-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Should you pay off your debt or invest that money?

May 23, 2019

6 mins

5 Rating

Have you recently received a considerable bonus cheque or experienced some windfall gain in your business? Are you wondering whether you should put this money away in a calculated investment or begin paying off your debt?

A classic dilemma, this question has no right or wrong answer, it depends entirely on your specific circumstances – such as type of debt you have, your risk appetite and your other financial goals. We’re bringing you a few points to consider before you take this decision.

Psychologically while paying off debt may seem like your first choice as it may relieve you of the stress of paying EMIs, there are other points you should consider especially in case the loan you are looking to pay off is a long term one.

The key lies in the difference between the cost of debt i.e.: the interest you will have to pay vis-a-vis profit from your investment i.e.: the return you can make.

If you have high cost debt such as high interest rate personal loans or expensive credit cards on which you may be paying interest rate of anything between 14% to 30%# p.a., then paying off such high debt may be advisable as banking on such high returns from investments may not be prudent.

However you may want to act differently in case you have a long term lower rate interest such as a home loan.

Let’s look at making a pre-payment against a home loan vis-a-vis investing the same amount for the remaining tenure of the loan in a hybrid/equity oriented mutual fund. On an average a home loan can be currently availed## at 8.5% to 9.5% p.a. While over a long time frame like 10-15 years, well managed equity oriented funds may earn in excess of 12% annual return. We have however, considered a conservative estimate of compounded annual growth rate of 10% over a long term.

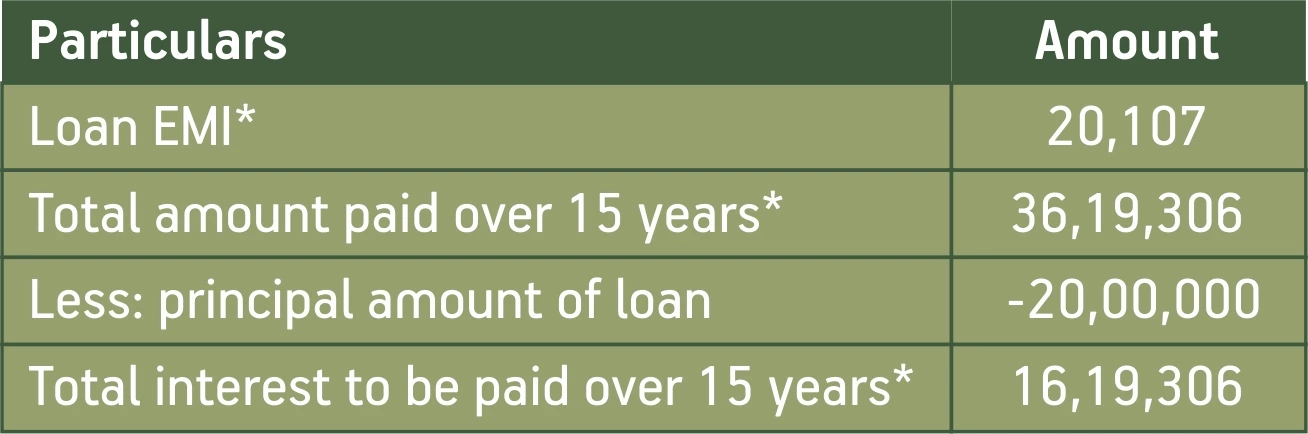

Illustration: Let’s assume you have an existing housing loan of INR 20 lacs at 8.85%p.a. interest and term of 15 years

After 3 years, if you get a lump sum amount of INR 5 lacs, you have two options:

Option 1 – Prepay the loan to the extent of 5 lacs

When you opt to prepay any portion of your home loan, the EMI remains the same but the loan tenure reduces as a result of which you save on interest payments.

In our example, if a prepayment of INR 5 lacs is made after 3 years of the loan, then the loan tenure will reduce by 57 months* and the total interest payable would amount to INR 9,58,600*.

Against the original interest payable of INR 16,19,306, this option leads to an interest saving of INR 6,60,706*.

Option 2 – Continue the loan as is and you can invest this amount in mutual funds

Alternatively, the amount of INR 5 lacs can be invested in well managed equity oriented mutual funds over the remaining tenure of 12 years. Considering a conservative CAGR of 10% p.a, the amount of INR 5 lacs will multiply to INR 15,69,207 over 12 years.

This results in a net profit on investment of INR 10,69,207 at the end of 12 years.

For sake of simplicity, we have not considered the additional tax savings on interest in case the loan is not prepaid in this option. This can only have an effect of increasing the net profit earned in this option.

As you may have noted, financially speaking Option 2 with a net benefit of INR 10,69,207 works out better than Option 1 with a net benefit of INR 6,60,706.

But what about if you go through a bad patch and find it difficult to pay your EMIs? Well that’s what your investments are for. Open ended mutual funds allow you to liquidate your investments as early as within 1 to 5 days. So opting for investing vis-a-vis paying off your debt even helps in building up a contingency fund for a rainy day.

While investing has no guarantees and paying off your debt may appear to be a safer option but if you are willing to wait it out over a longer term and have the risk appetite, investing in well managed equity funds as against paying off your low interest-long term debt may work out as a better option.

Source:

#https://www.bankbazaar.com/

##https://www.bankbazaar.com/home-loan.html

*https://emicalculator.net/home-loan-emi-calculator/

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000