-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

All you need to know about Silver Mutual Fund

Oct 18, 2022

4min

4 Rating

The proverbial privilege of being “born with a silver spoon” is bestowed upon only a select proportion of the global population. The rest of the world, in fact a majority of it, has to earn its own “silver spoons”, so to say.

Precious metals like silver pose a unique conundrum: they are desirable for their intrinsic as well as aesthetic value yet doubts regarding their purity and safety pose serious problems to buyers. But now, with mutual funds offering silver as an underlying asset with guarantee of its purity and minus its many security concerns, investing in silver has become easier than ever before.

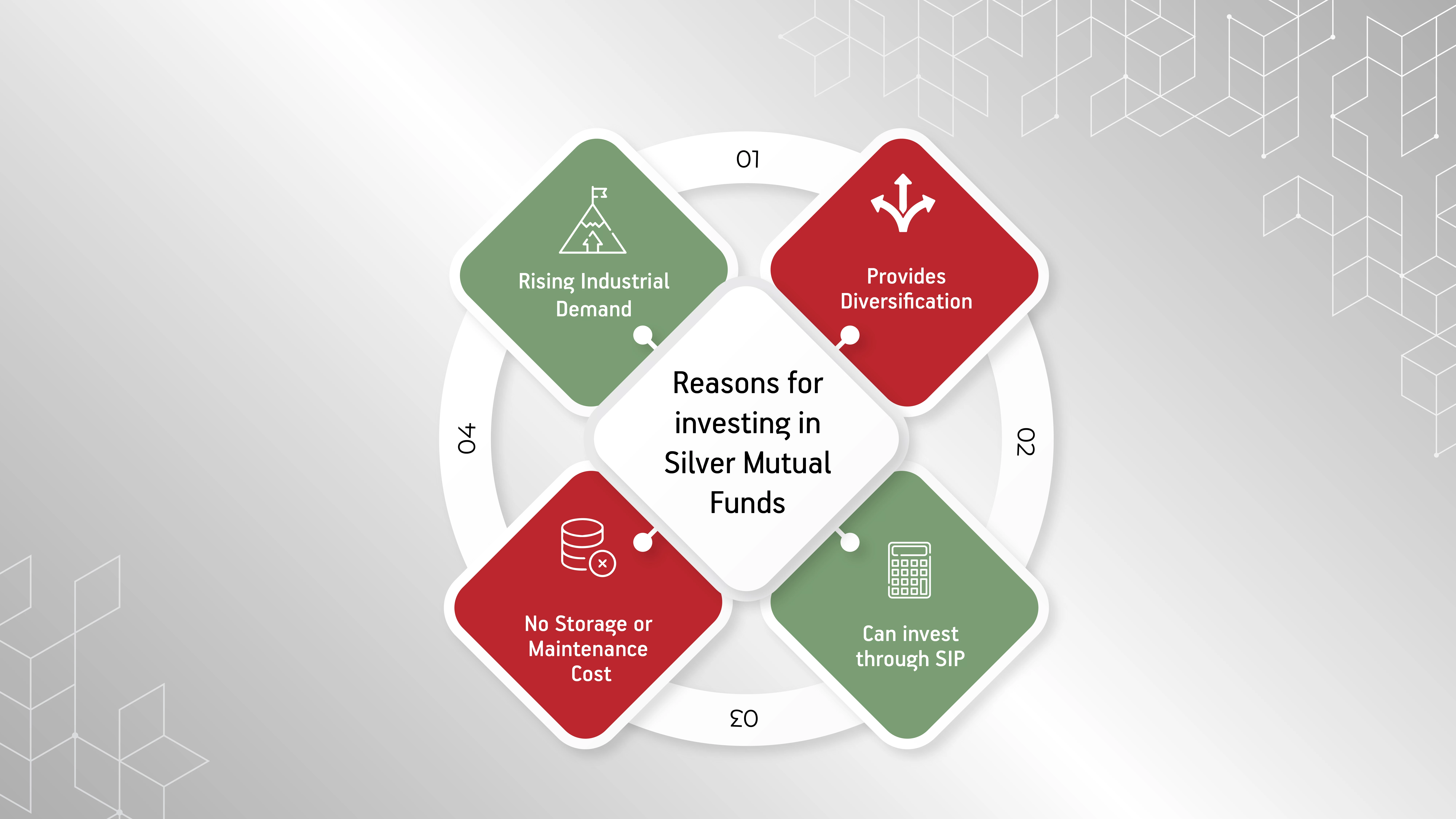

The silver mutual fund and its ETF is the “newest kid on the block”. But are these silver mutual funds worth all the hoopla? Here are 5 reasons investing in silver mutual funds could be the opportunity your portfolio has been waiting for:

1. Silver: The Unsung Hero of the Masses and Machines

Gold and silver as an asset class in themselves already have a widespread following in India.

In our country, silver coins, medallions, jewellery and silverware are commonly gifted during festivities and special occasions. However, many do not realize that despite its “precious” tag, silver is commonly found all around us! The varied applications of silver in medicine, technology and industry are still unknown to many potential investors. From 5G technology to solar panels to electric vehicles, silver is used in innumerable ways.

Despite this, it was not until recently that the true potential of silver as an investment tool was fully appreciated.

2. Opening the Investment Door Wider:

By bringing this valued asset into the mutual fund domain, this precious metal has now become easily available as an investment to many more investors.

Earlier, buying silver in physical form was something only a lucky few could afford. Buying silver meant saving up for months and cutting corners on essential requirements just to be able to buy a small silver coin. But now with the launch of silver mutual funds, any investor can invest a portion of his or her pocket money to buy it! You can now invest any amount of your choice, small or big*, into a silver mutual fund without punching a hole through your budget and savings. To make it even more convenient, you can even opt for doing so through a Systematic Investment Plan (SIP), helping you make regular and flexible investments in silver.

