-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

Investment Objective

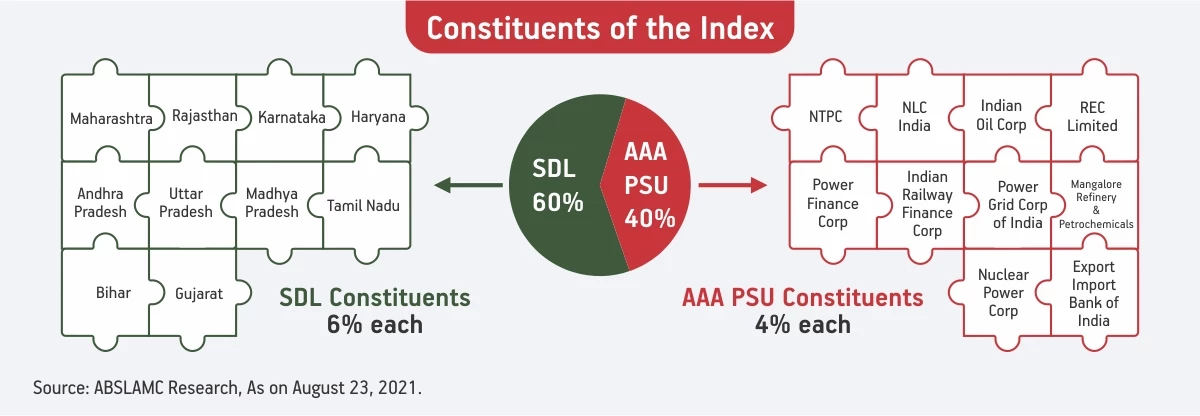

The investment objective of the scheme is to track the Nifty SDL Plus PSU Bond Sep 2026 60:40 Index by investing in PSU Bonds and SDLs, maturing on or before September 2026, subject to tracking errors.

This product is suitable for investors who are seeking

- Income over longer term

- Open ended Target Maturity Index Fund that seeks to track Nifty SDL Plus PSU Bond Sep 2026 60:40 Index

Fund Quants as of 30th June 2023

- Total Net Assets (Cr) :10,584.82

- The Average Maturity Of Complete Portfolio (Yrs) :2.89

- YTM (%) :7.44%

- Mark to Mkt (%) :99.65%

- Modified Duration (Yrs) :2.47

- Mac Duration :2.59

Fund Details

- Fund Type - Open-Ended

- Category - Other

- Sub- Category - Index Funds

- Min Investment - Minimum of Rs.500/- and in multiples of Re. 1/- thereafter

- Fund Manager - Mr. Mohit Sharma

- Latest NAV - 11.261 (as on 02-May-2024)

- Inception Date - Sep 24, 2021

View Full Details

Fund Performance

Trailing Return

Funds are bucketed on various parameters with respect to other funds in their category.

*Annualized returns are displayed for 1 year and above.

*Annualized returns are displayed for 1 year and above.

Annualized Returns

Fund Management

-

Mr. Mohit Sharma

Total Experience : 15 years

View Full ProfileMohit Sharma is a Senior Fund Manager with Aditya Birla Sun Life AMC Limited (ABSLAMC), with total experience of over 15 years.

Mohit has been part of ABSLAMC for last 5 years. His prior experience include stints at Standard Chartered Bank, ICICI Bank, Irevna Limited (Subsidiary of CRISIL) and as an entrepreneur.

br> Mohit did his Management Studies from IIM Calcutta (2005) and Engineering studies from IIT Madras (2003).

View Fund Managed by

Load More

Total Schemes managed by {fundmanagername} is {fundmanagerfundcount}

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

To check an all-time best return rate for equity funds, check how they've performed in the last 3 or 5 years.

Check your investment performance

Use this tool by entering any amount you would have invested to calculate how much it would be worth today.

I had invested

as an

CALCULATE RETURN

Rs

Minimum Amount is Rs 500

in

Select the type of Fund

Fund

Select the Fund name

as an

Select Lumpsum or frequency of SIP

starting on

Select the date invested

Your Investment Summary

- Investment AmountRs 5000

- Initial units per month 29.5

- Current valueRs 50,000

- Current NAV value 260

- Current Units 30

-

XIRR

5.10%

Internal rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals.

