-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Current & Historical NAV / Dividend

Oops! service is unavailable, please try after some time.

Methodology for calculating subscription and redemption price of units.

- Subscription / Switch-in (from other schemes/plans of the Mutual Fund) (This is the price investor need to pay for purchase/switch-in)

If the applicable NAV is Rs. 10/- and since there will be no entry load, then the purchase price will be Rs. 10/- - Redemption / Switch - out (to other schemes/plans of the Mutual Fund)(This is the price investor will receive at the time of redemption/ switch-out)

If the applicable NAV is Rs. 10/- and exit load is 0.5% then sale price will be 10 - (10 * 0.5%) = 10 - 0.05 = Rs. 9.95/-

The Power Of 3

The Power Of 3

Multi-cap Fund

• The objective of the scheme is to achieve long-term growth of capital, at relatively moderate levels of risk through a diversified, research-based investment in Large, Mid & Small cap companies.

• The scheme will invest 25-45% in Large cap and a minimum of 25-35% each in Mid and Small cap segments.

• It follows a Bottom-up approach of stock selection.

• The Portfolio will be biased towards secular growth opportunities from across the market spectrum.

What is a Multi-cap fund?

The economy today is on a path to recovery – with growth estimates for FY 22 pegged at 12.50%1. An accommodative monetary policy, numerous growth stimulating policy and fiscal measures, increase in foreign inflows – are some of the few pre-cursors paving the way for a broad-based growth in the country. This is likely to bring growth opportunities across the board and across all market caps. The National Stock Exchange (NSE) in India, itself houses the stocks of over 1900 companies1. The top 100 being segmented into large cap, the next 150 being mid-cap and the balance being small cap.

How can an investor effectively choose from such a vast universe of stocks? With the large expected to become larger, and the mid and small expected to benefit from economic recovery and growth stimulus – how can an investor suitably capitalise on diverse investing opportunities?

A multi-cap fund can be the answer for investors here. A multi cap fund is an equity oriented mutual fund scheme that invests across market capitalisations – with a minimum of 25% portfolio allocation each to large, mid and small caps. A multi-cap fund looks to select the ‘best from the best’ and provide investors with a diverse portfolio of growth-oriented stocks.

About Aditya Birla Sun Life Multi-Cap Fund

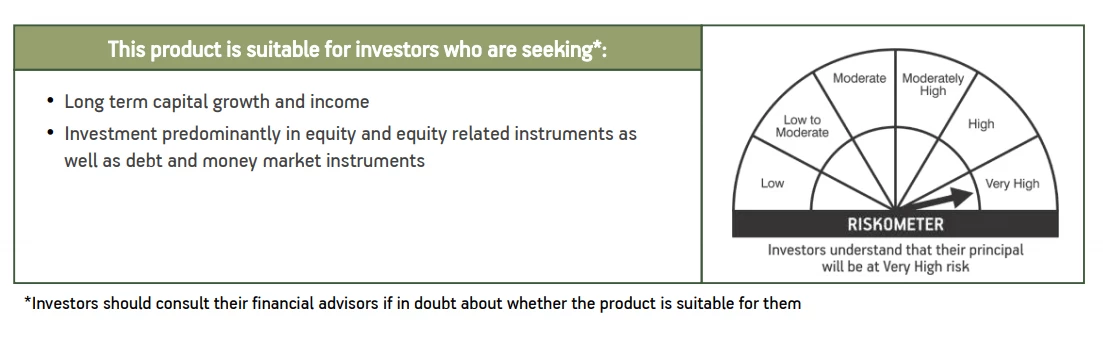

Aditya Birla Sun Life Multi-Cap Fund is an open-ended equity scheme investing across large cap, mid cap and small cap stocks in a disciplined manner. The objective of the Scheme is to achieve long term growth of capital, at commensurate levels of risk through a diversified research-based investment in Large, Mid & Small cap companies. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved.

The scheme will allocate 80-100% in equity instruments, with a 25-45% allocation to large cap and 25-35% allocation each to mid-cap and small cap stocks.

The fund follows a focussed and disciplined approach seeking out secular growth opportunities across market capitalisations. Its investing strategy is based on a bottom-up approach – with the focus being on identifying companies with sound corporate governance, competitive advantage and considerable and sustainable growth potential. It will narrow down to a portfolio of 50-60 companies from an investment universe of 400+ companies.

This strategy can help the fund to benefit from the growth momentum in the economy while maintaining high quality of the fund portfolio.

The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Why one can invest in Aditya Birla Sun Life Multi-Cap Fund now?

-

• Suitable in times of broad-based growth: This Fund seeks out opportunities across large, mid and small caps which makes it suitable to take advantage of a likely broad based market rally.

• Fiscal stimulus can benefit companies across the board: Growth boosting policy measures are directed across sectors and can bring in inclusive and diverse growth. This fund seeks out potential from across the board.

• A mix of stability and growth potential: The fund can provide investors with the stability of large caps along with the growth potential of emerging mid-caps and small caps.

• To take advantage of emerging opportunities: The funds focused and disciplined approach along with its bottom-up investing strategy is directed towards identifying and investing in growth opportunities as and when they arise

Benefits Of Multicap Fund

Long term capital appreciation potential of equity

Investing strategy seeks out stocks with high and consistent growth potential. This can help long-term investors achieve sustainable capital appreciation of their wealth.

Diversity in true sense

Provides a combination of 3 focussed portfolios within one fund – focused large cap, focused mid cap and focused small cap. This can provide investors the relative stability of large caps as well as the accelerated growth potential of upcoming mid and small caps

Portfolio flexibility

Fund manager has the flexibility to invest balance 25% of portfolio in emerging opportunities, irrespective of market capitalisation it belongs to

Fund manager expertise

Access to expertise and knowledge of experienced fund manager to hand-pick quality stocks across market capitalisations

Sources:

1. International Monetary Fund (IMF) estimates for India for FY 2022 in its publication World Economic Outlook published on 6th April, 2021

2. As on 31st March 2021 - https://www.nseindia.com/regulations/listing-compliance/nse-market-capitalisation-all-companies

Why invest now?

High Uncertainty

The pandemic has resulted in high uncertainty in the business environment.

Development of opportunities

With the changing behaviour and as we adjust to the ‘new normal’, several new trends and companies have emerged in different sectors.

Revision of ratings

The companies whose ratings have suffered due to current lack of demand can expect a boost in their valuations once things return back to normal.

1800-270-7000

1800-270-7000