-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Investing in quality at a discount: Why a value fund might be right for you?

Jan 20, 2025

5 min

4 Rating

Picture this: Black Friday sales in full swing, shopping malls buzzing with eager shoppers, and your finger ready to click on online deals. What is the appeal? Getting quality products at a fraction of their regular price—true value for money!

As a renowned multi-billion dollar investor, once said - "Price is what you pay. Value is what you get."

It is not just about buying things you love, but getting them at a bargain, ensuring you are getting the most out of your hard-earned money.

In the investing scenario as well, we seek value. Especially when you invest in equity for the long term. The goal is to play the waiting game, watching our investments grow and accumulate wealth over time.

Is there any specific investing strategy that can help you extract value from your long term investments?

The answer lies in value investing through a value fund.

Understanding value investing

Value investing is like scoring a top-tier laptop during a Black Friday sale. The laptop is on sale because it is a model from last year, but it still has all the features you need and is just as good as the latest version. While other shoppers overlook it for the newer model, you see its true value and grab it at a bargain price.

Value investing is all about identifying stocks that are priced below their true worth, with the expectation that their prices will eventually rise to reflect their intrinsic value. These stocks are typically strong, fundamentally sound companies that, for various reasons, are undervalued in the market. By investing in such stocks, you stand to gain significantly when the market corrects these inefficiencies, and their prices align with their true value

Value funds explained

Value funds are equity-oriented mutual funds that follow a value investing strategy. These funds invest at least 65% of their assets in stocks that are undervalued but show strong long-term growth potential.

Through rigorous fundamental analysis, these funds identify stocks with strong fundamentals that are trading below their intrinsic value. They rely on financial metrics like low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, high dividend yields etc to identify these undervalued opportunities. Once these stocks are added to the portfolio, they are monitored closely and sold when they reach their target price, reflecting their true value.

Why a value fund might be right for you?

Value funds might be right fit for your long term financial goals and here is why:

Gives your wealth accumulation a jumpstart

By focusing on stocks with strong fundamentals that are temporarily undervalued, value funds can provide a powerful boost to your long-term wealth. These stocks often have significant growth potential once the market recognizes their true value, giving your portfolio the chance to grow faster over time.

Potentially lower downside risk

Value stocks typically have a margin of safety due to their favourable price relative to their intrinsic value. This lower valuation cushion can help protect your investments in times of market downturns. As a result, value funds often offer a potentially lower downside risk.

Access to fund manager expertise

Investing in a value fund means you benefit from the expertise of experienced fund managers who specialize in identifying undervalued stocks. These professionals use their knowledge, research, and market insights to select high-potential value investments, taking the guesswork out of your decision-making and helping you navigate complex market conditions

Flexibility for diversification without a sectoral or market cap bias

Value funds usually cast a wide net, investing across different market caps and sectors, depending on where undervalued opportunities are found. This flexibility ensures you are not missing out on value stocks just because they belong to a certain sector or market capitalization.

Long term capital growth

Investment predominantly in equity and equity-related securities following value investing strategy i.e. investing in stocks priced lower than their true value, based on fundamentals

Aditya Birla Sun Life Mutual Fund brings to you a compelling proposition in this category with the Aditya Birla Sun Life Value Fund, designed to maximize your wealth accumulation over the long term.

“Investing in value today means reaping the rewards tomorrow. Start your journey with Aditya Birla Sun Life Value Fund and unlock your portfolio’s true potential!”

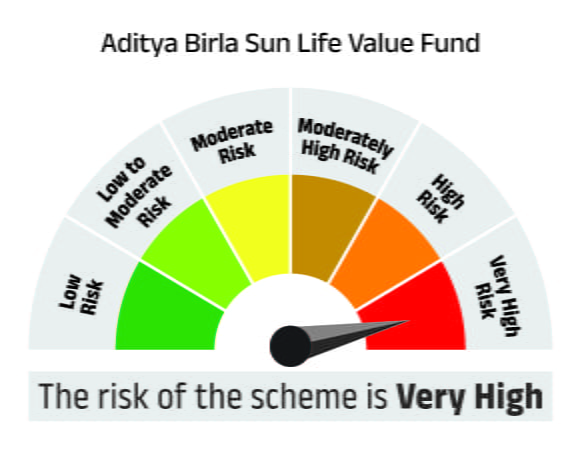

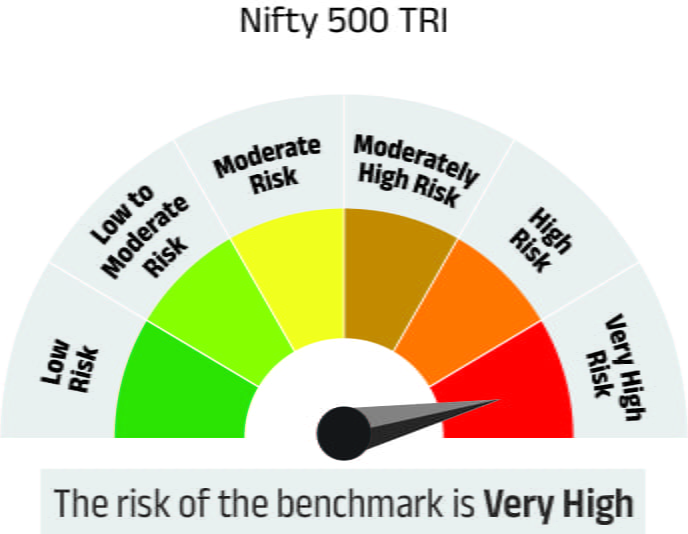

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Value Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000