-

Our Products

Our FundsTop Performing Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Target Maturity Fund to capitalise on higher short term debt yields!

• Favourable Debt Market

Liquidity tightening for inflation control has led to an interest rate hike cycle. Interest rates are now at a decade high; a rate cut cycle likely to follow from 2024.

• The advantage of State Development Loans (SDLs)

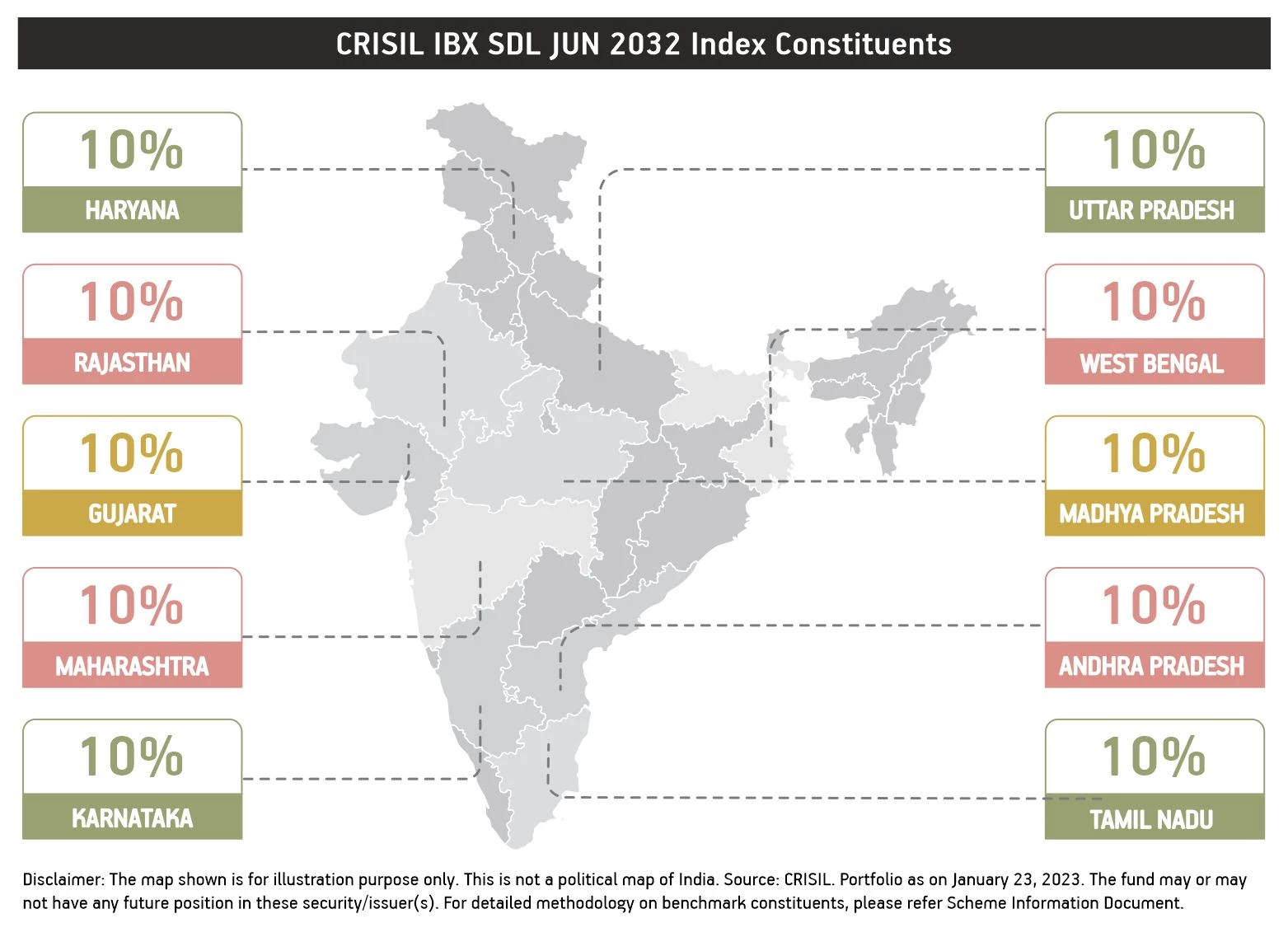

SDLs are bonds issued by state governments. They have a sovereign rating & are facilitated by RBI with a provision to be served from central government’s allocation to states. These features make them akin to G-secs while still offering higher yields than G-secs.

• The ‘sweet spot’ for SDL yields

With interest rates almost peaking out, here lies an opportunity to lock in higher yields for longer horizon as current 10yr SDL index yields are above long-term average. Target maturity funds can be the ‘go-to’ investment to capitalise on these yields.

Why should you invest in Aditya Birla Sun Life CRISIL IBX SDL JUN 2032 Index Fund?