-

Benchmark XIRR

8%

Internal Rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals for respective benchmark index.

Fund Summary

Entry Load

Exit Load

Load Comments

NIL

NIL

Highlights

- Benefit of 5-Year indextion

- Credit risk mitigated as part of design

- No Duration risk at time of maturity

- Low minimum investment

Why should you invest in this fund now?

- Provides predictable reasonable returns : By buying and holding fixed income SDLs and PSU bonds, the fund focuses on earning predictable returns for its investors. The 5-year term appears as ideal period to maximise yields.

- Scheme has a fixed maturity : This fund has fixed maturity (30th September 2026), making it amenable to financial planning.

- Managed risks : The fund only invests in top SDLs and AAA rated PSU bonds, increasing quality and safety of your investment. 5-year Roll-down strategy reduces interest rate risk. Passive investing style also reduces active stock selection risk of the portfolio.

- Lends liquidity to your portfolio : The fund is open-ended with no lock-in, keeping your investments liquid while providing reasonable returns and stability.

- Tax efficiency : Debt funds with holding period of more than 36 months qualify for long term capital gains and indexation benefit in taxation. Indexation helps in adjusting the purchase price of the investments and in turn lower the tax liability. Since the fund has a maturity tenure of 5 years, it gets the indexation benefit and capital gains tax efficiency.

- Low costs and low minimums : The fund has lower cost of investing than actively managed funds. It also provides access to bonds and SDLs otherwise requiring high investments, at low minimums.

Why Debt Index funds?

Investors looking for fixed income securities can typically choose between traditional saving instruments, bonds or debt mutual funds. Debt market yields are becoming attractive against the backdrop of conducive economic environment - moderated inflation, sustained economic growth, monetary policy conviction on interest rates etc.

Passive debt funds can be an option here for investors. Passive debt funds combine the benefits of predictability of returns with the safety of high-quality debt offering investors, the means to capitalise on this rising fixed income opportunity.

Debt Index funds are mutual funds that seek to mimic the performance of an underlying index by investing in the same debt securities, in the same proportion of the index it tracks. Following a passive investing strategy, these funds provide a transparent, tax-efficient way to invest in high quality debt instruments to participate in the fixed income opportunity in the market.

Aditya Birla Sun Life Nifty SDL Plus PSU Bond Sep 2026 60:40 Index Fund

(An open ended scheme tracking the Nifty SDL Plus PSU Bond Sep 2026 60:40 Index)

This product is suitable for investors who are seeking*

- Income over longer term

- Open ended Target Maturity Index Fund that seeks to track Nifty SDL Plus PSU Bond Sep 2026 60:40 Index

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Show More

Similar Funds

-

View Details

Aditya Birla Sun Life CRISIL IBX 60:40 SDL + AAA PSU - Apr2027 Index Fund

Nav

11.0790.01(0.06%)

-

View Details

Aditya Birla Sun Life Nifty 50 Index Fund

Nav

226.3160.43(0.19%)

-

View Details

Aditya Birla Sun Life CRISIL IBX Gilt Apr 2029 Index Fund

Nav

11.2670.02(0.14%)

-

View Details

Aditya Birla Sun Life CRISIL IBX 50:50 Gilt plus SDL – Apr 2028 Index Fund

Nav

11.2350.01(0.07%)

-

View Details

Aditya Birla Sun Life CRISIL IBX Gilt – April 2026 Index Fund

Nav

11.1650.01(0.07%)

-

View Details

Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund

Nav

16.0180.06(0.38%)

-

View Details

Aditya Birla Sun Life CRISIL IBX 60:40 SDL + AAA PSU - Apr 2025 Index Fund

Nav

11.1020(0.04%)

-

View Details

Aditya Birla Sun Life Nifty Midcap 150 Index Fund

Nav

20.9450.09(0.43%)

-

View Details

Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

Nav

18.820.01(0.06%)

-

View Details

Aditya Birla Sun Life Nifty Next 50 Index Fund

Nav

16.0320.27(1.7%)

-

View Details

Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund

Nav

11.1690.01(0.07%)

-

View Details

Aditya Birla Sun Life Nifty SDL Sep 2027 Index Fund

Nav

10.8870.01(0.06%)

Disclaimer

For further details on the Scheme, refer Scheme Information Document and Key Information Memorandum.

1800-270-7000

1800-270-7000