-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

• This fund actively manages allocation to invest in 2 asset classes - Equity & Fixed income.

• Ideal investment solution to tackle the highs and lows of market while eliminating the need for timing entry into the market.

• Investors can invest across market cycles in this fund with an investment horizon of at least 3 years.

• The equity allocation is increased when markets are at lower valuations & vice versa. Helps in reducing the risk & equity exposure when market is at peak.

What is a balanced advantage fund?

The stock market today is consistently scaling new heights, yet corporate earnings and growth rates seem to be closer to their all-time lows1. This can create an environment of volatility for investors. Investors look to ‘time’ the market to ‘buy low and sell high’ but often lack the expertise to do so while navigating market volatility. An investor, especially a new one looking to capitalise on the growth potential of equity in the long term but at a relatively lower volatility level than pure equity funds, can look at a balanced advantaged fund category. .

A balanced advantage fund works on the premise that different asset classes are subject to different risks and can earn different returns at different points in a market cycle. Thus, a dynamic asset allocation approach seeks to balance its holding between equity and debt basis market opportunities, so as to earn reasonable returns at a relatively lower volatility than pure equity funds.

Add flexibility to your portfolio with Aditya Birla Sun Life Balanced Advantage Fund

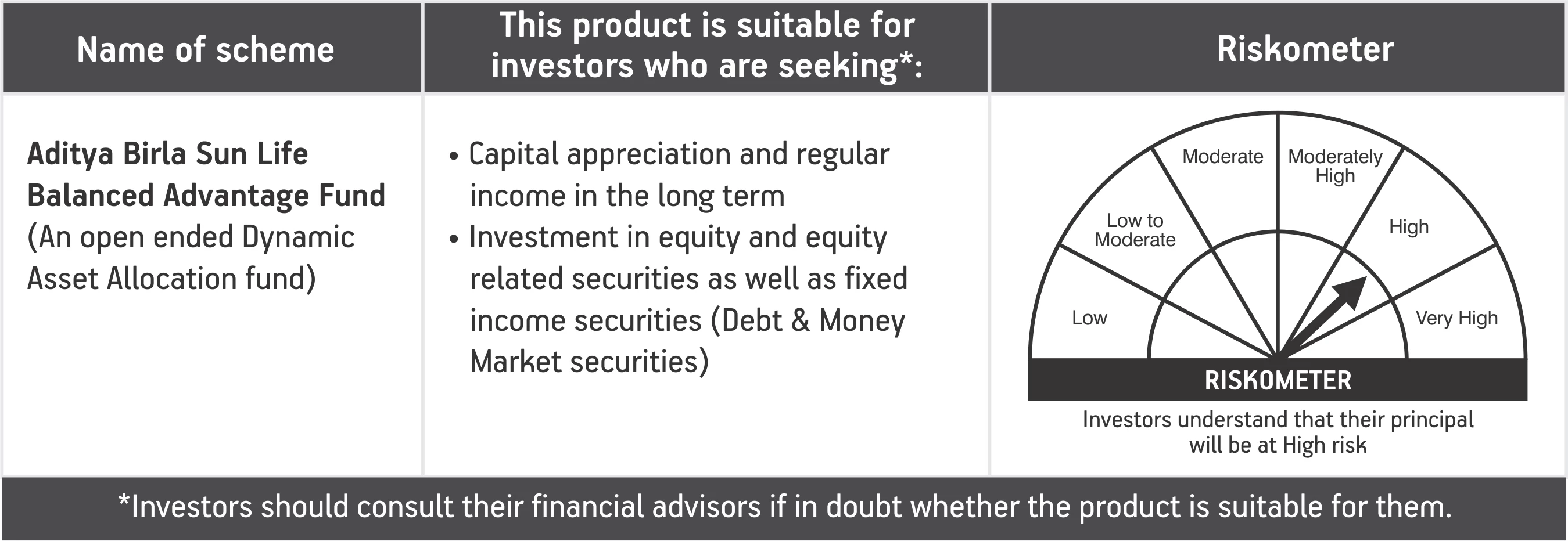

Aditya Birla Sun Life Balanced Advantage Fund is an open ended Dynamic Asset Allocation fund that invests in a mix of equity & equity related securities as well as fixed income securities (Debt & Money Market securities) following a P/E based approach.

The primary objective of the Scheme is to generate long term growth of capital and income distribution with relatively lower volatility by investing in a dynamically balanced portfolio of Equity & Equity linked investments and fixed-income securities. There can be no assurance that the investment objective of the Scheme will be realized.

The fund follows a blend of top-down approach and bottom-up approach to identify potential growth sectors as well as individual stocks. The fund seeks out opportunities across market capitalisations.

A P/E based approach is followed to determine equity exposure. When the markets move towards an overvalued scenario, equity allocation is reduced, and balance is invested in Arbitrage along with Debt & Money Market Instruments. The equity exposure can range anywhere between 65-100% depending on market outlook. This asset allocation is monitored monthly and rebalanced every quarter.

This strategy can help the fund to capitalise on a bull-run of the market creating long term wealth as well as help manage the downside at the time of a market correction. The fund also uses derivatives with an aim to manage risk of its equity portfolio.

Why one can invest in Aditya Birla Sun Life Balanced Advantage Fund

1) Timing the market is a difficult task

Timing the market to ‘buy low and sell high’ is an arduous task especially when the economy is volatile. Dynamic asset allocation in response to market changes aims to keep the portfolio balanced eliminating the need to time the market

2) Provides equity exposure with potential to manage volatility as compared to pure equity funds

Allows investors especially beginners access the potential capital growth of equity but potentially at lower risk levels than pure equity funds.

3) Interest rates are at low levels

Low interest rates2 likely to continue providing limited returns from debt-based instruments. Balanced advantage fund can provide reasonable returns in the long run.

Benefits Of Balance Advantage Fund

Equity exposure for long term capital appreciation potential

Opportunistic approach to identify sectors and stocks which may have growth potential.

Potential to Manage the Overall Volatility

P/E based valuation approach to dynamically adjust portfolio between equity and debt with a potential to manage risk.

Mix of both Equity and Debt

Access to capital growth potential of equity as well as fixed income from debt instruments.

Portfolio flexibility

Fund has flexibility to invest across market capitalisations, so as to take advantage of opportunities across the board as and when they arise.

Why invest now?

High Uncertainty

The pandemic has resulted in high uncertainty in the business environment.

Development of opportunities

With the changing behaviour and as we adjust to the ‘new normal’, several new trends and companies have emerged in different sectors.

Revision of ratings

The companies whose ratings have suffered due to current lack of demand can expect a boost in their valuations once things return back to normal.

1 https://www.economist.com/finance-and-economics/2020/12/05/despite-a-weak-economy-indias-stockmarket-is-at-record-highs

2 https://www.livemint.com/news/world/ultralow-interest-rates-here-to-stay-2021-central-bank-guide/amp-11609821011614.html

1800-270-7000

1800-270-7000