-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Snapback, but mind the risks

Jan 27, 2021

3 mins

5 Rating

Bhupesh Bameta

Bhupesh Bameta

Mr. Bhupesh Bameta, CFA

Global economy is likely to snapback in 2021 after witnessing the worst decline since World War 2 in 2020. Our benign outlook mainly stems from our expectation of continuation of extraordinary monetary-fiscal support in an economy recovering because of waning impact of pandemic. We believe that unlike post Global Financial Crisis (GFC) period where policymakers withdrew fiscal support too early, we will see continuation of fiscal support well into recovery phase, even as monetary policy would remain very accommodative.

The downturn in 2020 was an exogenous shock due to the virus and can be somewhat compared to a natural disaster or war on its impact on economy, except in one crucial aspect: productive capacity was mostly not damaged. Unlike an endogenously caused recession, which is generally the result of some deep economic malaise in the system and requires a long period to correct, the snapback this time is likely to be very fast.

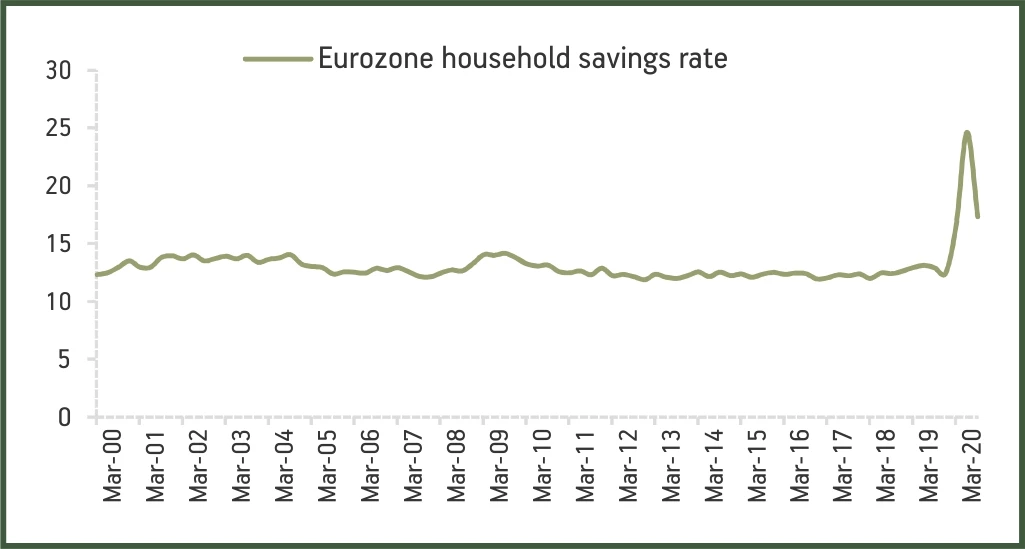

We also note that policy makers in developed markets (DMs) have been able to limit scarring in the economy in 2020 and households have accumulated a significant war-chest of savings, which they should put to use once economy re-opens. Moreover, 2020 recession was due to an exogenous shock and we did not have excesses which entails a prolonged healing period.

The key risks to our optimistic view come from 1) Pandemic: It’s a new virus and there are still uncertainties regarding the evolution of pandemic and efficacy of vaccine. 2) Inflation: The strong dose of monetary-fiscal stimulus in a recovering economy has the potential risk of inflationary pressure, which may result in earlier withdrawal of policy support than we are anticipating and it is this support which is the key underlining reason of our bullishness.

