-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

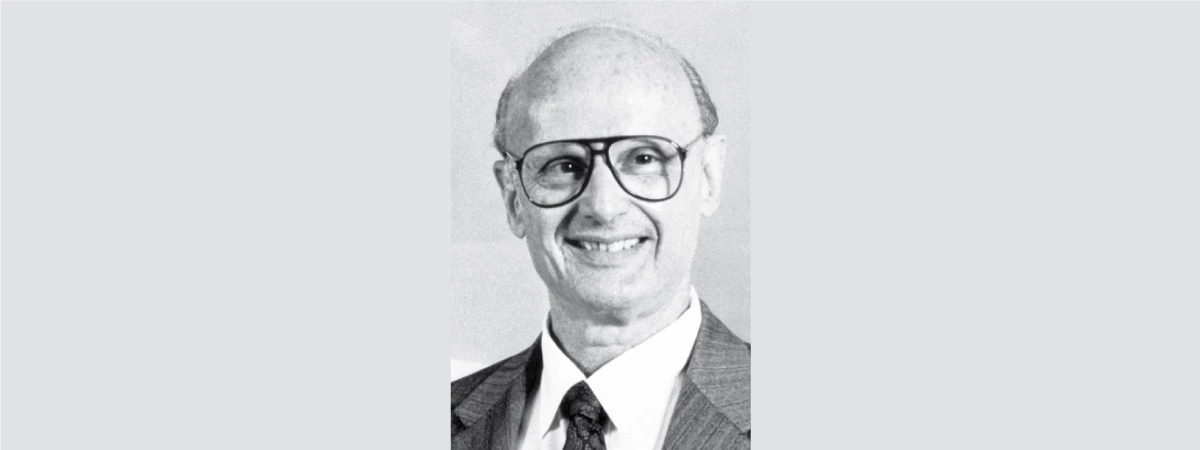

In remembrance of the pioneer of Modern Portfolio Theory

Jul 11, 2023

3 Mins Read

Amrita Panja

Amrita Panja

Listen to Article

“A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies.” - Harry Markowitz, Economist

You have possibly come across the terms like ‘diversification’ and ‘asset allocation’ in your investment journey. These are concepts that are fundamental to investment and endorsed by financial planning and investment management professionals worldwide.

Imagine it is the 1950s and someone says that the traditional belief that only investing in stocks with maximum potential is not the sure shot way to derive the best possible investment outcome. People would definitely take notice of such a theory that disrupts conventional ideas. That someone was none other than Nobel prize winning American economist, Harry Markowitz. Through his dissertation in 1952 at the University of Chicago on Portfolio Selection, Markowitz gave to the world what is called the Modern Portfolio Theory (MPT). The world of finance lost Markowitz in June this year but his legacy lives on. At Aditya Birla Sun Life AMC (ABSLAMC) Knowledge Centre, we thought of sharing the core ideas of his ground breaking work with our readers in remembrance of Markowitz and his contributions.

Modern Portfolio Theory (MPT) is a fundamental framework for investment management that aims to optimise investment decisions by balancing risk and return. MPT revolutionised the field of finance by introducing a quantitative approach to portfolio construction. Markowitz recognised that investors should not focus solely on the expected returns of individual assets, but also consider the interactions between assets and the overall portfolio.

At its core, MPT assumes that investors are rational and risk-averse individuals who seek to maximise their portfolio returns while minimising risk. MPT suggests that by diversifying investments across a range of assets, investors can reduce the overall risk of their portfolios without sacrificing potential returns.

Markowitz's key insight was that by diversifying investments across a range of assets with different risk and return characteristics, investors could achieve a more efficient portfolio. He mathematically formalized this concept by introducing the notion of risk and correlation in portfolio construction.

The key concept in MPT is the efficient frontier, a graph that illustrates the optimal portfolios that offer the highest expected return for a given level of risk. The efficient frontier is derived by analysing the historical performance, correlations, and volatilities of different assets and indicative return possibilities for a given level of risk tolerance.

MPT also emphasises the importance of asset allocation, which involves dividing an investment portfolio among different asset classes such as stocks, bonds, and cash. The optimal asset allocation depends on factors like an investor's risk tolerance, investment goals, and time horizon. MPT suggests that a well-diversified portfolio should contain a mix of assets with varying degrees of risk and return potential, as this can help reduce the impact of any single investment's performance on the overall portfolio.

Furthermore, MPT introduced the concept of the capital asset pricing model (CAPM), which provides a framework for calculating the expected return of an individual security or portfolio based on its systematic risk. The CAPM helps investors to quantify the relationship between risk and return and determine whether a particular investment is offering adequate returns based on its level of risk.

Investors can utilize MPT by following a few key principles: Focus on diversification to spread risk across different asset classes, industries, and geographic regions. Carefully assess one’s risk tolerance and align asset allocation accordingly. Regularly review and rebalance their portfolios to ensure they remain aligned with their investment objectives. It is important to note that while MPT provides a solid foundation for investment decision-making, it does have its limitations. MPT assumes that market prices are always efficient, and it relies heavily on historical data, which may not accurately predict future market conditions. It also assumes that investors are risk-averse and will always select the less-risky portfolio. Nevertheless, MPT continues to be an important theory in the field of finance, offering noteworthy insights into portfolio construction and risk management. The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). ABSLAMC has used information that is publicly available. The information gathered and the material used in this document is believed to be from reliable sources. (Image source: NobelPrize.org) Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

A revolutionary idea

Understanding the Efficient Frontier

Learning from the key principles

You May Also Like

Loading...

1800-270-7000

1800-270-7000