-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india

care.mutualfunds@adityabirlacapital.com -

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Declaration

The information and data contained in this Website do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any Schemes/Units of Aditya Birla Sun Life Mutual Fund (ABSLMF), securities or financial instruments in any jurisdiction in which such distribution, sale or offer is not authorised. In particular, the information herein is not for distribution and does not constitute an offer to buy or sell or the solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and Canada to or for the benefit of United States persons (being persons resident in the US, corporations, partnerships or other entities created or organised in or under the laws of the US or any person falling within the definition of the term "US Person" under the US Securities Act of 1933, as amended) and persons of Canada.

By entering this Website or accessing any data contained in this Website, I/We hereby confirm that I/We am/are not a U.S. person, within the definition of the term 'US Person' under the US Securities laws/resident of Canada. I/We hereby confirm that I/We are not giving a false confirmation and/or disguising my/our country of residence. I/We confirm that Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited (ABSLAMC) is relying upon this confirmation and in no event shall the directors, officers, employees, trustees, agents of ABSLAMC associate/group companies be liable for any direct, indirect, incidental or consequential damages arising out of false confirmation provided.

Harness the best of ‘Man and Machine’ capabilities to power your investments!

-

Powering Ahead with Machine Technology

In an era of advancing technology, how we function in every sector is being revolutionized. But can the investment world benefit from these powerful machine capacities? -

A Combination of Man and Machine in the Investment World

Modern machines excel in computational tasks, efficiently managing various analytical activities in investing, such as high-volume data processing and execution. Coupled with human cognitive abilities, judgment, and creativity in investment decisions, this synergy can translate to successful investments powered by tech and guided by wisdom. -

Introducing Quant Investing

Quantitative investment strategies use mathematical models and algorithms to identify investment opportunities. This makes it a disciplined, unbiased, rule-based, and data-driven approach to investing. Fund managers monitor investment decisions and model performance to ensure better risk management. -

Experience Human-Machine Fusion with a Quant Fund

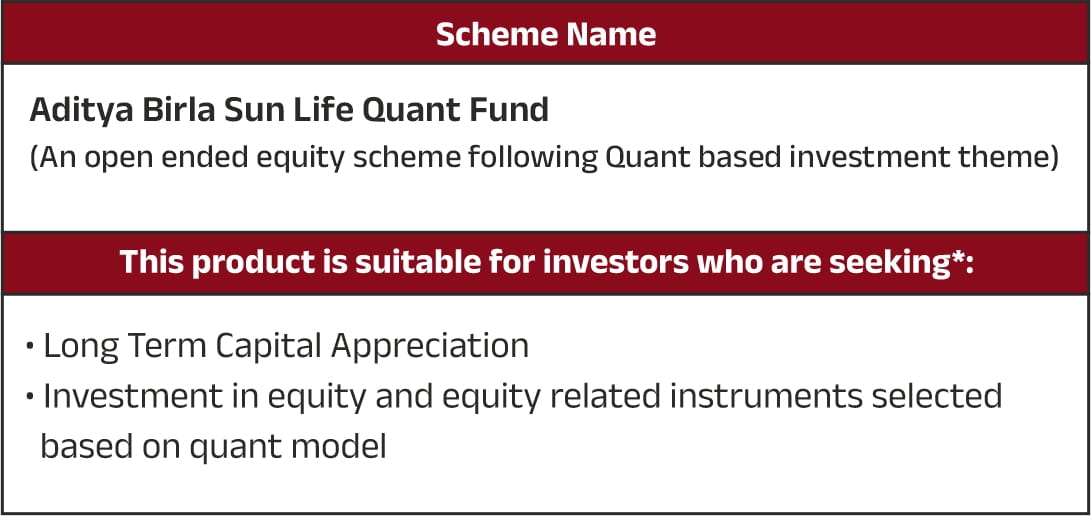

A thematic equity fund that utilizes a quantitative investing strategy, blending human insight with technological precision offering potential for long-term capital appreciation in equity investments.

What it is?

An open-ended equity scheme following Quant based investment theme.

Investment Objective

The investment objective of the Scheme is to generate long term capital appreciation by investing in equity and equity related securities based on quant model theme. The Scheme does not guarantee/indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved.

Feature

A factor-based quant strategy that combines the power of rule-based machine-driven investing with active fund manager intervention to generate long-term returns.

Minimum Application Amount

Minimum of Rs. 500/- & in multiples of Re. 1/- thereafter during the NFO period.

How Aditya Birla Sun Life Quant Fund works?

The fund has devised a model for harvesting proprietary investing signals:

It applies wide fund manager expertise to identify the Top 75 stocks from Top 15+ Mutual Fund houses.

It further applies the quality factor (5 years track record), momentum factor (consistency of last 6 month returns), sell side revision composite and weighs in low volatility.

This ultimately builds a portfolio of 40-50 stocks.

The model is monitored and rebalanced (mostly quarterly) by the fund manager.

Who should invest in Aditya Birla Sun Life Quant Fund?

Investors Seeking the Best of Both Worlds:

Investors looking for a disciplined quant investing model that combines human insight with machine precision and a factor investing strategy.Sector & Market cap Agnostic Investors::

Equity investors who do not have preference of investing in any specific sector or any specific market cap category.Long-term Investors

Investors with a time horizon of 3-5 years or more

Combination of Man and Machine

Benefit from a disciplined, data-driven approach that combines human expertise with advanced mathematical models.

Long-Term Capital Growth Potential

This fund aims for long-term wealth creation by earning returns that can outperform the benchmark.

Factors Based Investing

This fund devises its investment model based on some of the well-researched factors that have the potential to generate return in the long run.

Low Entry Point

Start with investments as low as Rs. 500/- and access all these benefits.

Enhance your portfolio with the perfect blend of technology and human wisdom. Get started today!

Aditya Birla Sun Life Quant Fund

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000