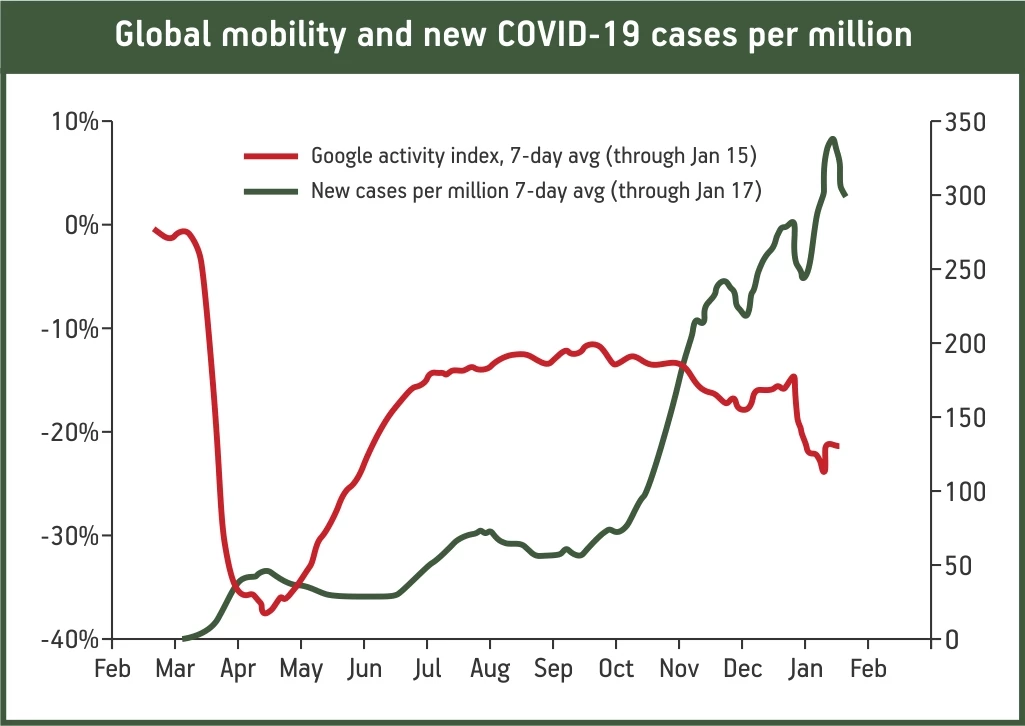

We expect both emerging markets (EMs) and DMs participating in the recovery. US is likely to lead the recovery and strong US consumer demand shall have positive impact on global economy. However, we believe that the raging second wave of pandemic will hit growth in 1Q in Europe and US, which should subside from 2Q21 onwards as vaccine becomes more widely available and climate turns warmer in the Northern Hemisphere.

Let us elaborate on some of the points:

-

Receding pandemic

Biggest source of optimism comes from the likely waning impact of pandemic given the widespread vaccination and the impressive number of vaccines on the horizon. Moreover, Sero survey already show high level of prevalence in many countries and medical/policy response would keep improving. Lockdowns have already become more targeted and less disruptive for economic activity.

However, big caveat here is that pandemic is also the biggest source of uncertainty. It is a new virus and while the current outlook looks positive we need to keep a close watch on how things evolve, especially with respect to vaccination.

Figure 1: Pandemic becoming less disruptive but would hit Q1 growth

-

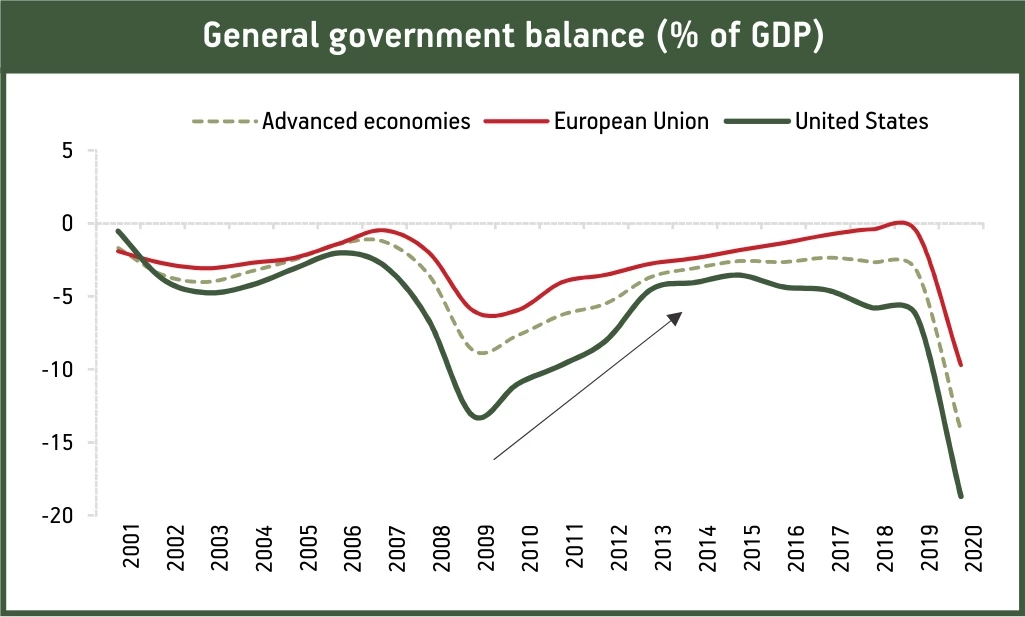

Learning from GFC: Fiscal support to continue well into recovery

Monetary-fiscal policy is expected to remain exceptionally supportive even when global growth would rebound with waning pandemic. Two key learnings from post GFC policy response amongst DM policy makers are that 1) Policy support, particularly fiscal, should not be withdrawn prematurely, and 2) Disinflationary forces are much more entrenched and Philips curve is much flatter than earlier thought. Hence growth can be pushed to a much greater extent without worrying about inflation.

