-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

Aditya Birla Sun Life Arbitrage Fund

Fund Overview

Aditya Birla Sun Life Arbitrage Fund is an open ended equity scheme investing in arbitrage opportunities.

Investment Objective

The scheme seeks to generate income by investing predominantly in equity and equity related instruments. Scheme intends to take advantage from the price differentials/mis-pricing prevailing for stock/index in various market segments (Cash & Future).

Why one can invest:

If you are looking for relatively better short-term returns than returns earned from conventional saving means; derived from equity-based arbitrage opportunities.

If you are a conservative investor looking for practically risk-free returns.

If you are looking to generate reasonable short-term income with the add on of beneficial equity taxation.

If you are looking to benefit from arbitrage opportunities with investments starting from Rs.1,000.

If you are looking for an investment avenue for your short-term investing goals – up to 1 year.

Know what is Equity Mutual Fund?

Fund Details

CAGR

Latest NAV

(as on )

AUM

()

Inception Date

()

Risk

Investment Horizon

Short term; up to 1 year

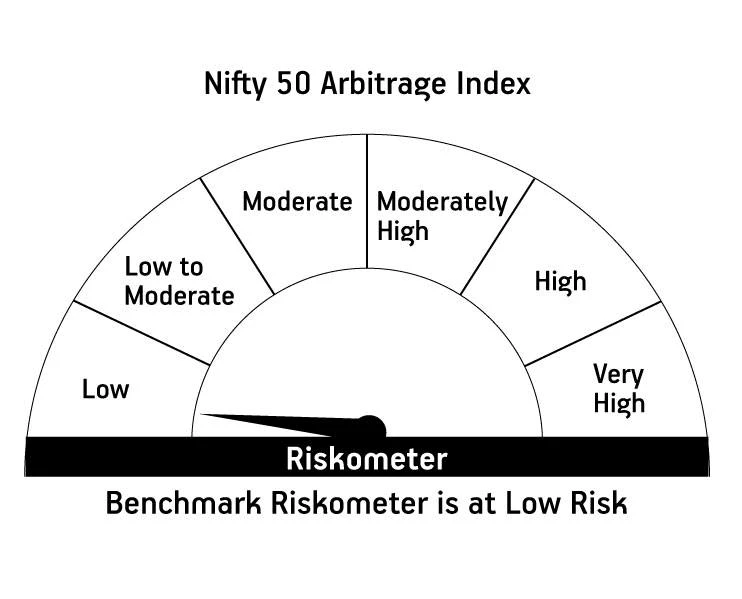

Annual Benchmark Returns

Min Investment

Entry load

NIL

Exit load

0.25%

For redemption / switch-out of units on or

before 15 days from the date of allotment:

0.25% of applicable NAV. For redemption/switch out of units after 15 days from the date of allotment: Nil.

Modified Duration

-

Yield to Maturity

-

Portfolio Turnover:

-

Average Maturity

-

Macaulay Duration

-

Net Equity Exposure

-

Total Expense Ratio (TER)

Sharp Ratio

Beta Ratio

Other Parameters

Standard Deviation

Fund Managers

Mr. Lovelish Solanki

Mr. Pranav Gupta

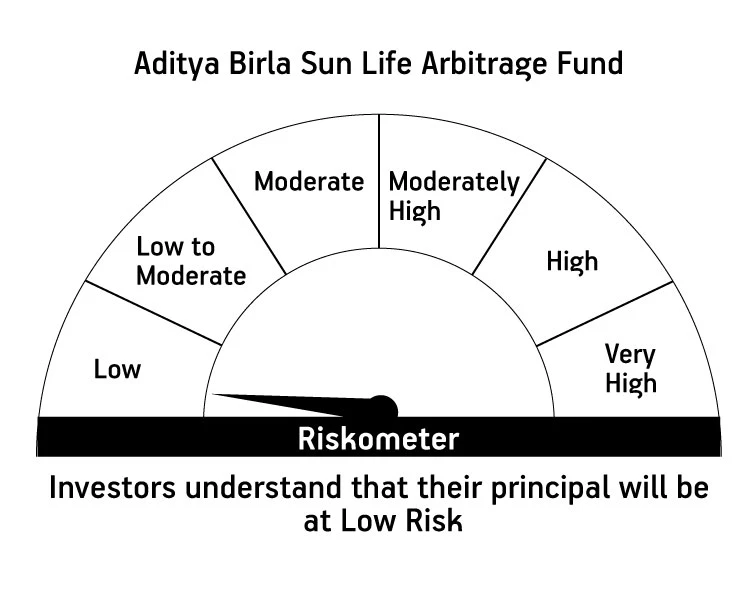

Riskometer

(An open ended scheme investing in arbitrage opportunities)

This product is suitable for investors who are seeking

-

Income over short term

-

Investments in equity and equity related securities including derivatives for taking advantage from the price differentials / mis-pricing prevailing for stock / index in various segments i.e Cash & Futures

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Portfolio & Sector Holdings

Retail

% of Net Assets

Sector Holdings

Dividend History

Any income received under this option would be considered as income for the investors and hence would be taxed at applicable tax slab rates.

Investment Performance

IDCW Plan of this scheme has distributed income to its investors out of its earnings, from time to time. The details of the same is tabulated:| Declared on date | IDCW Yield (Regular Plan) | IDCW Per Unit | Cum IDCW NAV |

|---|

Fund Summary

- Conservative investors looking for short term income usually rely on conventional fixed income investments

- However, the high tax rates (slab rate) and TDS applicability on these investments make them tax inefficient, ultimately reducing the net returns considerably. This is especially so for investors who fall in higher tax brackets.

