-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

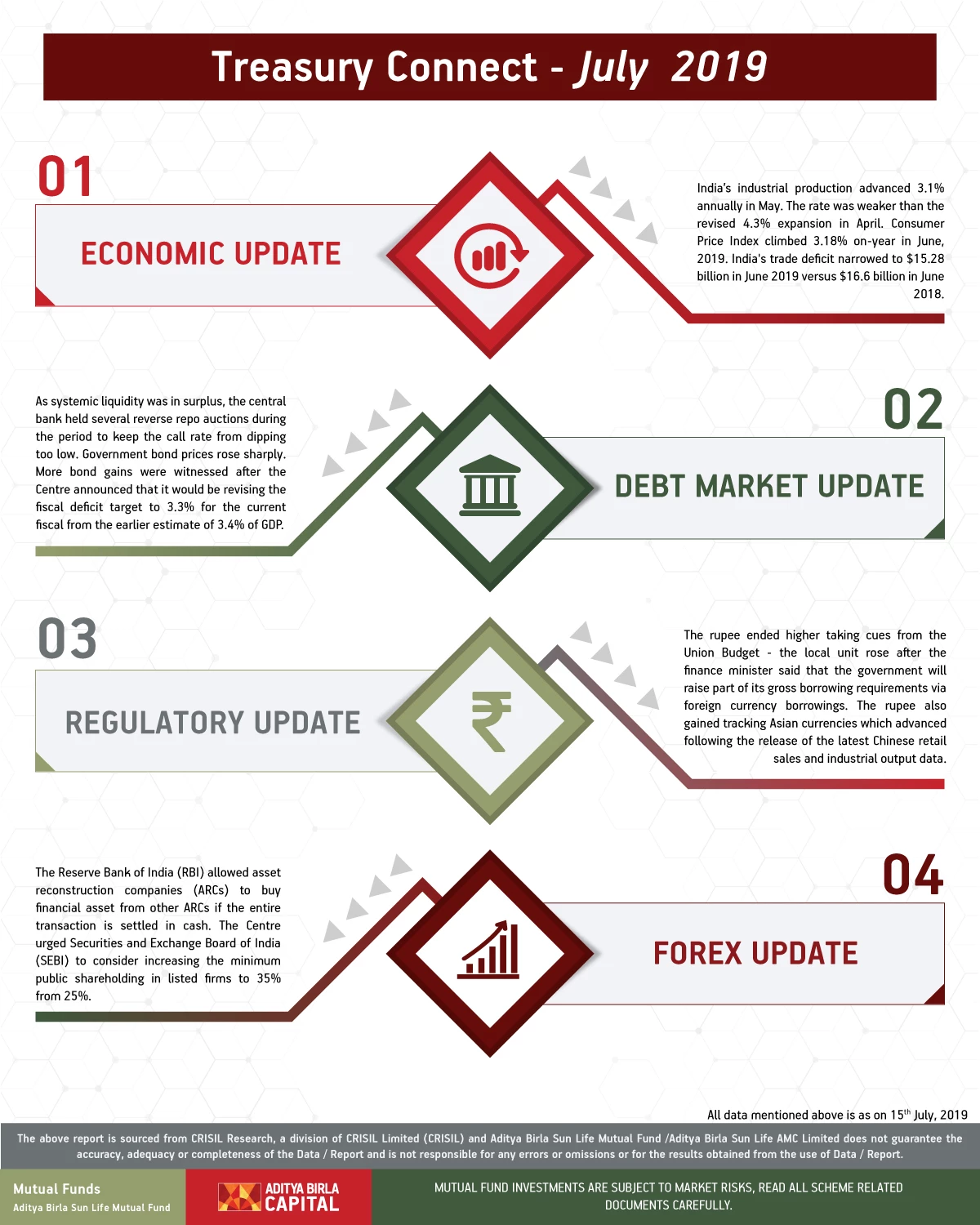

Treasury Connect July 2019 - I

Jul 26, 2019

5 mins

4 Rating

Economic Update

India’s industrial production advanced 3.1% annually in May. The rate was weaker than the revised 4.3% expansion in April.

Consumer Price Index climbed 3.18% on-year in June, 2019. India's trade deficit narrowed to $15.28 billion in June 2019 versus $16.6 billion in June 2018.

Debt Market Update

As systemic liquidity was in surplus, the central bank held several reverse repo auctions during the period to keep the call rate from dipping too low.

Government bond prices rose sharply. More bond gains were witnessed after the Centre announced that it would be revising the fiscal deficit target to 3.3% for the current fiscal from the earlier estimate of 3.4% of GDP.

Forex Update

The rupee ended higher taking cues from the Union Budget - the local unit rose after the finance minister said that the government will raise part of its gross borrowing requirements via foreign currency borrowings.

The rupee also gained tracking Asian currencies which advanced following the release of the latest Chinese retail sales and industrial output data.

Regulatory Update

The Reserve Bank of India (RBI) allowed asset reconstruction companies (ARCs) to buy financial asset from other ARCs if the entire transaction is settled in cash.

The Centre urged Securities and Exchange Board of India (SEBI) to consider increasing the minimum public shareholding in listed firms to 35% from 25%.

All data mentioned above is as on 15th July, 2019

The above report is sourced from CRISIL Research, a division of CRISIL Limited (CRISIL) and Aditya Birla Sun Life Mutual Fund /Aditya Birla Sun Life AMC Limited does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000