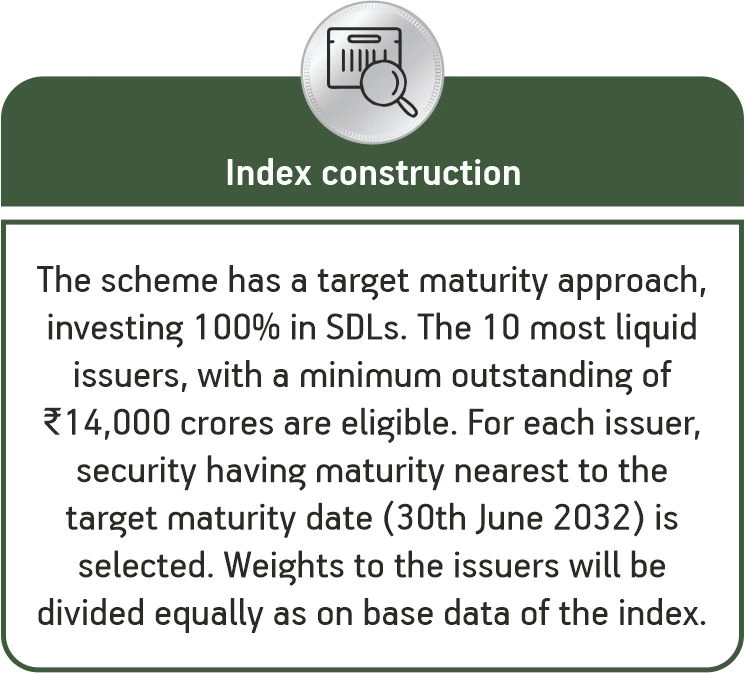

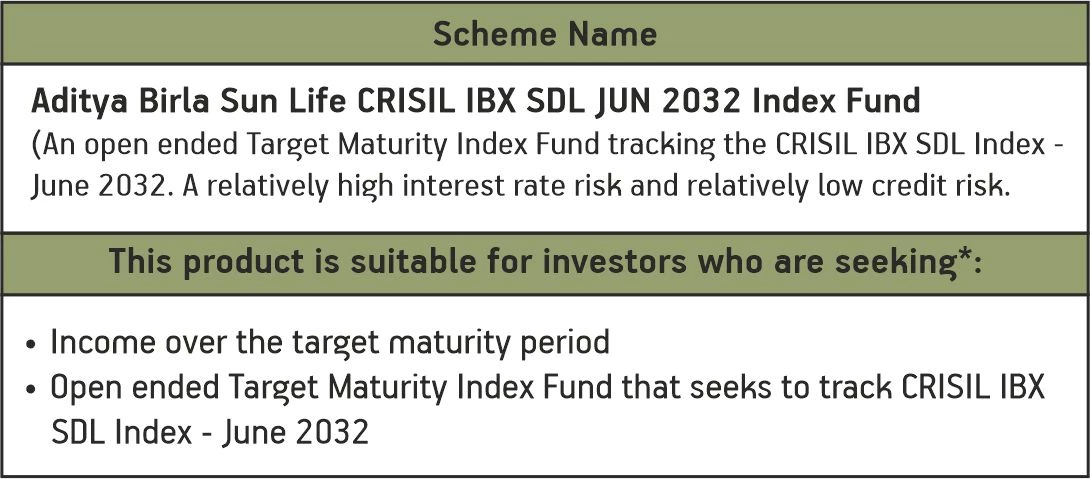

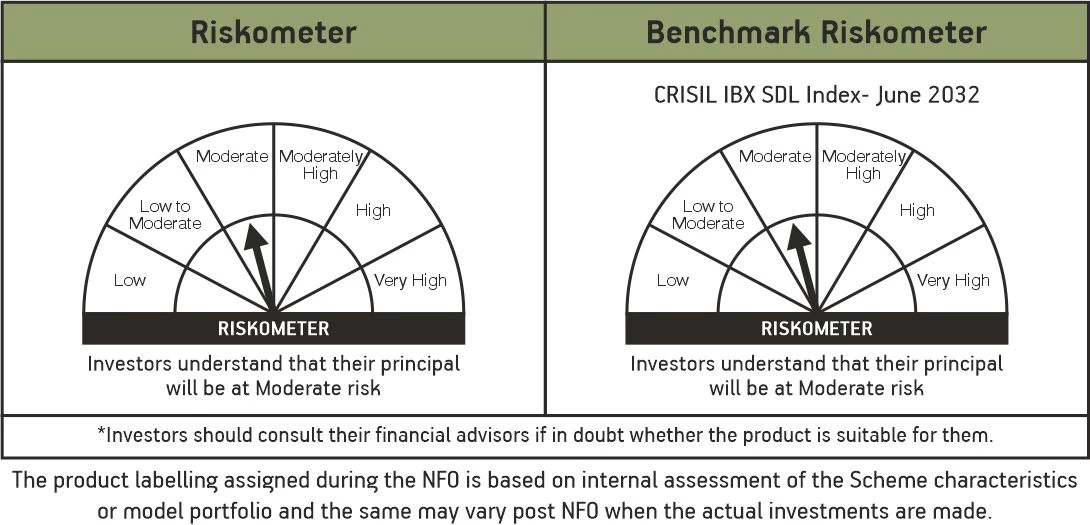

Aditya Birla Sun Life CRISIL IBX SDL JUN 2032 Index Fund

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000