-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Is it time to say Bye Bye Liquid & Hello Arbitrage? Maybe not

Aug 01, 2019

5 mins

5 Rating

The ongoing debate on liquid funds v/s arbitrage funds gained traction again sometime back when SEBI revised valuation norms for debt securities. This is the third time in the last few years, that these two fund categories have gone under the microscope.

Arbitrage funds first grew in prominence after 2014 Union Budget. Government increased the long-term capital gains (LTCG) tax holding period for debt funds from 12 months to 36 months. Meanwhile, returns on equity funds held for more than 12 months were tax-free. This advantage ended post Union Budget 2018, when government re-introduced LTCG tax on equity funds. Moreover, lackluster performance of these funds in last one year, further hampered their popularity. However, SEBI revised valuation norms for debt securities in March’19. Now mutual funds will have to mark to market securities having maturity of 30 days or more. Post the change average maturity of liquid funds is likely to come down to about 20 days from current 35-40 days. Consequently, liquid fund returns are likely to reduce and churn in liquid funds likely to increase. Does this make a case for arbitrage funds? Let’s find out.

What are arbitrage funds?

Arbitrage is simultaneous buying and selling of securities in two different markets to profit from the price difference existing between them. Assuming a stock is currently trading at Rs. 50 and the stock future is trading at Rs. 54. Then the difference between the spot and future price will be the profit, in this case its Rs. 4. The fund buys equal quantity of the stock in both spot and derivatives markets to safeguard itself against any price change. However, this is true at the time of the maturity. In the interim all positions are marked to market, which may lead to some volatility in the NAV. Thus, these funds are more suitable if the investment horizon is 3 to 6 months. Liquid funds on the other hand are suitable for investors investing for even a day. This is reflected in their exit load too, whereas liquid funds do not have exit load, the exit load of an arbitrage fund tends to be around 30 days to discourage early redemptions.

Generally, when markets are volatile and there is uncertainty about market direction, the spreads between spot and derivatives expand. The number of arbitrage opportunities may also increase. Thus, these funds tend to generate better returns in volatile markets compared to when markets are steady. This makes the overall fund returns slightly unpredictable.

Moreover, as arbitrage funds become popular, the number of arbitrage opportunities available will reduce and the spread between spot and future market prices will shrink. Eventually, the return potential of the fund will decrease.

Cost check

Trades in futures markets are in lots. To make sizeable profit, arbitrage funds need to execute large number of transactions. This increases fund cost. Hence, expense ratio of an arbitrage fund is higher than liquid funds.

Taxed as Equity

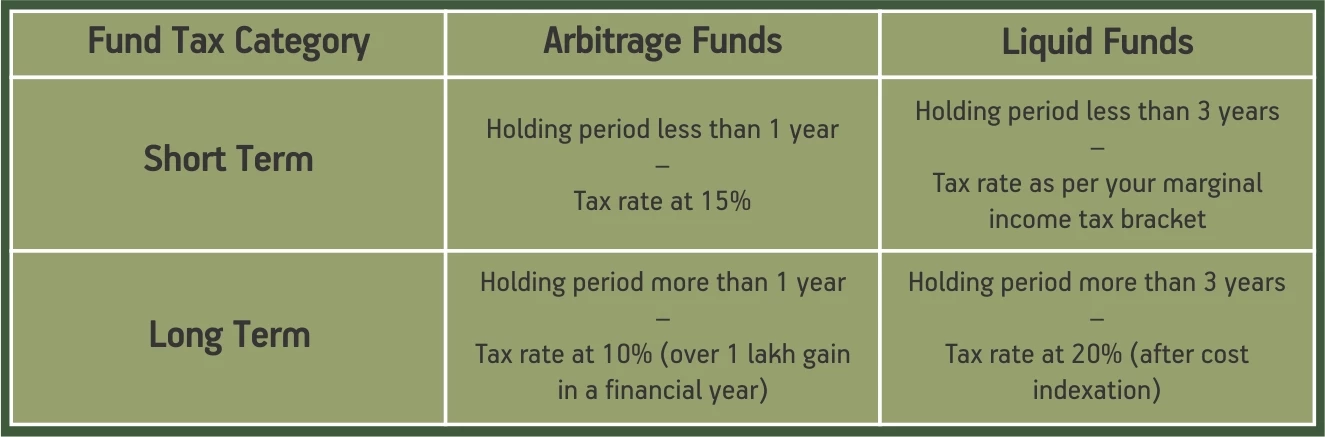

As at least 65% of the portfolio is invested in equity or equity derivatives, arbitrage fund is taxed as equities. So, the fund incurs 15% Short Term Capital Gains (STCG) Tax. The Long Term Capital Gains (LTCG) Tax is 10% if long term capital gains during the year are more than Rs. 1 lakh, else nil.

Liquid funds on the other hand are taxed as per slab rate for STCG and in case of LTCG, tax rate is 20% with indexation. This makes arbitrages slightly better from tax angle for investors in higher tax bracket. However, investors in 5% tax bracket may be better off investing in liquid funds.

While arbitrage funds are low risk alternative to participate in equities, unpredictability of returns makes it riskier than liquid funds. Moreover, better liquidity, lower costs and predictability make liquid funds a better bet for amateur investors. Mature investors in higher tax brackets may consider investing in arbitrage funds after evaluating the like movement in spreads over next 3 to 6 months.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000