As discussed in an earlier Blog, (https://mutualfund.adityabirlacapital.com/blog/covid-19-a-watershed-event-for-world-economy-and-economics) Covid-19 is turning out to be a watershed event for world economy. What we are witnessing now is a broad-based consensus in DMs amongst most economists, Central Bankers and politicians that fiscal support would be needed for more time. This is unlike GFC when the consensus was of quick reversal of fiscal easing, which is widely believed to be a mistake in hindsight.

Figure 2: Fiscal policy turned contractionary very early in post GFC recovery

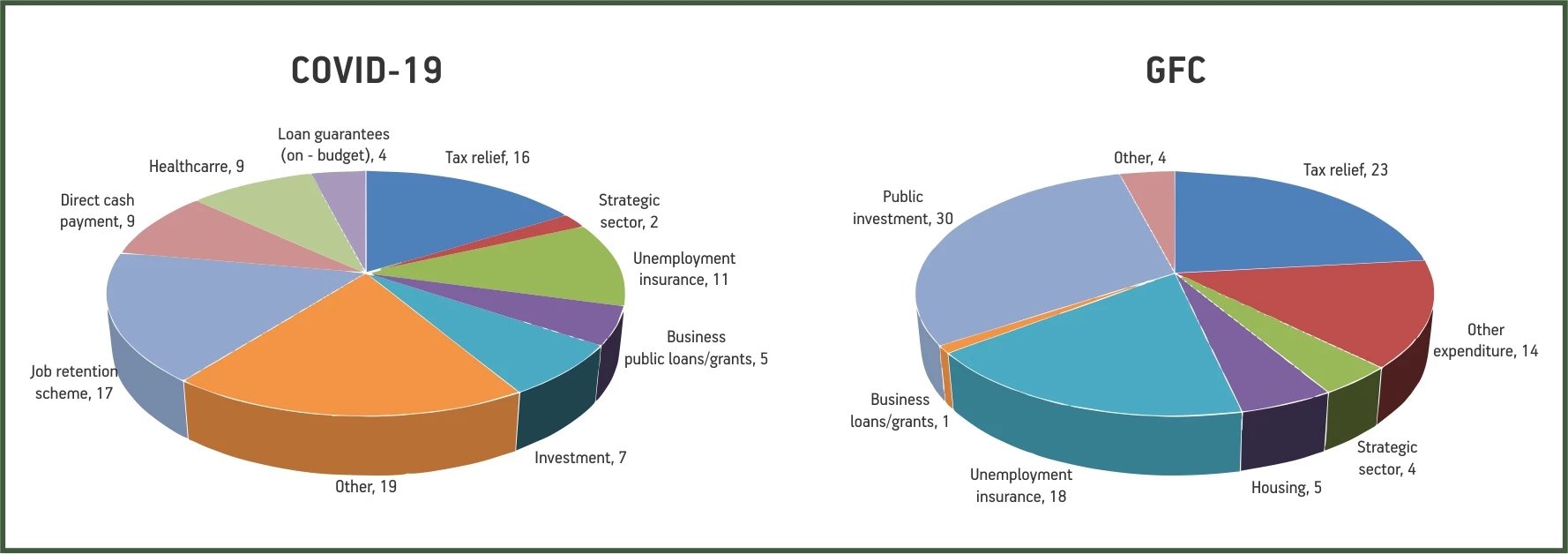

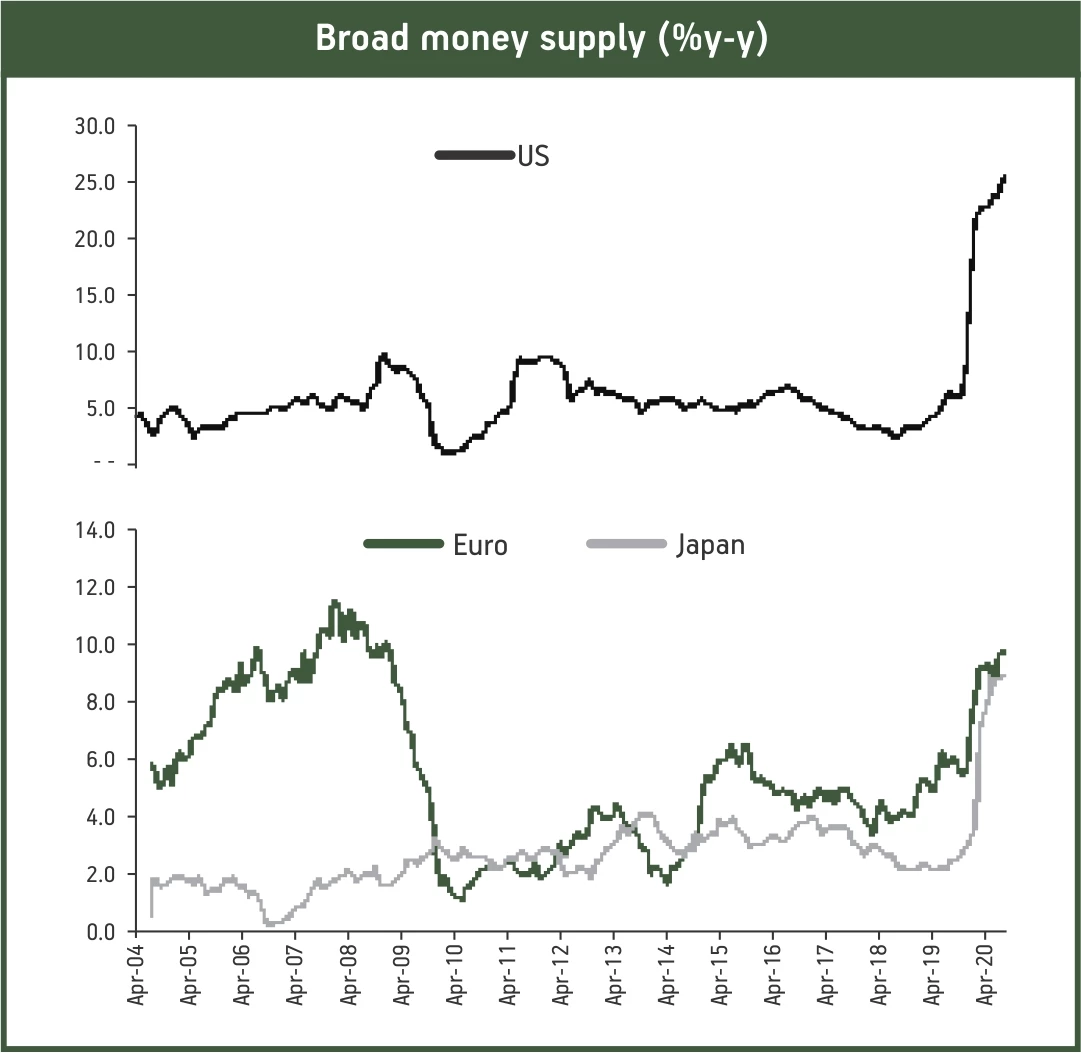

We also note that the range of policy support has been much more exhaustive compared to post GFC with greater focus on job retention schemes, loan guarantees and direct cash transfers. The results would likely be much less scarring. Moreover, the aggressive loan-guarantee schemes and monetary-fiscal tango has also resulted in big jump in broad money supply unlike GFC.

Figure 3: Composition of fiscal stimulus has been different from GFC

Figure 4: Broad money supply growth has been very strong unlike in post GFC response

