-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Mutual Fund Categorization - Investors’ Ready Reckoner – Equity Funds

Jun 27, 2018

6 mins

5 Rating

In this post, we cover the most exciting segment of mutual funds – Equity funds.

As we mentioned in our introductory post on scheme re-categorization, investors of open ended equity mutual funds can now choose from some well-defined categories.

In fact, if you are an existing investor in one of the Aditya Birla Sun Life Equity Mutual funds, you will also see some clearly defined funds. Not just that the universe they are likely to choose their investments from is defined too.

Within equity, there are now 10 types of funds that can be offered by any mutual fund house.

Let’s take a closer look.

The new categories are:

- Multicap fund – minimum 65% investment in stocks / equity

- Large cap fund – invests 80% or more in large cap stocks

- Large & Mid cap fund – invests at least 35% in large and mid cap stocks each.

- Mid cap fund – invests 65% or more in mid cap stocks

- Small cap fund - invests 65% or more in small cap stocks

- Value / Contra fund – minimum 65% investment on the basis of the value / contra strategy

- Dividend Yield Fund – invests 65% or more in dividend yield stocks

- Focused Fund – invests in equity maximum of 30 stocks

- Sectoral / Thematic – invests 80% or more in equity

- ELSS or Tax saving mutual fund – minimum 80% investment in equity under guidelines of tax savings issued by Ministry of Finance. 3 year lock in applicable.

Large caps here mean the top 100 stocks as ranked by full market capitalization.

Mid caps here refer to the 101st to 250th stocks as ranked by full market capitalization.

The rest of the stocks from 251st stock and onwards is referred to as small caps.

*average full market capitalization of the previous six month will be considered

For Sectoral/Thematic funds, there is no limit to the number of fund schemes that a fund house can have. Only that each one of them has to be distinct or unique in sector/theme.

As you realise, the rationalization and recategorization doesn’t limit the options that you have as an investor but only makes them clearer for you to understand and invest.

In fact, these are very sharp and clear labels for equity funds to choose from and yet offer great clarity as to what stock market classification the fund will pick investments from or strategy the fund will follow to build your portfolio.

You can choose a market cap biased fund, a free flow multicap, or a particular strategy of your choice.

Frankly, choosing a fund for your wealth generation has never been easier.

Aditya Birla Sun Life Mutual Fund schemes follow these defined categories to make it easier for you to pick the right fund for your needs.

Now to achieve the right label and category, we had to make certain changes to the funds from as simple as a change in scheme name to merging some of the existing schemes to offer a more robust investment option.

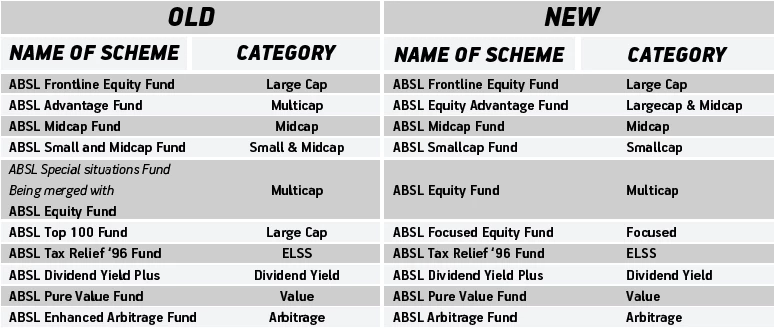

Here’s a table that shows you the transition from the old to the new.

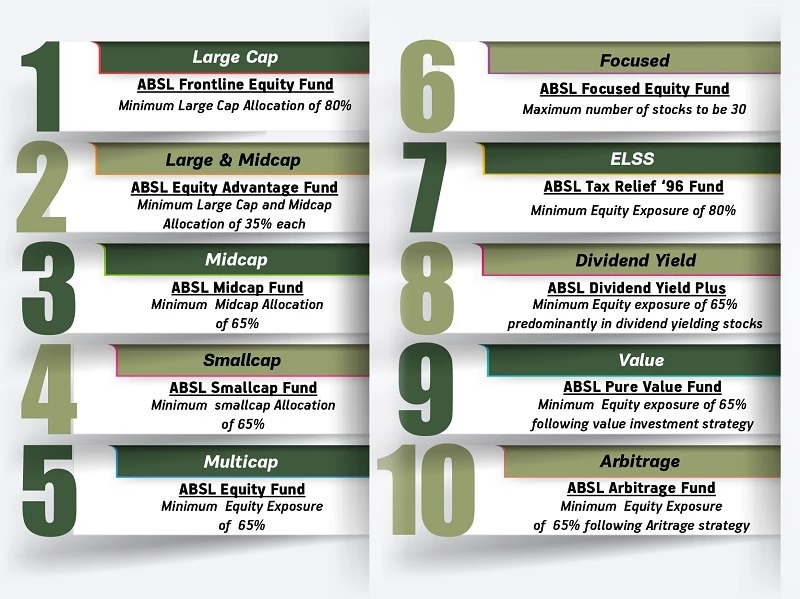

To make it further easy to pick your fund or where does not existing fund now stands, here’s how the new line up of Aditya Birla Sun Life schemes looks like.

As you can see, each of the fundshas something unique to offer.

Want to invest for tax savings? Aditya Birla Sun Life Tax Relief 96 could be your answer.

Wish to take a value approach to your investments? Aditya Birla Sun Life Value Fund could be your choice.

Or simply want to take a full market exposure via a multicap fund – you may go for Aditya Birla Sun Life Equity Fund.

Simple, isn’t it?

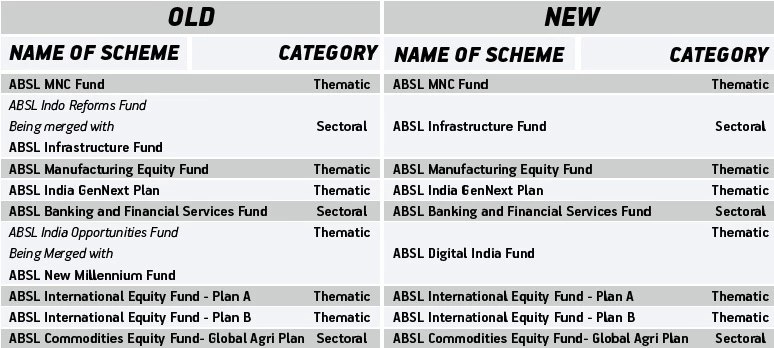

In sectoral / thematic funds, here’s how the changes look like. Nothing dramatic has happened here since sectoral/thematic funds were largely unique. We have merged a couple of funds to make the choices more compelling.

So, go ahead and make your choice. If you feel infrastructure is going to witness the next wave of growth and wish to include a fund dedicated to that theme, Aditya Birla Sun Life Infrastructure fund could be considered

Note:If you are already invested in a particular fund and it has undergone a name or a category change, there is nothing to panic.

Once you are clear about your goals and risk appetite, picking a mutual fund is going to be much easier than before.

If you need, you can work with your financial advisor to choose the right fund for you.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000