-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

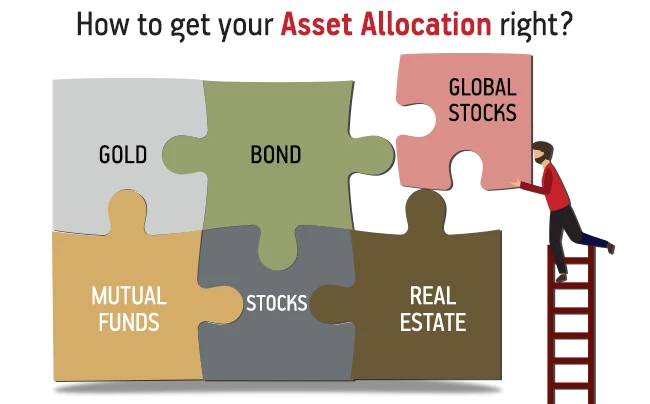

How to get your Asset Allocation right?

Dec 27, 2022

4 Min

3 Rating

Imagine having to eat the same dish, three times a day, for the rest of your life.

Not an appetising thought, right? You will soon get fed up and your appetite will grow smaller, till one day it will disappear altogether.

Just like you, your money has an appetite of its own – and just like you, it thrives on variety. In-vesting all your hard-earned money into a single asset class could turn out to be like the proverbial “all eggs in one basket”. To avoid such a mishap, one has to understand and carefully master the art of Asset Allocation.

What is Asset Allocation?

In simple words, it is segregating your investments into different asset classes to aim for long term returns. These asset classes include Equity (Domestic & International), Debt, Fixed Income Funds, Com-modities, Real Estate, Cash and Cash Equivalents, Gold, etc.

Each of these has its own features. So, making a careful study of each class and analysing their suit-ability for your portfolio before investing in them is imperative.

Why is getting your Asset Allocation right so important?

Just allocating your investments to all classes is not enough. Getting the proportions right is equally important. Think of it as running a race. All racers start at the same time and run the same lap, but finish at different times. The difference lies in their chosen strategy - when to pause and when to pace. Similarly, two people may invest the same amount in the same assets but adopt a different allocation strategy. Therein lies the crux: investing in the right assets at the right time.

Right asset allocation can help you realise your financial goals on or before time while creating wealth in the long term.

Choose your way:

Earlier, asset allocation was based on your age. It was assumed that the younger you are, the more risk-taking capacity you have. But with more observation and study, it has become apparent that it is not just age, but also a person’s income, financial goals, inherent investment attitude and of course, the current market situation that determine his or her risk profile. Once these factors are calculated, the next step is choosing an investment strategy.

You may also read about : What is nav

One way is through Strategic Asset Allocation which relies more on passive investing techniques that can be reviewed periodically. The other is Tactical Asset Allocation which is more dynamic and active in nature and needs to be reviewed regularly to make the best of the market situation.

Striking the right balance:

As mentioned earlier, each asset class has its pros and cons. Equity can prove to be a game-changer in the long run; but for shorter periods, debt/bonds can be considered. In India, gold has been relied upon as a hedge against inflation for ages. So, the trick lies in creating a customised mix of assets that suit your income, risk tolerance and goals.

Mutual funds are a useful tool in this respect. They offer a platter of many permutations and com-binations of these asset classes. Furthermore, you can also make a balanced choice between pas-sive funds including index funds and ETFs, as well as benefit from fund manager expertise with actively managed funds.

Core, Goal, Score!

A good asset allocation technique is to divide your investments into two broad categories. The first one is your “core fund” that is focused on long term financial goals like buying a house or retirement. Sudden market movements in your core fund may not impact your end goal. This fund can focus more on equity. Within equity, you can choose different type of mutual funds depending on your risk appetite and market conditions.

Then comes your secondary funds – these are more for your short to medium term goals and can be monitored and updated regularly. Aligning your investments to your goals helps you plan with more precision. For instance, your goal can be to build an emergency fund or an international vacation in 2 years.

You can experiment or play around a bit to see which combination of assets can transform your goal into reality in the stipulated time frame. If your goal is near maturity, you can reallocate money from equity funds to liquid funds.

Right asset allocation of your portfolio is like a wholesome, balanced meal with all the necessary elements in it: “core” nutrients to keep it strong and sustained for years to come, as well as flavorful, fulfilling goal-oriented elements to keep you enthusiastic and happy.

Reference articles:

https://www.businesstoday.in/magazine/cover-story/story/tips-for-asset-allocation-in-mutual-fund-portfolio-returns-45938-2014-06-11

https://www.etmoney.com/blog/what-is-asset-allocation-and-how-to-do-it-right/

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000