*Please refer to the SID of respective mutual fund scheme to know the minimum investment amount criteria.

Click Here to Calculate Your SIP

3. Shine without the Stress:

With physical silver, buying was just the beginning. This would be followed by the problem of storage and the fear of losing it. In addition to this, unlike gold, silver blackens over time and needs to be polished periodically to retain its sheen.

With the advent of silver mutual funds, storage and theft are no longer a burden. No additional expense for its maintenance is necessary.

4. The “x” Factor in the Risk-Return Equation:

When it comes to investing, a diversified portfolio can be an effective way of reaching your financial goals. During volatile stock market, distributing your investments among equity, fixed income and bullion can be a good strategy to get reasonable returns during changing market moods. While equity investments can give you long term returns in a bullish phase, it is the bullion class which may help cut down risks.

5. Rising Demand:

Silver is constantly at work through its various applications. Thus, it is always in demand in various industrial, technological or pharmaceutical quarters. According to the World Silver Survey 2022, global demand for silver grew by 19% in 2021 which was much higher than the increase in its supply (5% year-on-year). The global demand in 2022 is projected to grow 8% to a record high.

Source: World Silver Survey 2022; 20th April 2022

Thanks to the increased interest in ‘green technologies’ such as EVs and solar energy, as well as an effort to boost the semiconductor industry, the demand for silver on an industrial level is also high.

The introduction of silver mutual funds has now given the investor more power. An investor can enjoy all the benefits of investing in silver without the tension and burden. But the journey to this stage has not been an easy one. It has taken silver a long time to win an opportunity to stand in the spotlight. It is truly its time to shine now. Make the best of this opportunity and aim to let your portfolio shine in its light as well!

Reference Links:

https://economictimes.indiatimes.com/markets/commodities/news/make-use-of-the-mutual-fund-route-to-silver-for-a-more-diversified-portfolio/articleshow/88994386.cms

SILVER SUPPLY & DEMAND - The Silver Institute

Slide 1 (silverinstitute.org)

Global Silver Demand Forecast To Reach A Record 1.112 Billion Ounces In 2022 (silverinstitute.org)

Read More:

What is Equity SIP?

Types of Equity Funds

What is Mutual Fund?

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000