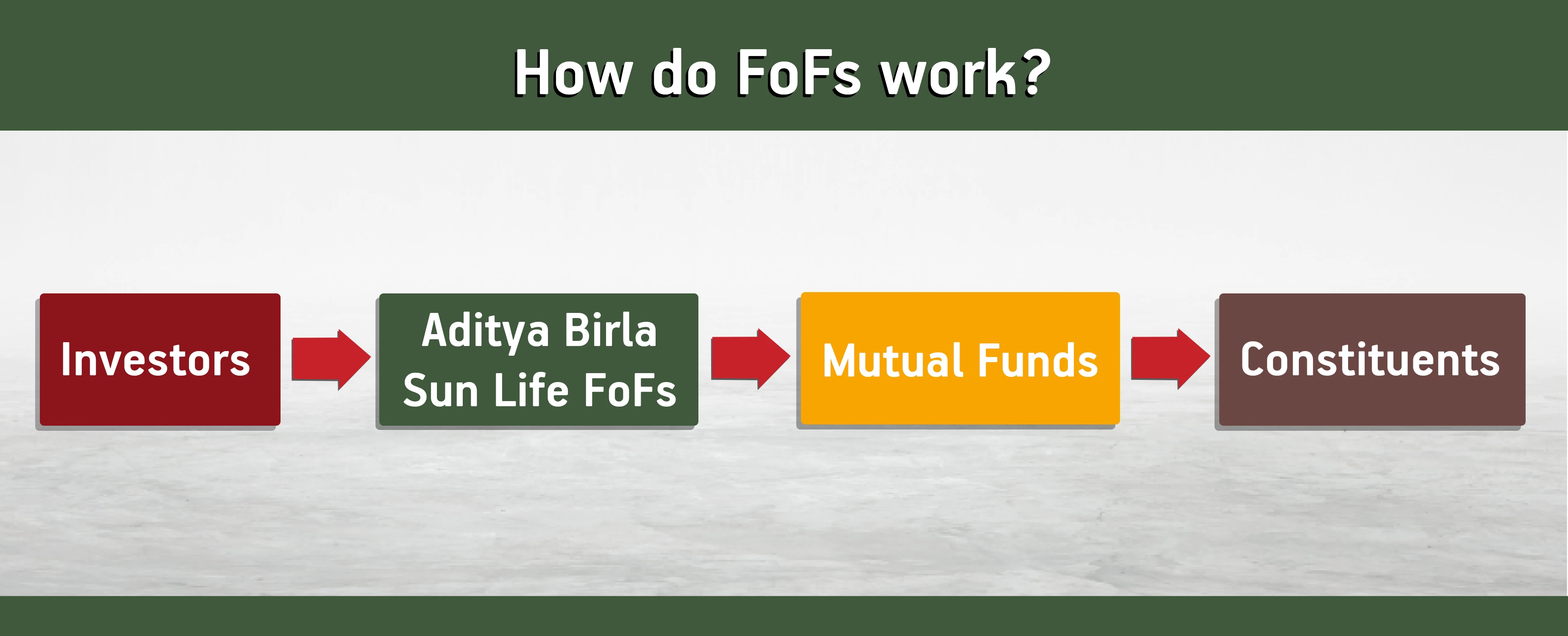

Fund of Funds (FOF) is a type of mutual fund scheme that pools investor resources and invests them in a portfolio that comprises of other mutual funds. A FoF thus seeks out broad diversification through investment in diversified mutual funds rather than directly investing in stocks and other securities.

-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

1800-270-7000

1800-270-7000