-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

Small Beginnings can lead to

Great Things

Investor App

Small Beginnings can lead to

Great Things

Investor App

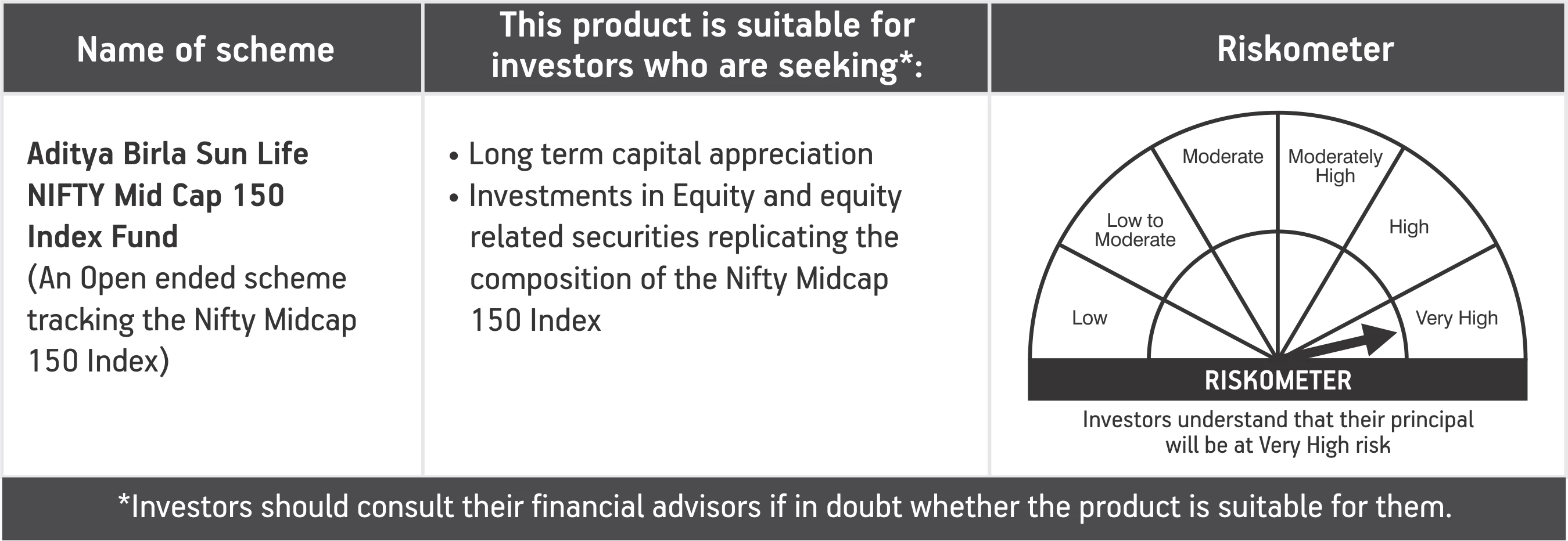

ABSL Nifty Midcap 150 Index Fund

• It is an open-ended scheme tracking the NIFTY Midcap 150 Index. The fund’s objective is to provide returns that closely correspond to the total returns of securities as represented by Nifty Midcap 150 Index, subject to tracking errors.

• The scheme offers investors access to a diverse portfolio of all 150 high growth companies that comprise the mid cap universe.

• This scheme follows a passive management strategy, altering its portfolio composition only when there is a change in the constituents of the underlying index.

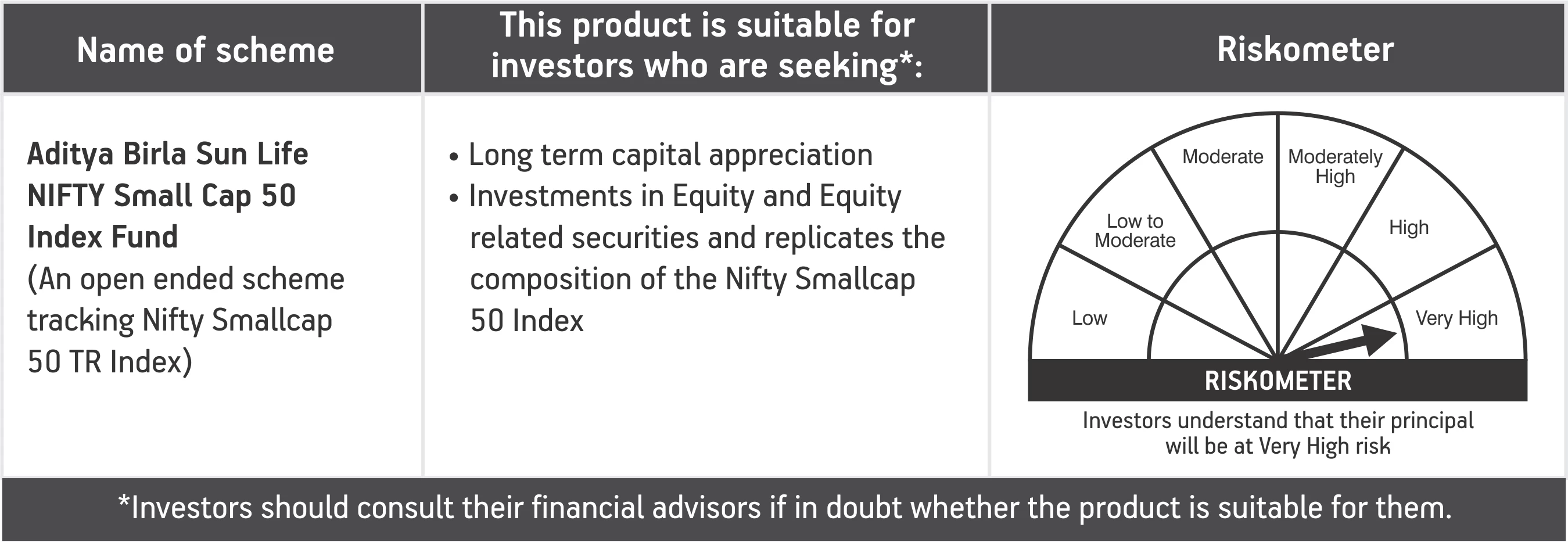

ABSL Nifty Smallcap 50 Index Fund

• It is an open-ended scheme tracking the NIFTY Small cap 50 Index. The fund’s objective is to provide returns that closely correspond to the total returns of securities as represented by Nifty Small cap 50 Index, subject to tracking errors.

