-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Current & Historical NAV / Dividend

Oops! service is unavailable, please try after some time.

Methodology for calculating subscription and redemption price of units.

- Subscription / Switch-in (from other schemes/plans of the Mutual Fund) (This is the price investor need to pay for purchase/switch-in)

If the applicable NAV is Rs. 10/- and since there will be no entry load, then the purchase price will be Rs. 10/- - Redemption / Switch - out (to other schemes/plans of the Mutual Fund)(This is the price investor will receive at the time of redemption/ switch-out)

If the applicable NAV is Rs. 10/- and exit load is 0.5% then sale price will be 10 - (10 * 0.5%) = 10 - 0.05 = Rs. 9.95/-

A Broad-Based Gilt ETF: Capturing the Potential of G-secs

Elevated yields, potential capital gains, and sovereign safety

-

India Macros vs. G-sec Yields

Currently, repo rates and G-secs yields are at multi-year high levels to balance growth and inflation. With inflation decreasing, there's room for monetary easing, making it a good time to lock in high yields. -

Inclusion of G-secs in JPM GBI EM^ Bond Index – Rising FII flows

G-sec inclusion in the index (up to target allocation of 10%) is set to boost FII inflows, increasing global demand for FAR G-secs.

^JPMorgan Government Bond Index-Emerging Markets -

Capital Gain Potential

As global demand increases, G-sec yields are likely to decrease, creating an opportunity for capital gains on price returns. -

Attractiveness of G-secs

The anticipated decline in G-sec yields makes it an opportune time to lock in elevated yields and benefit from potential capital gains. -

Broad Based Gilt ETF route to invest in G-secs

Given the likely increase in demand for FAR securities, a fund focusing on them can enhance investor gains. The returns of the CRISIL Broad-Based Gilt Index closely track those of the JP Morgan IGB FAR Index. An ETF tracking this Broad-Based Gilt Index can be a suitable way to access the current G-sec opportunity.

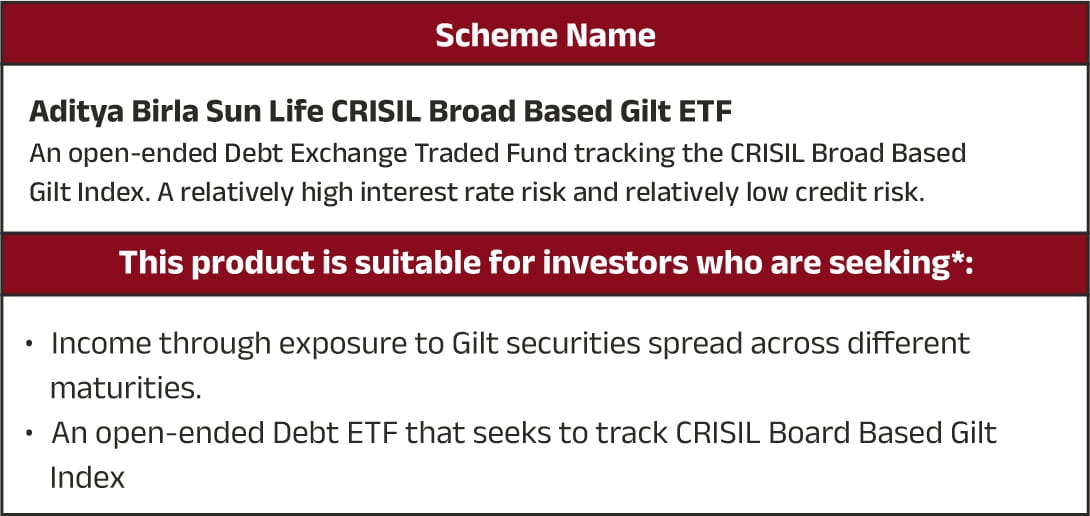

What it is?