-

Wall of household savings

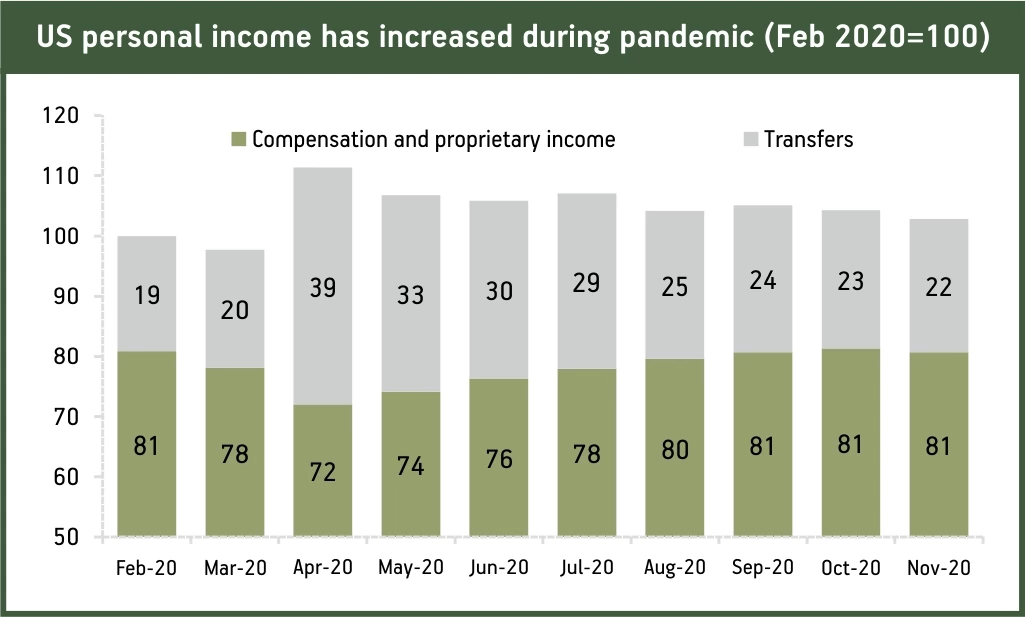

The aggressiveness of policy support, particularly in US can be gauged from the fact that personal income of household (including transfers) actually increased in the pandemic, which means that the government transfers more than compensated for the loss in wages. Personal income is likely to increase further with the proposed US$1.9 tn stimulus plan of the new US President.

Figure 5: Rise in US personal income reflects the extraordinary policy support

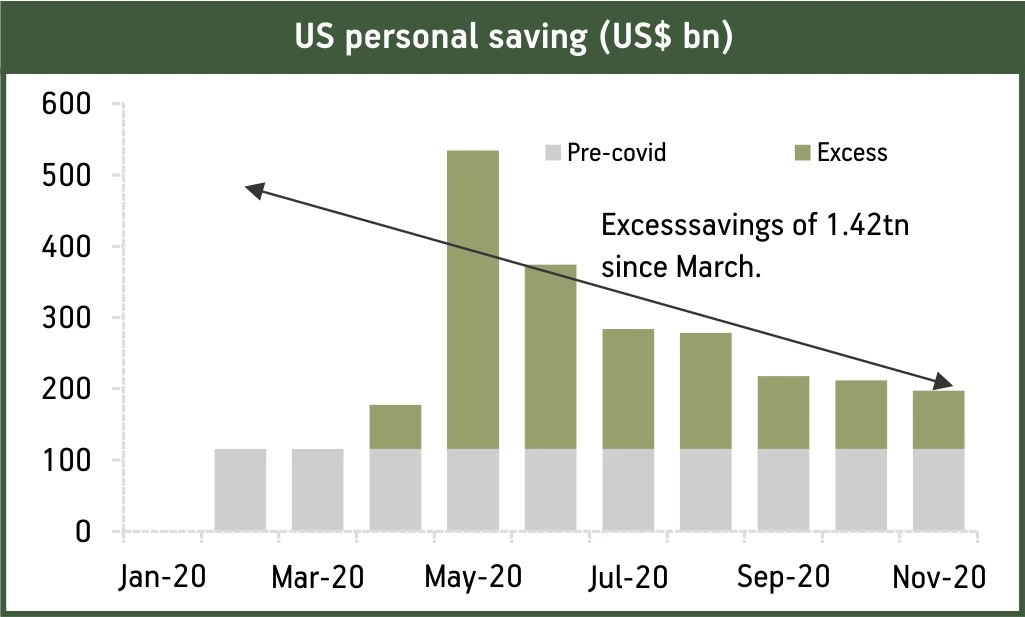

With personal incomes rising, the precautionary savings due to uncertainty about the pandemic, and closure of economy (particularly services), has resulted in very big rise in savings, particularly in US, where the cumulative savings has reached US$1.42 trillion by November and is likely to reach US$2tn level by 2Q, if the US President’s stimulus plan is passed. This massive wall of savings is a huge dry powder which will be deployed once economy reopens, likely from spring season. On the flip side, this has potential inflationary implications.

