-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

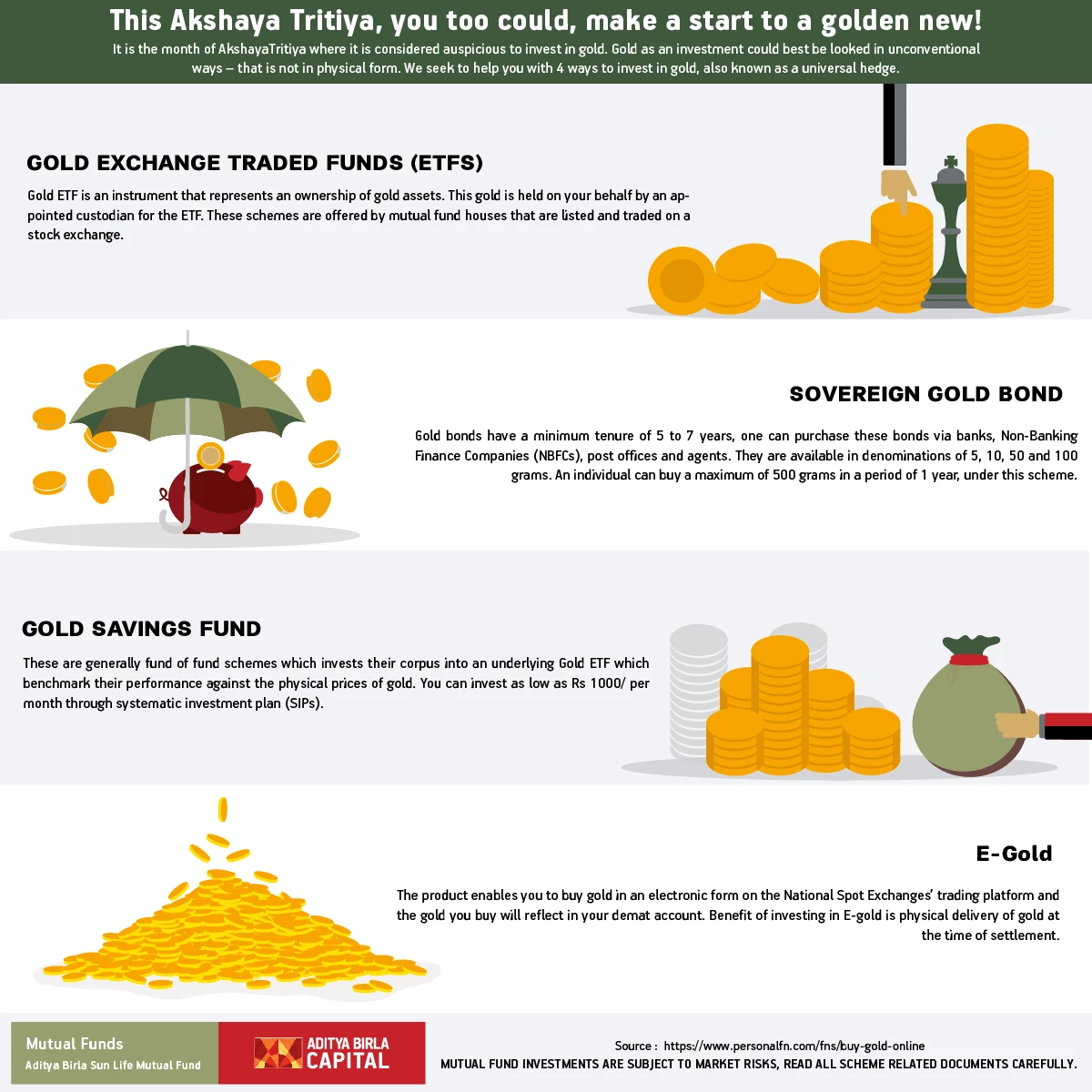

This Akshay Tritiya, you too could, make a start to a golden new!

Apr 18, 2018

3 mins

3 Rating

The sheen of gold is always alluring. After all, it is an ornamental metal and shines in any shape it is cast in. It is the month of Akshaya Tritiya where it is considered auspicious to invest in gold. Special offers, schemes, designs will all be rolled out by sellers to meet the appetite we have for gold.

While many of us will consider buying gold around Akshaya Tritiya, it is important to understand the purpose of buying. Among a variety of reasons for owning the yellow metal, Gold makes a sound investment too. It provides diversification to one’s portfolio and therefore 5-10% of your investment portfolio could be in gold.

Ways of investing

Gold as an investment could best be looked in unconventional ways – that is not in physical form. We seek to help you with 4 ways to invest in gold, also known as a universal hedge.

- Gold Exchange Traded Funds (ETFs)

ETFs are schemes offered by mutual fund houses that are listed and traded on a stock exchange. They represent ownership in an underlying security, commodity, or asset. It simply means, a Gold ETF is an instrument that represents an ownership of gold assets. This gold is held on your behalf by an appointed custodian for the ETF.

Gold ETF’s are open-ended funds that track prices of gold. Each unit of gold in the fund you can buy is equal to certain gram of gold. It is advisable to read the scheme information document before investing. Gold ETFs are listed and traded on a stock exchange. Hence, these can be bought and sold like stocks on a real-time basis.

- Gold Savings Fund

Also known as Gold funds, these are generally fund of fund schemes which invests their corpus into an underlying Gold ETF which benchmark their performance against the physical prices of gold. Hence by doing so, they attempt to provide potential returns that closely correspond to the probable returns of its underlying Gold ETFs. These funds allow investors to invest as little as Rs.1000/- a month in gold through systematic investment plan (SIPs).

- Sovereign Gold Bond

One can purchase these bonds via banks, Non-Banking Finance Companies (NBFCs), post offices and agents. They are available in denominations of 5, 10, 50 and 100 grams. These bonds can be held in paper or demat form. An individual can buy a maximum of 500 grams in a period of 1 year, under this scheme. Gold bonds have a minimum tenure of 5 to 7 years, which takes care of short-term and medium-term volatility. Nevertheless, you can redeem them before the end of this period by selling them on the exchange. Moreover, you earn interest at the rate of 2.50% on initial value of investment. Its frequency of payment is once in six months.

- E-Gold

The product enables you to buy gold in an electronic form on the National Spot Exchanges’ trading platform and the gold you buy will reflect in your demat account. The biggest advantage is that E-Gold allows you to buy gold in smaller denomination such as 1, 2, 3 grams. One unit of E-gold is equal to one gram of gold. Thereby, offering liquidity. Additional benefit of investing in E-gold is physical delivery of gold at the time of settlement. Further, there are no storage or holding costs involved.

These new investment avenues are generating a lot of interest and are being looked as modern instruments for keeping up with the tradition.

This Akshaya Tritiya, you could too, make a start to a golden new!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000