• The scheme offers investors exposure to a selection of 50 small cap stocks out of a universe of 250 stocks.

• The scheme’s passive management strategy tracking the top small cap 50 companies, lends a combination of focus yet diversification with liquidity to the portfolio.

Why Mid and Small cap Index funds?

The economy today has begun its upward recovery from a year of negative growth induced by the pandemic. Growth drivers such as substantial policy reforms, the make in India regime and low interest rates, set up the market for a phase of recovery. This could be an opportune time for mid and small caps to shine. Mid and small caps are growing companies that may be suited to capitalise on incentives and an environment of economic recovery to flourish. An investor, especially a beginner looking to capitalise on the growth opportunity presented by these companies can look towards index funds.

Index funds are mutual funds that seek to mimic the performance of an underlying index by investing in the same stocks, in the same proportion of the index it tracks. These funds follow a passive management strategy, minimising the risk of active stock selection. Index funds that track the mid and small cap index are a simple and effective way of participating in mid and small cap companies without the need for expertise in stock selection.

Why should you invest in Nifty Index funds?

ABSL NIFTY Mid Cap 150 Index Fund

-

• Sunrise sectors: Chance to participate in high growth sunrise sectors largely unrepresented by large caps.

• Mid-cap companies to benefit in economic recovery: Access to midcap companies that could benefit from policy and fiscal incentives.

• Hassle-free investing: Provides simple means of investing in mid-caps, limiting the risk of active stock selection.

ABSL NIFTY Small Cap 50 Index Fund

-

• Access to high growth businesses: Allows investors to invest in emerging companies that operate in high growth sectors with niche business models.

• Balancing of risk with growth potential: Opportunity to invest in companies that have the potential to achieve accelerated growth by taking advantage of favourable economic environment.

• Natural selection: Process of natural selection of the index fund retains the top 50 companies maintaining diversification.

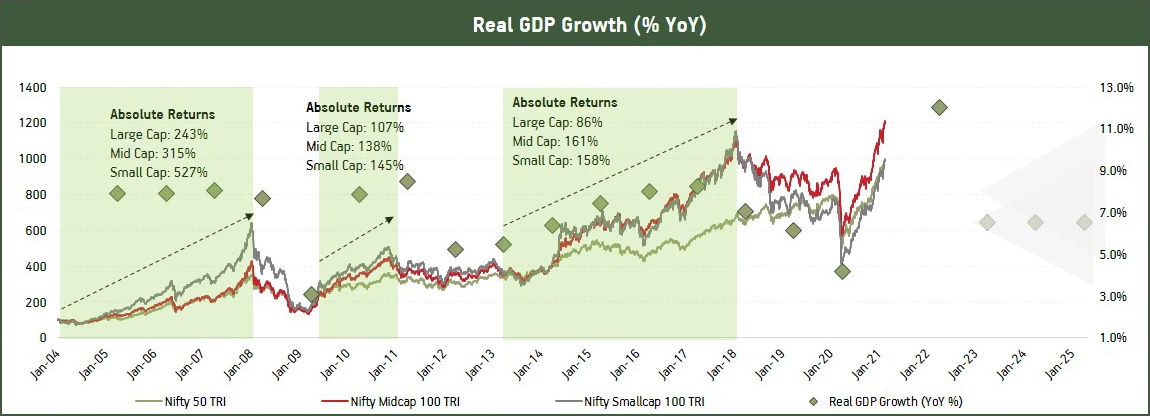

Mid & Small Caps Outperform in every Economic Recovery

Source: RBI, MFIE, Bloomberg, ABSLAMC Research;

Source: RBI, MFIE, Bloomberg, ABSLAMC Research; Data as on 16th February 2021

Past performance may or may not be sustained in the future.

Benefits of Index Funds

ABSL NIFTY Mid Cap 150 Index Fund

Mid cap Equity exposure for long term capital appreciation

Investment in high-growth, sunrise sector companies that have potential for long term growth

Minimal fund manager risk

Investing across all 150 midcap companies minimises active stock selection risk

High liquidity and diversification with minimum investment

Access to vast universe of mid cap stocks with low minimum investment

Lower costs

Involves lower expense ratio than actively managed funds

ABSL NIFTY Small Cap 150 Index Fund

Small cap Equity exposure for long term capital appreciation

Access to emerging, high growth business that have high long-term growth potential in a developing economy.

Natural selection

Benefit from collective wisdom of the market, selecting top 50 small cap performers thus eliminating stock selection risk.

Focussed portfolio yet maintaining diversification

Opting for top 50 companies across several sectors offers diversification and liquidity.

Lower costs

Involves lower expense ratio than actively managed funds.

Why invest now?

High Uncertainty

The pandemic has resulted in high uncertainty in the business environment.

Development of opportunities

With the changing behaviour and as we adjust to the ‘new normal’, several new trends and companies have emerged in different sectors.

Revision of ratings

The companies whose ratings have suffered due to current lack of demand can expect a boost in their valuations once things return back to normal.

1800-270-7000

1800-270-7000