-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Why continuing SIP in a falling market could be your best bet?

Jan 07, 2020

5 mins

4 Rating

The stock market has been volatile during the last year 20191. As an SIP investor, especially if you began SIPs during or just before the fall, you could be witnessing negative returns from your SIP investments. This may worry you and prompt you to stop your SIPs and wait till the market recovers. It’s natural to worry about and track your investments – while traditional saving instruments may be accumulating interest, seeing SIP investments lose value can be unnerving. But is this really the right response to a falling market? Probably not... and here’s why...

Markets do not always remain down

The fundamental truth of stock market behaviour is that its cyclical - what goes down eventually comes back up and vice versa. Although markets had been constantly declining since June 2019, it has recently began recovering with certain positive announcements by the government. Not ‘lack of investing’, but ‘long term investing’ could be the cover for short term volatility.

SIP can benefit you differently in a falling market

One of the biggest plus points of SIP investing is the benefit of rupee cost averaging. This means that as you invest a fixed amount periodically, you can buy more units when prices are low and less units when prices are high. This reduces the need to time the market.

Let’s take a simple example to understand this, say you decide to invest INR 20,000 in gold each month – in the first month gold costs say INR 2,000 per gm, means you can buy 10gms of gold. Say the price of gold falls to INR 1,800 per gm in the next month – you will get more gold – in the same INR 20,000 – 11.11gms. So, although it may seem your investment is losing value you are actually getting more grams for the same amount which you can take advantage of when the gold prices eventually increase. SIPs work on the same rationale.

*The above gold price figures are taken for illustration purpose only.

Continuing an SIP v/s stopping an SIP

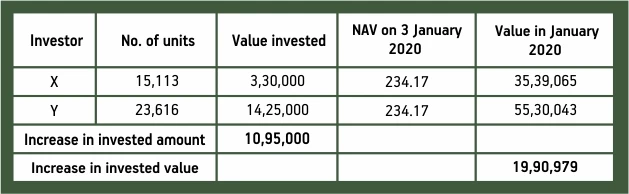

For instance, let’s look at how an SIP started in Aditya Birla Sun Life Large Cap Fund (An Open ended equity scheme predominantly investing in large cap stocks) at its inception would have performed.

To illustrate, let’s suppose Investor X and Investor Y both began with a modest SIP of INR 5,000 each month at the inception of this fund – 30th August 2002. In the early months of 2008, the stock market faced a crash – and the Fund’s NAV dropped from INR 82.13 to INR 69.08 in a month in January 2008.

Investor X wary of losing money stopped his SIP in the Fund – having accumulated 15,113 units till January 2008. Investor Y on the other hand continued his SIP investments. The position of both their investments by January 2020 stands as follows:

Data Source: https://www.advisorkhoj.com/mutual-funds-research/historical-NAV/Aditya-Birla-Sun-Life-Frontline-Equity-Fund-Growth

The table shown above is for illustration purpose only and does not assure or guarantee any returns. For SIP calculations above, the data assumes investment of Rs. 5000/- on 1st day of every month or the subsequent working day. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return). Past performance may or may not be sustained in future. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax advisor.

Investor Y today would have extra investment worth almost INR 20 lacs by investing just under INR 11 lacs more than Investor X.

In fact, it’s important to note that the additional investment of INR 11 lacs was not a lump sum investment made at the time Investor X exited the SIPs but investment which has accumulated steadily over 10 years – this may further increase the CAGR earned on the investment.

Continuing SIP by Investor Y has in fact resulted in him doubling his additional investment amount, an opportunity which Investor X lost out on due to fear of earning negative returns.

Investor SIP strategy during falling markets

As an SIP investor you should thus ignore the short term negative returns that your investment may earn during falling markets. By continuing your SIPs you can accumulate more units during falling prices, in fact you can even step up your SIP allocation to take advantage of this. This can help augment your wealth when markets rise.

Be patient and stay clear from day to day tracking of your SIP investments. Staying committed to your SIPs especially in falling markets can eventually propel you towards achieving your long-term goals.

Apart from benefiting from rupee cost averaging, you can also benefit from the power of compounding that SIPs offer to multiply your wealth.

Sources: 1https://tradingeconomics.com/india/stock-market

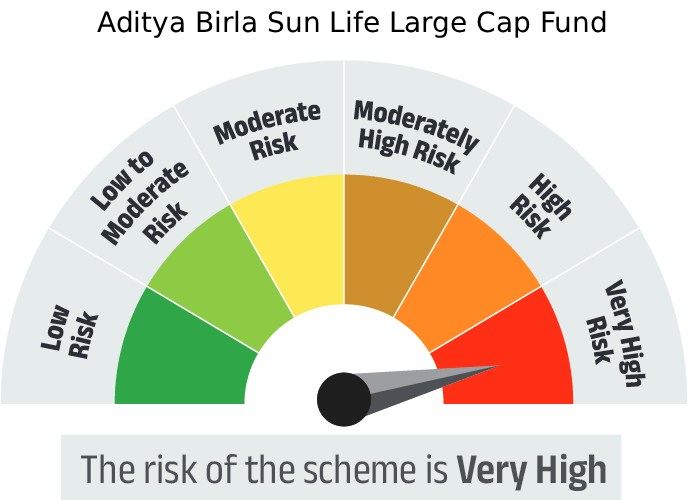

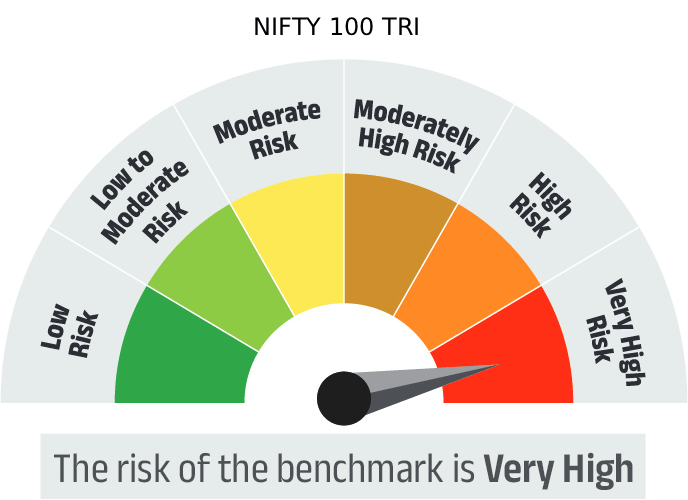

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Large Cap Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000