The current geopolitical issues and see-sawing global financial markets stand at a juxtaposition with India’s fast-progressing growth story.

While the Indian markets have been enjoying a bull run for a while, they are not completely unaffected by global events and fluctuations either. In such a situation you as an investor obviously want to give your portfolio the strength to not just withstand any market volatility but also try and thrive when the opportunity presents itself.

For this, it is important for you to diversify your investments across asset classes to create an all-weather solution for your portfolio.

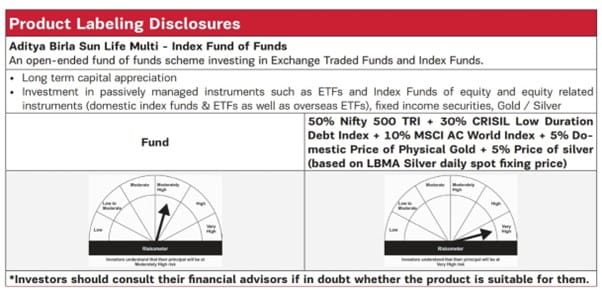

Aditya Birla Sun Life Multi-Index Fund of Funds is an open-ended fund of funds scheme that offers your investments diversity through passive optimal asset allocation in Exchange Traded Funds and Index Funds.

Multiple needs, one solution:

Every individual has his or her own financial goals and aspirations. Each of these goals is unique in its own way and the means to achieve it differ as per the person’s risk appetite.

Proper planning and research are required to understand how to build up a portfolio that helps you achieve each of your goals without burdening your day-to-day expenses and lifestyle. Hence, investing a certain amount in each asset class is important.

With guidance and experience, an investor can map out and manage his or her investments as per their goals. But till then, it is better to have a starting point that puts you on the road to goal realisation.

A multi-index fund does exactly this. By investing across asset classes, it helps start off your journey on a pre-determined index route that does not require you to have in-depth knowledge or expertise. Your investments are guided by the collective wisdom of the market, making it easier for you to track them.

An investment umbrella for all seasons:

Every asset class has its advantages. Equity can provide growth in favourable, bullish market summer, while fixed income can give a sense of stability during uncertain economic monsoons. Meanwhile, commodities like gold and silver can act as a hedge against volatility caused by both micro and macroeconomic winters.

ABSL Multi-Index Fund of Funds offers access to all these asset classes through a single investment. Furthermore, it invests 95%-100% in Index Funds and ETF (Exchange-traded Funds), which replicate a particular benchmark index. Thus, your invested money simply follows the growth pattern of the underlying index and the economy. Also, the fund invests in both domestic as well as international equity markets, giving you exposure to more growth opportunities on a global level.

At the same time, it provides a maximum 5% shield of fixed income investments that offer stability in case of volatile market movements.

The Fund assesses and rebalances itself as per changing moods of the market with the aim to take optimum advantage of any capital appreciation opportunities the market offers. So it can alternate between aggressive equity investing in times of high growth and conservative debt investing when the market bulls are around.

And being a passive investment strategy, it does all this at a low cost!

Why your portfolio needs a multi-index fund-of-funds

Summing it up, the fund’s strategic asset allocation gives it a 360 degree diversification not only across sectors and asset classes, but also across national and international markets. While the fund gives new investors a good start in their mutual fund journey, it can give seasoned investors a comfort in diversification.

Being a master of one has its benefits but being a jack of all also has its benefits. While you do a customized diversification of your core and non-core portfolio, the multi-index fund of fund can be your backup. Aditya Birla Sun Life Multi-Index Fund of Funds is an all-weather investment in which you can invest anytime, without worrying about the bull or bear market.

The investors will bear the recurring expenses of the Fund of Fund (‘FoF’) scheme in addition to the expenses of the Underlying Schemes in which Investments are made by the FoF scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000