-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How to save for multiple financial goals

Jun 15, 2022

4 Min

4 Rating

‘Our necessities are few but our wants are endless! - This famous quote is eternally true!

When you are a young child, owning that prized toy may seem like your life's mission; when you are in college owning a superbike may become the new goal. With time these goals keep changing. As age and income levels increase so do both your responsibilities and your aspirations.

Sit down with a pen and paper and look ahead and you will likely be able to jot down a long list of financial goals! From an international holiday to a new diamond set and a new home to a retirement fund. But can you achieve them all?

Most certainly yes - if we plan prudently!

Employ a stepwise plan

In a snapshot this is what needs to be done

Let’s get there step by step!

Bucket your financial goals

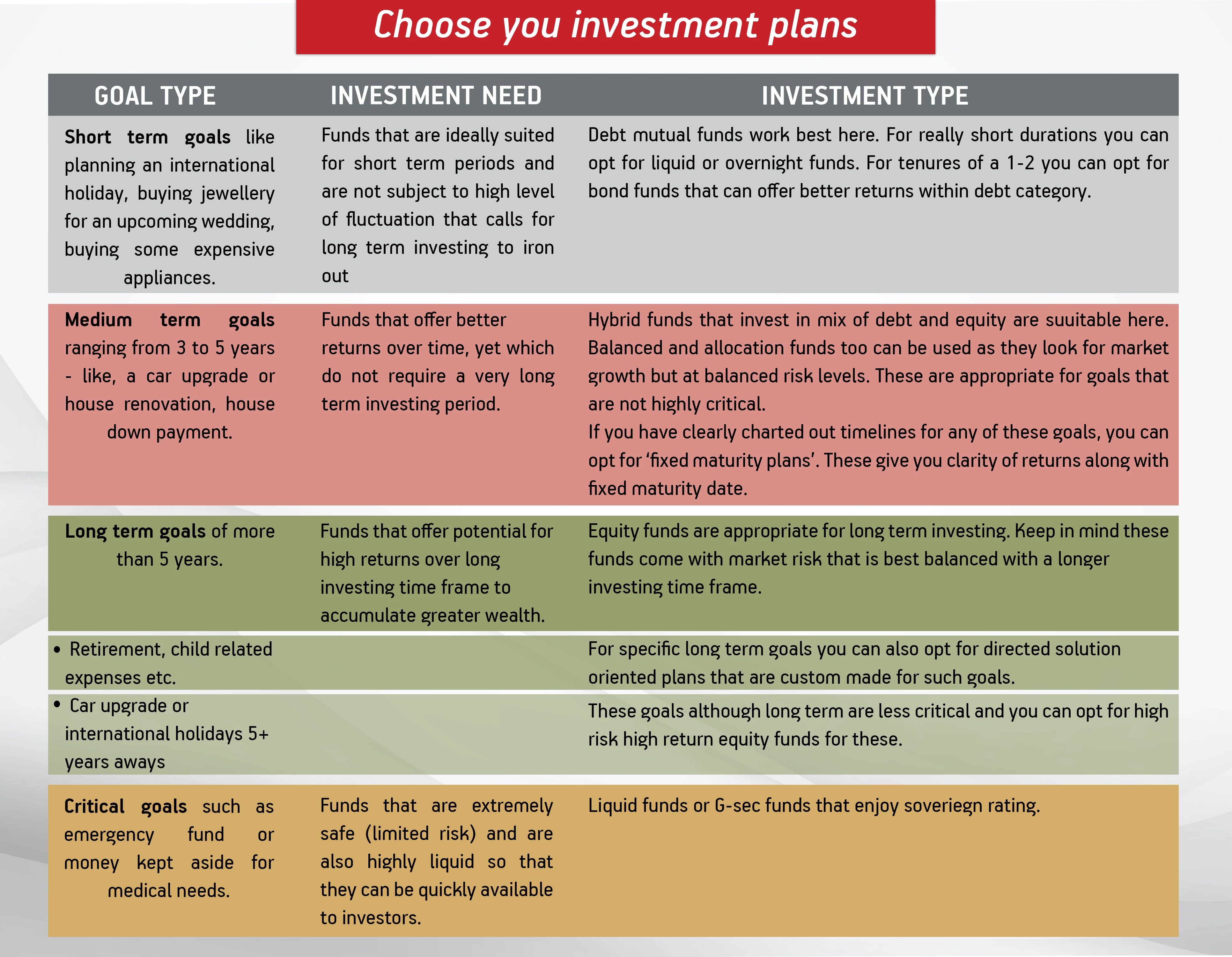

While goals are plentiful, it is important to categorise them. Every investment type comes with its own risk exposure, return potential as well as ideal investing tenure. To assign investments to each goal, knowing these aspects of each goal is a must.

This can be based on:Term – An international holiday for example may be a goal a couple of months from now; a new car may be a medium term 3–5-year goal; children’s higher education or retirement planning are further off long term goals.

Criticality – An emergency fund or retirement corpus is a far more critical goal that lets say a new car or house renovation.

Value – Retirement fund, child education or marriage, home down payment tend to be higher value goals than say travel plans or a car upgrade.

Quantify them

Assigning a fairly accurate monetary amount is key. Now we may not be able to quantify this to the last rupee, but quantifying with vision is key.

Considering rising prices due to inflation, taking help of online retirement planning calculators etc can be useful here.How much can you put away

Work out your monthly investible surplus after considering all your expenses. As a salaried individual this should be a fairly easy task as your earnings are regular. If you are self-employed too, you can work out basis average inflows and outlook for your business in the years to come.

Choose you investment plans

At this stage, you need to choose investment plans that match with each of your financial goals. Mutual funds are widely considered as the best for financial planning. They have many options across asset types and investing tenures. You are most likely to find a different mutual fund for each of your different financial goals. Match their risk parameters and return potential to the classifications we have done in step 1.

Also Check out - What is mutual fund investmentAllocate away

Short term and critical goals can be funded through lumpsum investments. Slightly longer-term goals can be appropriately funded through SIPs in suitable equity funds which you can put away little at a time to ultimately meet your goal.

There are several SIP calculators online which can help you quantify the installment amount you will need to reach your goals.

Also Check out - What is sip investment

Using this stepwise plan, you can be well on your away to not just financial success but financial freedom too! Yet, if you find this exercise daunting you can always approach a portfolio manager or financial manner of repute to do this planning for you.

Also read about the Tax on SIP's

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000