-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Making Aditya Birla Sun Life Liquid Fund your friend in need

Mar 13, 2023

4min

4 Rating

Aditya Birla Sun Life Liquid Fund is an open-ended liquid fund with moderate credit risk and low interest rate risk. If you are looking for reasonable returns in the short-term with greater safety and liquidity, this could be an appropriate option. The fund's corpus is invested in superior-quality debt and money market instruments with maturity of up to 91 days.

What is a Liquid Fund?

Liquid funds primarily invest in debt securities, such as government securities, treasury bills, commercial papers, and others that have a maturity of up to 91 days. These investments are suitable if you want to park your money for a short period but earn more than the traditional saving instruments . Liquid funds also allow you to withdraw the funds at a short notice, which makes it appropriate if you want to invest in instruments that provide access to cash at a short notice.

Features of a Liquid Fund

The primary aim of such funds is to ensure capital protection along with greater liquidity. Some common features include:

Investments in superior debt instruments like commercial papers, certificate of deposits, and others.

Average maturity of securities comprised in the fund portfolio is up to three months.

NAV does not tend to fluctuate as much as other mutual funds because the duration of the securities in the portfolio is short.

The liquid fund withdrawal time for most AMCs is 24 hours.

Why invest in Aditya Birla Sun Life Liquid Fund?

ABSL liquid fund can be an appropriate option if you want to park your funds for a short period. Here are five reasons why Aditya Birla Sun Life Liquid Fund can be your friend in need:

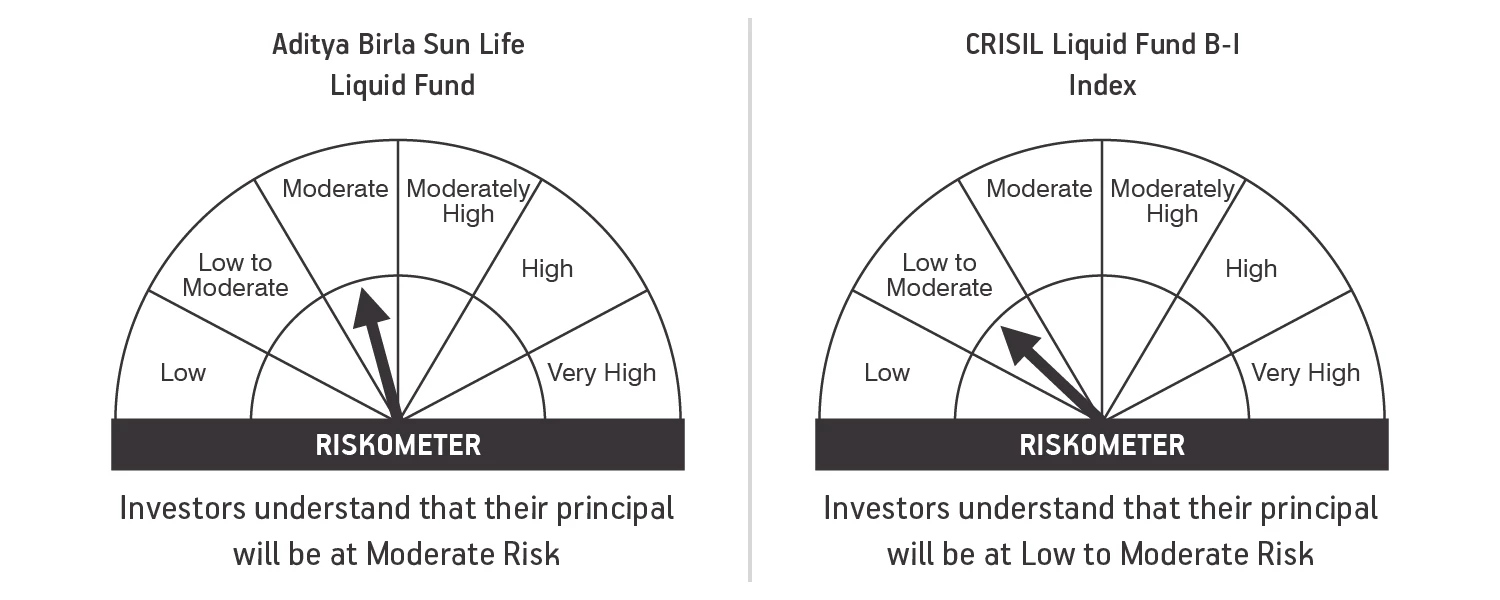

Moderate risk

Instruments included in the fund portfolio have a maturity period of up to 91 days. Moreover, the chosen investments have higher ratings, which carry minimal risk of default. A high percentage of the corpus is invested in government-backed securities with a low risk providing greater capital protection.

Higher returns

Most of the fund corpus is invested in low-risk high-rated debt instruments that offer a reasonable return on investments. Compared to returns from traditional savings instruments, liquid fund returns could be better thereby allowing you to earn slightly more than some fixed-income securities.

Greater flexibility

Unlike FDs, liquid funds have no minimum lock-in period, which allows you to withdraw the funds when required. Additionally, there is no entry load when you invest in this fund. The AMC charges a nominal exit load if you withdraw your money within seven days from the date of investment. Exit load becomes nil if you invest the amount for seven or more days.

Also read- Exit Load in Mutual Fund: Meaning, Types, and CalculationProfessional fund management

Aditya Birla Sun Life liquid fund is managed by highly experienced and professional fund managers. The corpus is managed by four fund managers who have a combined experience of more than 50 years.

Also read - Types of Mutual FundsTax benefits

Liquid fund investments are categorised as debt funds and the returns are subject to capital gain tax regulations. If you exit the scheme within three years, the returns are taxed as per your income tax slab. Long-term capital gains tax at the rate of 20% with indexation is applicable when you invest for more than three years.

Liquid funds have several uses and can be used as an excellent alternative for traditional saving accounts. These can also act as an appropriate way to build an emergency fund or to temporarily park funds that are still not invested.

To know more about Aditya Birla Sun Life Liquid Fund, visit: https://mutualfund.adityabirlacapital.com/saving-solutions/aditya-birla-sun-life-liquid-fund or contact your financial advisor today.

Aditya Birla Sun Life Liquid Fund

(An Open-ended Liquid Scheme)

This product is suitable for investors who are seeking*

- reasonable returns with high levels of safety and convenience of liquidity over short term

- investments in high quality debt and money market instruments with maturity of upto 91 days

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000