Figure 6: Exceptional rise in accumulated personal savings is very bullish for demand once economy reopens

India is also likely to see sharp rebound

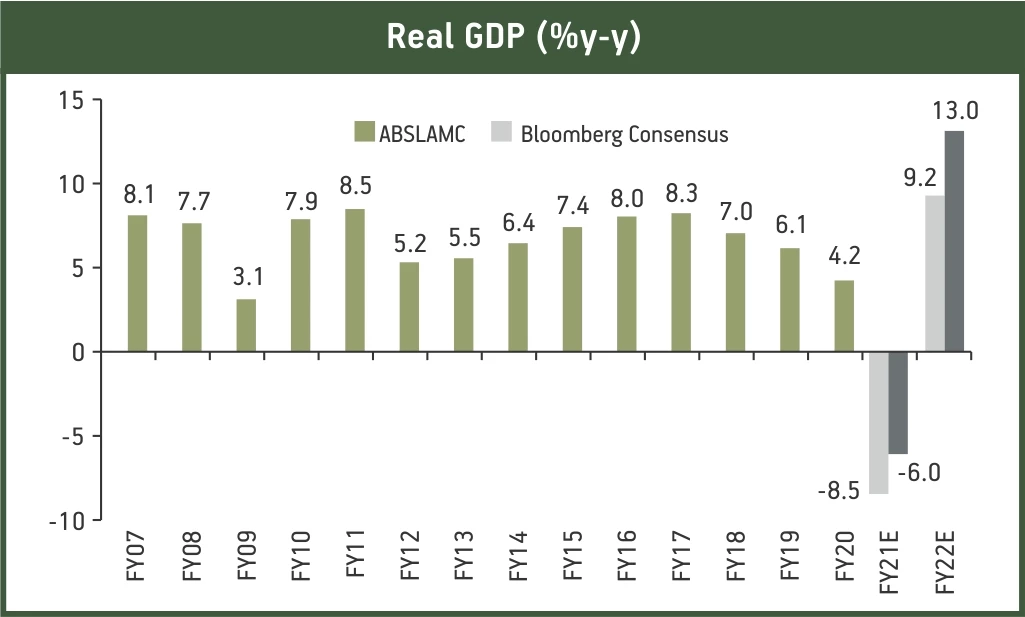

In India we expect FY22 growth to rebound to 13% y-y (6.2% growth from FY20) from -6% y-y in FY21. This is significantly above consensus. We are guided by the experience of other economies in current pandemic, and experience of Spanish flu which point to fast return to normalcy. The impact of pandemic in India has anyway been relatively less damaging and is steadily declining. Substantial activity normalisation will likely be over before large-scale vaccination happens. However, vaccine rollout will still be important for boosting sentiments, which would be crucial for urban consumption and capex. We are particularly bullish on the aggressive monetary easing done in 2020, which we expect to work its way in the economy in 2021.

Figure 7: We expect a strong growth rebound in India

Asset class view

We continue to bet on the reflation trade in 2021, given economic normalisation along with persistence of aggressive monetary-fiscal stimulus. Equities and Real Estate can be key beneficiaries of the reflation trade. Equities could also benefit from the growth upturn. Moreover, with bond yields so low, equity risk premium is still elevated. We expect dollar to stay weak/weaken further, particularly against EMs. Our view stems from counter-cyclical nature of USD, which typically weakens in periods of global growth, declining US yield differential, high current account deficit in US and USD strength on PPP basis. Weaker dollar is generally favorable for global markets and economy. Bonds have become richly valued and given our view on growth and the rebound in inflationary expectations, we expect yields to have bottomed out and expected to inch upwards in 2021. However, given the unprecedented monetary accommodation and Central Bank commitment, we expect the upward journey to be gradual.

Sources: Bloomberg, CEIC, RBI, JP Morgan, UBS

The views and opinions expressed are those of Bhupesh Bameta, Fund Manager and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). ABSLAMC/ the Fund is not guaranteeing/offering/communicating any indicative yield on investments. The document is solely for the information and understanding of intended recipients only. If you are not the intended recipient, you are hereby notified that any use, distribution, reproduction or any action taken or omitted to be taken in reliance upon the same is prohibited and may be unlawful. Wherever possible, all the figures and data given are dated, and the same may or may not be relevant at a future date. In the preparation of the material contained, ABSLAMC has used information that is publicly available including information developed in-house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. While utmost care has been exercised, ABSLAMC or any of its officers, employees, personnel, directors make no representation or warranty, express or implied, as to the accuracy, completeness or reliability of the content and hereby disclaim any liability with regard to the same. Recipients of this material should exercise due care and read the scheme information document (including if necessary, obtaining the advice of tax/legal/accounting/financial/other professional(s) prior to taking of any decision, acting or omitting to act. Further, the recipient shall not copy/circulate/reproduce/quote contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit approval of ABSLAMC. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000