-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

What is Aditya Birla Sun Life Pharma & Healthcare Fund? Meaning & Benefits

Mar 29, 2024

5 min

4 Rating

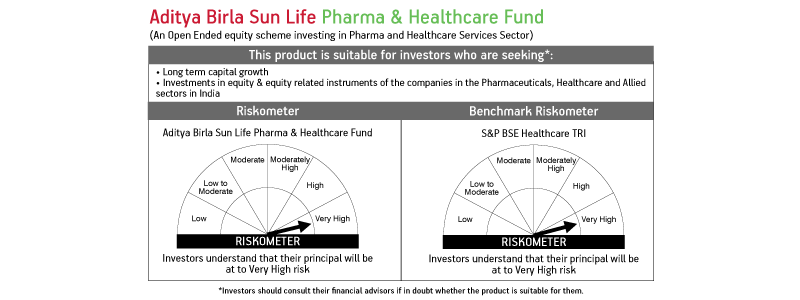

Are you interested in investing in India's rapidly growing healthcare sector? Aditya Birla Sun Life Pharma & Healthcare Fund tactically taps specialised sectoral expertise, spotting innovators sustaining market leadership through scientific discoveries and delivery efficiencies.

ABSL Pharma & Healthcare Fund Overview

The ABSL Pharma & Healthcare Fund focuses on India's high-growth healthcare sector by actively handpicking innovators who are pioneering solutions to improve lives appreciably. India's global leadership in supplying affordable essential generics and vaccines already makes the sector structurally attractive.

Meanwhile, lifestyle changes and government policy expanding healthcare access nationally sustain continued opportunities beneficially over the coming decades despite economic cycles affecting consumer sentiment periodically.

Complete in-house healthcare investing experience equips the expert team to identify competitive disruptors outpacing respectably. A selectivity application screens opportunities, maximising the upside consistency harvested through standards.

The fund aims to optimise risk-adjusted returns through quality ideas, blending growth with balance prudently.

Introducing Aditya Birla Sun Life Pharma & Healthcare Fund

The ABSL Pharma & Healthcare Fund focuses on investing in India's high-growth pharma, healthcare services and allied sectors using a concentrated sector-focused strategy for long-term wealth creation. With 4.8+ years of performance history, prudent diversification, seasoned fund management, and structural industry merits tactical allocation periodically.

Performance and Attributes Summary

Latest NAV (Net Asset Value per unit): Rs 25.79 (As of 15-Mar-2024)

Total Fund Assets: Rs 692 Cr (As of 28-Feb-2024)

Inception Date: 10-Jul-2019

Recommended Investment Horizon: 5+ years

Minimum Investment: Rs 1,000 for lumpsum

Note - Latest NAV of the Scheme is available on the website https://mutualfund.adityabirlacapital.com/

Note - For disclosure of quarterly AUM/ AAUM and AUM by Geography, please visit our website: https://mutualfund.adityabirlacapital.com/

Key Fund Features Benefits

Open Ended Scheme Structure: Allows continual entry/exits dynamically at NAV prices daily sans lock-ins

Minimum Investment: Rs 1000 onwards enhances affordability, attracting retail investors seamlessly

80% plus Equity Exposure: Harnesses long-term wealth creation potential optimally

0-20% Debt Assets: Manages liquidity needs while regulating volatility during uncertainties

Thus, the core hybrid structure of pharma mutual funds retains equity orientation that is reasonably consistent with projected uptrends in the healthcare sector. Moreover, accessibility and moderate risk constructs aid participation attractively.

Assessing Fees and Risk Parameters

b. Exit Loads If Redeemed Early: 1% of applicable NAV if exited on or before 30 days from the date of

allotment

c. Portfolio Risk Levels: IIt is very high given higher sector volatility traditionally

d. Ideal Investment Tenure: At least 5+ years recommended for smoothing interim fluctuations

Therefore, investors with sufficient risk appetite and investment horizons that temporally match projected industry growth benefit from investing through efficient sector expert-managed funds, avoiding comparatively self-managed pitfalls.

Building a Differentiated Sectoral Portfolio

Aditya Birla Sun Life Pharma & Healthcare FundScheme invests in companies taking into account the business fundamentals like nature and stability of business, prospects of future growth and scalability, financial discipline and returns, valuations in relation to broad market and expected growth in earnings, the company's financial strength and track record.

Top 10 Stocks in Portfolio (As on 28th Mar’24)

Stock Invested in |

Sector |

% of Total Holdings |

Sun Pharmaceutical Industries Ltd. |

Pharmaceuticals |

15.09% |

Cipla Ltd. |

Pharmaceuticals |

8.31% |

Torrent Pharmaceuticals Ltd. |

Pharmaceuticals |

7.50% |

Apollo Hospitals Enterprises Ltd. |

Hospital |

6.52% |

Sanofi India Ltd. |

Pharmaceuticals |

4.33% |

Fortis Healthcare Ltd. |

Hospital |

4.29% |

Zydus Lifesciences Ltd. |

Pharmaceuticals |

4.25% |

Ajanta Pharma Limited |

Pharmaceuticals |

4.16% |

Lupin Ltd. |

Pharmaceuticals |

3.85% |

Alkem Laboratories Ltd. |

Pharmaceuticals |

3.69% |

Source - https://mutualfund.adityabirlacapital.com/products/wealth-creation-solutions/aditya-birla-sun-life-pharma-and-healthcare-fund

Conclusion

ABSL Pharma and Healthcare Fund offers a sensible avenue for participating in India's high healthcare growth potential by outsourcing expertise through a focused sector fund managed professionally.

Therefore, allocating selectively alongside other key sectors aids portfolio construction dynamically targeting alpha unlocks, overcoming limitations of self-managed piecemeal stock picking comparatively.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000