-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

The Artificial Intelligence (AI) Revolution: A Tour de Force of our times

Feb 12, 2024

5 Mins Read

Vinod Bhat

Vinod Bhat

Listen to Article

Blackrock in its 2024 Global Outlook, mentions the Intelligence Revolution driven by Artificial Intelligence (AI) as one of the mega forces of the future. They see the entire tech industry – led by a handful of large tech firms – pivoting their business focus to AI and the implications are likely to go beyond just the immediate focus on productivity gains.

For the uninitiated, AI is the science of creating intelligent machines. Artificial Intelligence refers to the simulation of human intelligence in machines that are programmed to think, learn, and problem-solve like humans. AI encompasses a wide range of technologies and applications, and it can be categorized into different facets based on its capabilities and functionalities. As a concept, it covers various subfields that include machine learning, natural language processing, neural networks, and deep learning.

AI is moving beyond just being a statistical engine (i.e. just predicting the next alphabet or word based on maths and probability) to a cognitive engine (i.e. able to know, learn and understand). That is, AI is progressing from just processing Natural Language to reasoning.

They showed examples of how Copilot could improve the productivity of an employee in Sales, Marketing, Procurement, Finance, and IT. For example, Copilot could help to create a marketing campaign, enable better sales targeting, help create purchase orders in time, and enable a programmer to write code faster. It seems employees in the US are reporting that they are saving 30 mins per day and knowledge workers are finishing their tasks 37% faster using Copilot. I got some anecdotal data from a friend of mine who runs a software firm in Pune. He told me that product development teams who have given a Copilot license to their employees 40% improvement in their productivity plus better code quality. A Chief Technology Officer (CTO) in one of the panel discussions said that he even uses Copilot as a sounding board to discuss strategic issues and suggested trying it out. Another friend of mine, who is the CTO of a large manufacturing company in Pune, has been trying out Copilot for some time. He informed me that prompt engineering is key here and it can take some iterations to get good results. An example here is Indigo's 6E-skai chatbot built on GPT-4 which helps users with flight bookings. It seems that just in Banking and Financial Services, Microsoft has collated 75-80 use cases which various corporates are working on. The key here is to take small steps linked to the organization’s digital and personnel capability. As per a study by the consulting firm IDC, the payback period for an AI investment can be as short as 14 months and the ROI can be 3.5x ROI. This is still in the nascent stages. Trust and security are key issues here. The outlook on artificial intelligence (AI) in businesses and industries is marked by continuous growth, innovation, and transformative impact across various sectors. Its multifarious utility and implementation across industries make it a megatrend of our times. In fact, Blackrock in its outlook suggests that their early research shows a potential positive correlation between a pickup in AI patents and broad earnings growth. We need to watch this space closely given the pace and intensity of innovation taking place.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

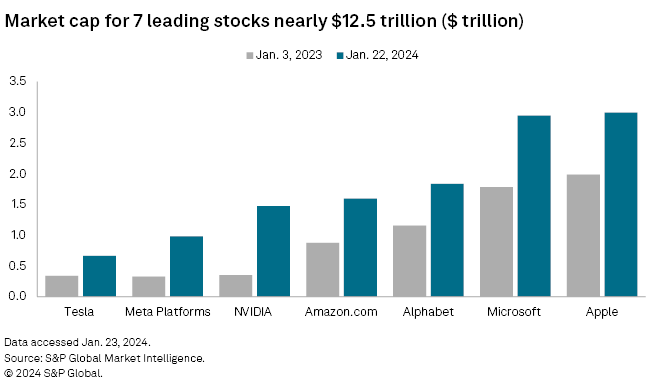

In the US, mega-cap tech stocks have rallied sharply year-to-date, outperforming the broader S&P 500 index, driven by optimism about the large growth opportunity coming from AI. Over the last year, a new moniker of the “Magnificent Seven” has been popular. The Magnificent Seven stocks are megacap companies focused and capitalizing on tech growth trends including AI, cloud computing, and cutting-edge hardware and software. These companies have gained an outsized influence on the S&P 500’s direction as they have collectively nearly doubled in market capitalization to about $12.5 trillion, up $5.67 trillion from the start of 2023.

To get a sense of the key trends in AI and see what new AI tools and solutions have been developed for different industries, I attended the Microsoft AI Tour convention held in Mumbai on 31 January, 2024.

After New York and London, Microsoft had selected Mumbai as the venue for the third edition highlighting the importance of India in its AI agenda. The theme for the convention was ‘Copilot. Microsoft Copilot is a chatbot developed by Microsoft, based on a large language model.

The key takeaway for me was that you can love AI or hate AI. But you can't ignore AI.

Microsoft highlighted 3 levels of AI adoption for enabling a transformation:

Level 1: Create, Discover, and Automate using Copilot even if we don't have any IT background.

Level 2. Build your own Copilots to develop transformational solutions using AI.

Level 3. Co-innovate by partnering with AI.

I am planning to experiment with Copilot and see how it goes. Will keep you all posted.

You May Also Like

Loading...

1800-270-7000

1800-270-7000