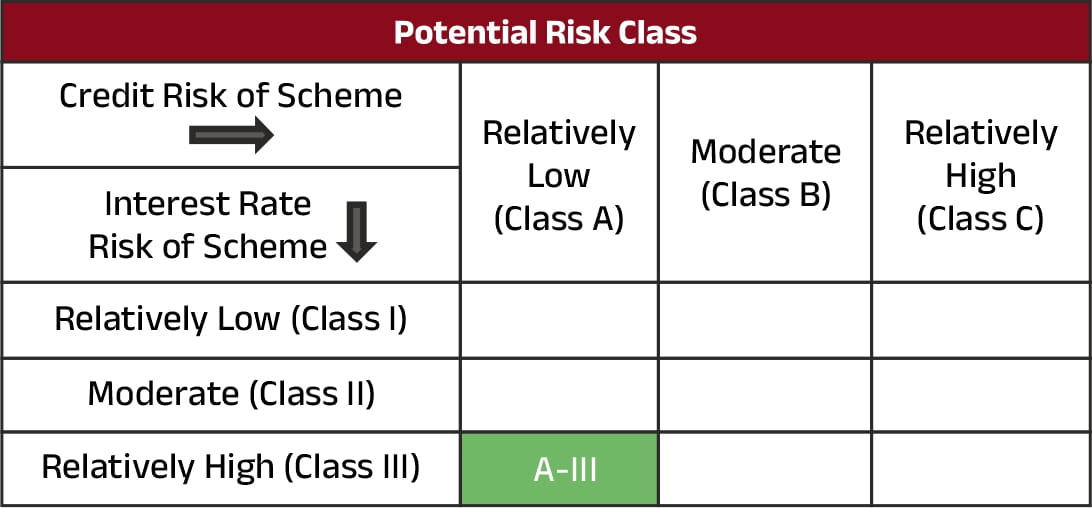

An open-ended Debt Exchange Traded Fund tracking the CRISIL Broad Based Gilt Index. A relatively high interest rate risk and relatively low credit risk.

Investment Objective

• To generate returns corresponding to the total returns of the securities as represented by the CRISIL Broad Based Gilt Index before expenses, subject to tracking errors.

• The Scheme does not guarantee/indicate any returns.

• There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

Index Construction

• The scheme invests a minimum of 95% in G-secs forming part of the index & up to 5% in T-bills and cash and cash equivalents.

• 100% Gsec ETF.

• All the Government securities outstanding as of previous month with amount outstanding greater than or equal to Rs.3000 crores will be the part of index.

• Weights to eligible securities will be based on amount outstanding.

• Please refer to the SID for further detailed methodology.

Feature

ETF will track Broad based G0Sec Index enabling investor to

A) Lock in currently available elevated yield levels

B) Potential capital gains

C) Real Time tracking and trading with ETF Format

Minimum Application Amount

Minimum of Rs. 1,000/- & in multiples of Rs. 100/- thereafter during the NFO period.

What are G secs and why invest in them?

G-secs are debt securities issued by the RBI on behalf of the Government of India as an acknowledgment of money borrowed. They are backed by the central government which gives them sovereign rating.

Therefore, G-secs being sovereign debt instruments come with negligible credit risk. Their repayment is guaranteed by the Central Government of India.

Owing to high demand and high trading volumes, G-secs are also highly liquid.

The current inclusion of Indian G-secs in the JP Morgan Index and likely future inclusion in more global indices creates an opportunity for future capital gains from G-sec investments

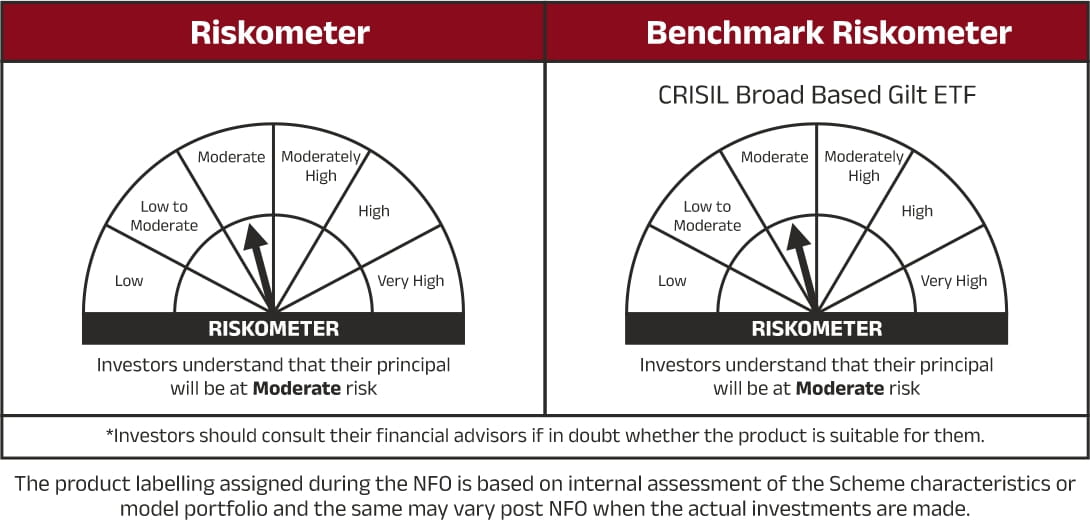

Why should you invest in Aditya Birla Sun Life CRISIL Broad Based Gilt ETF?

Aditya Birla Sun Life CRISIL Broad Based Gilt ETF

Download

Index Methodology: https://www.crisil.com/content/dam/crisil/indices/index-linked-products/index-linked-products-methodology.pdf

For more information on the scheme, please refer to SID/KIM of the scheme.

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers.

Investors are advised to read the scheme information document of the scheme carefully before investing and consult their Tax Consultant or Financial Advisor to determine tax benefits applicable to them.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000