Know More About Income Tax Slab

- Is there a more tax efficient means for short term, low risk income from investments?

-

Arbitrage opportunities can be sought out for this. This involves simultaneous buying and selling of equity instruments in different segments of the market (such as cash and future) to derive income from the price differentials in the two market segments. Since the transactions occur simultaneously, the positions are hedged ensuring risk-free income.

- Aditya Birla Sun Life Arbitrage Fund is an open-ended hybrid fund that invests in arbitrage opportunities. The scheme looks to earn risk free profits for its investors while giving tax efficiency even over the short term.

- The fund is best suited for a short-term investing period.

- However, the high tax rates (slab rate) and TDS applicability on these investments make them tax inefficient, ultimately reducing the net returns considerably. This is especially so for investors who fall in higher tax brackets.

Know More About Income Tax Slab

- Is there a more tax efficient means for short term, low risk income from investments?

-

Arbitrage opportunities can be sought out for this. This involves simultaneous buying and selling of equity instruments in different segments of the market (such as cash and future) to derive income from the price differentials in the two market segments. Since the transactions occur simultaneously, the positions are hedged ensuring risk-free income.

- Aditya Birla Sun Life Arbitrage Fund is an open-ended hybrid fund that invests in arbitrage opportunities. The scheme looks to earn risk free profits for its investors while giving tax efficiency even over the short term.

- The fund is best suited for a short-term investing period.

Fund discipline

- The Scheme aims to allocate a minimum of 65% (up to 100%) of its net assets to equities and equity linked instruments/derivatives including index futures, stock futures, index options and stock options

- The scheme can also allocate up to 35% of its net assets into debt securities and money market instruments and up to 10% into units issued by REITs and InVITs

- Scheme aims to identify the price differentials prevailing for a stock / index in 2 market segments (cash, futures, etc.)

- Generally, trades will be executed provided that they generate returns higher than short term debt instruments (call money, money market instruments, liquid schemes, etc.) net of expenses.

Value Added Products

Systematic Investment Plan (SIP) investing means automatically investing a pre-determined sum of money in this fund, at periodic and pre-determined time intervals.

Gives investors the benefit of rupee cost averaging – better suited to manage market volatility

SIP facility is augmented by several add ons such as Step-up SIPs, Pause SIP, Multi Scheme SIPs etc.

Systematic Investment Plan Available Online & Offline for Direct & Regular investors to iron out intermittent market volatility and enable long term savings.

Salient features of STP:

Step up SIP - This facility lets investors enhance the SIP amount during regular intervals. This allows you to make the most out of your SIP investments by increasing your contributions towards those schemes that are performing well. Additionally, you can also increase your investment amount when there is a hike in your pay.

Multi Scheme SIP Facility - The Facility enables investors to subscribe under various Schemes through SIP using a single application form and payment instruction.

Systematic Investment Plan Available Online & Offline for Direct & Regular investors to iron out intermittent market volatility and enable long term savings.

Salient features of SWP:

Step up SIP - This facility lets investors enhance the SIP amount during regular intervals. This allows you to make the most out of your SIP investments by increasing your contributions towards those schemes that are performing well. Additionally, you can also increase your investment amount when there is a hike in your pay.

Multi Scheme SIP Facility - The Facility enables investors to subscribe under various Schemes through SIP using a single application form and payment instruction.

Systematic Investment Plan Available Online & Offline for Direct & Regular investors to iron out intermittent market volatility and enable long term savings.

Salient features of CATP:

Step up SIP - This facility lets investors enhance the SIP amount during regular intervals. This allows you to make the most out of your SIP investments by increasing your contributions towards those schemes that are performing well. Additionally, you can also increase your investment amount when there is a hike in your pay.

Multi Scheme SIP Facility - The Facility enables investors to subscribe under various Schemes through SIP using a single application form and payment instruction.

Tax Applicability

Investment held for less than 12 months

Short Term Capital Gain Tax would be applicable. Any gains/profits would be taxed at 15% (plus applicable surcharge and cess).

Investment held for more than 12 months

Long Term Capital Gain Tax would be applicable. Gains/profits in excess of Rs. 1 lakh would be taxed at 10% without indexation (plus applicable surcharge and cess).

Any income received under this option would be considered as income for the investors and hence would be taxed at applicable tax slab rates.

Forms & Downloads

Investors also viewed

Don’t know where to start? Start here!

Frequently Asked Questions

Investment in this fund can be made in two ways:

o Direct Plan – Subscribing to units of the fund directly from the fund house i.e.: Aditya Birla Sun Life Mutual Fund

o Regular Plan – Subscribing to units of the fund from a mutual fund distributor or broker offering the same

The only other difference between these two plans is that they charge different expense ratios and thus have different NAVs. Their investment portfolio however is identical.

To redeem your investments in the direct plan of Aditya Birla Sun Life Arbitrage Fund, you can use their mobile app or desktop webpage and select a specified amount or number of units to redeem. For investments made in the regular plan through Registrar and Transfer Agent (RTA) or Mutual Fund Distributor (MFD), you can submit a duly signed redemption form to the respective RTA/MFD or redeem online through their portal, if available.

Yes, the Aditya Birla Sun Life Arbitrage Fund offers both SIP and lumpsum investing options to investors. The choice of mode of investing will be guided by your investing objective, risk appetite, investing term and affordability.

- Returns Calculator

1800-270-7000

1800-270-7000