top-up “magic’ work:

Discipline

Ensure to be disciplined and consistent with your SIPS and top-ups. Any missed instalments can hamper your Compounding benefit

Avoid premature withdrawal

Any mid-tenure withdrawal from your investment can adversely impact your compounding. Think of it as losing out on years of compounding and starting scratch from a zero-investment base.

Duration

Last but certainly not the least, stay invested for long. The longer the time period the greater shall be the effect of compounding!

So, while a 5% top-up can do wonders for your investment, a 10, 15 or 20% top-up can do even better. The more the merrier! So, work out your affordability and incorporate a top-up plan of your choice in your SIP investment, to benefit first hand from the magic of compounding!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Popular Search

What is Debt Fund

What is Equity Fund

What is Hybrid Fund

What is Index Fund

What is Liquidity?

ELSS

CAGR in Mutual Funds

Folio Number in Mutual Funds

Mutual Fund VS Direct Equity

Relief Under Section 89(1)

Passive Mutual Funds

Exit Load in Mutual Fund

What is ITR?

XIRR in Mutual Funds

Income Tax Slabs

STCG in Mutual Funds

How to Invest in Mutual Funds

How to Invest in Nifty Index Fund?

How to Track Mutual Fund Investments?

Investment Options

Market Mood Index

Market Sentiment

Types of Equity Mutual Funds

What are Flexi Cap Funds?

What is ELSS Fund

NFO

What is ROI?

PE Ratio

Equity vs Debt Funds

ETF Full Form

You can start investing in Mutual fund schemes through the AMCs website or from digital partners/platforms that are available in the market. Aditya Birla Capital has come up with an app to help you manage all your Aditya Birla Sun Life Mutual Funds in one place.

However, if you are investing in multiple financial institutions, it could get difficult to manage all websites and accounts. In such a case you can use digital distribution apps that show you your entire portfolio in one place.

Must Read - What are GILT Funds?

You can start investing in Mutual fund schemes through the AMCs website or from digital partners/platforms that are available in the market. Aditya Birla Capital has come up with an app to help you manage all your Aditya Birla Sun Life Mutual Funds in one place.

However, if you are investing in multiple financial institutions, it could get difficult to manage all websites and accounts. In such a case you can use digital distribution apps that show you your entire portfolio in one place.

Must Read - What are GILT Funds?

So, while a 5% top-up can do wonders for your investment, a 10, 15 or 20% top-up can do even better. The more the merrier! So, work out your affordability and incorporate a top-up plan of your choice in your SIP investment, to benefit first hand from the magic of compounding!

1800-270-7000

1800-270-7000