-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

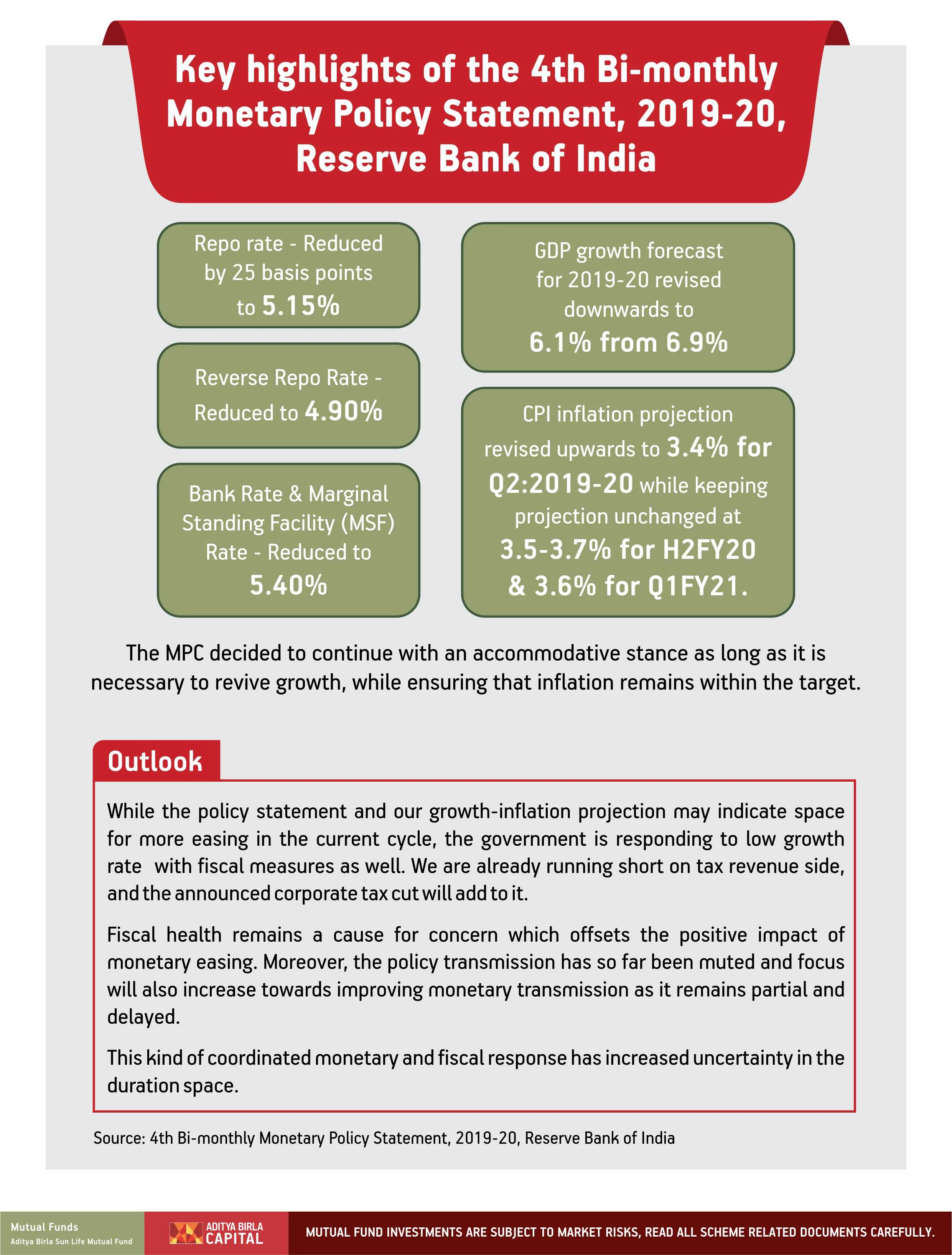

Key highlights of the 4th Bi-monthly Monetary Policy Statement, 2019-20

Oct 07, 2019

5 mins

4 Rating

Repo rate – Reduced by 25 basis points to 5.15%

Reverse Repo Rate – Reduced to 4.90%

Bank Rate & Marginal Standing Facility (MSF) Rate – Reduced to 5.40%

CPI inflation projection revised upwards to 3.4% for Q2:2019-20 while keeping projection unchanged at 3.5-3.7% for H2FY20 & 3.6% for Q1FY21.

GDP growth forecast for 2019-20 revised downwards to 6.1% from 6.9%

The MPC decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

Outlook

While the policy statement and our growth-inflation projection may indicate space for more easing in the current cycle, the government is responding to low growth rate with fiscal measures as well. We are already running short on tax revenue side, and the announced corporate tax cut will add to it.

Fiscal health remains a cause for concern which offsets the positive impact of monetary easing. Moreover, the policy transmission has so far been muted and focus will also increase towards improving monetary transmission as it remains partial and delayed.

This kind of coordinated monetary and fiscal response has increased uncertainty in the duration space.

Source: 4th Bi-monthly Monetary Policy Statement, 2019-20, Reserve Bank of India

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000