-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Mutual Fund Categorization - Investors’ Ready Reckoner – Hybrid Funds

Jun 27, 2018

6 mins

5 Rating

In this ongoing series about scheme re-categorization and rationalization, we have so far covered the equity and debt segments.

Today we cover probably the most popular segment of mutual funds in recent times – Hybrid funds.

Let’s face it. Not all investors invest in mutual funds for the highest returns.

As an investor, you also want to ensure that your investment has safety built in but does not sacrifice returns in the name of safety. You might have been saving so far in the traditional investments and taking that leap of faith and start to invest in mutual funds may not be easy.

You may not be comfortable with 100% equity investment in your mutual fund investment. You may not like the volatility or the fluctuations in value that is at display with full-fledged equity funds.

The question on your mind is - “What if I lose my savings?”

That’s where the hybrid category of mutual funds comes in. They are called Hybrid because they involve a mix ofgrowth-oriented equity as well as capital-preserving debt. At a more evolved stage, they can have more asset classes, but essentially they have 2 asset classes i.e. equity and debt at least

Also Read - What is Hybrid Fund?

In short, the best of both the worlds.

Let’s take a closer look.

The new hybrid categories as defined by SEBI are:

| Sr.No. | Category | Equity & Equity related Instruments | Debt Instruments |

| 1) | Conservative Hybrid fund | 10% to 25% | 75% to 90% |

| 2.1) | Balanced Hybrid Fund (no arbitrage) | 40% to 60% | 40% to 60% |

| 2.2) | Aggressive Hybrid Fun | 65% to 80% | 20% to 35% |

| 3) | Dynamic Asset Allocation or Balanced Advantage | 0 – 100% | 0 to 100% |

| 4) | Multi Asset Allocation (invests in 3 or more asset classes such as equity, debt, gold, etc.) | Minimum 10% | Minimum 10% |

| 5) | Equity Savings | Minimum 65% | Minimum 10% |

As you can notice, as per point 2, a fund house can have either the Balanced Hybrid or an Aggressive Hybrid but not both.

Given the new classification structure, Aditya Birla Sun Life Mutual Fund too aligned its existing schemes with it. Within hybrid, there are now 4 types of funds that are on offer by Aditya Birla Sun Life Mutual Fund.

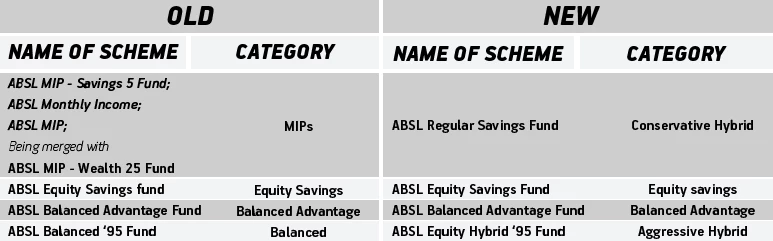

Here’s a table that shows you the transition from the old to the new.

All the MIP or Monthly Income Plan products have now been merged into one simple offering as a Conservative Hybrid and renamed Aditya Birla Sun Life Regular Savings Fund.

All other hybrid funds continue the way they have been managed so far. Of course,Aditya Birla Sun Life Balanced ‘95 Fund has a new name – Aditya Birla Sun Life Equity Hybrid ’95 Fund.

To make it further easy to pick your fund or where does not existing fund now stands, here’s how the new line up of hybrid funds.

As you can see, each of the funds has something unique to offer across the risk reward spectrum. You can now choose to make equity and debt work for your portfolio in different combinations.

Want debt to provide lower risk to your portfolio and yet get equity like tax benefits, then you may choose the Aditya Birla Sun Life Equity Hybrid ‘95 with an aggressive bend.

Want still lower volatility? You may choose Aditya Birla Sun Life Balanced Advantage fund.

If you are a first time investor or moving from traditional investments to mutual funds, Aditya Birla Sun Life Equity Savings could be the fund to start with.

Simple, isn’t it?

Then, make the hybrid work for your portfolio.

Must Read - How to Invest in Mutual Funds?

Note: If you are not clear about which funds to go forplease work with your financial advisor to pick the right funds for your needs.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000