-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

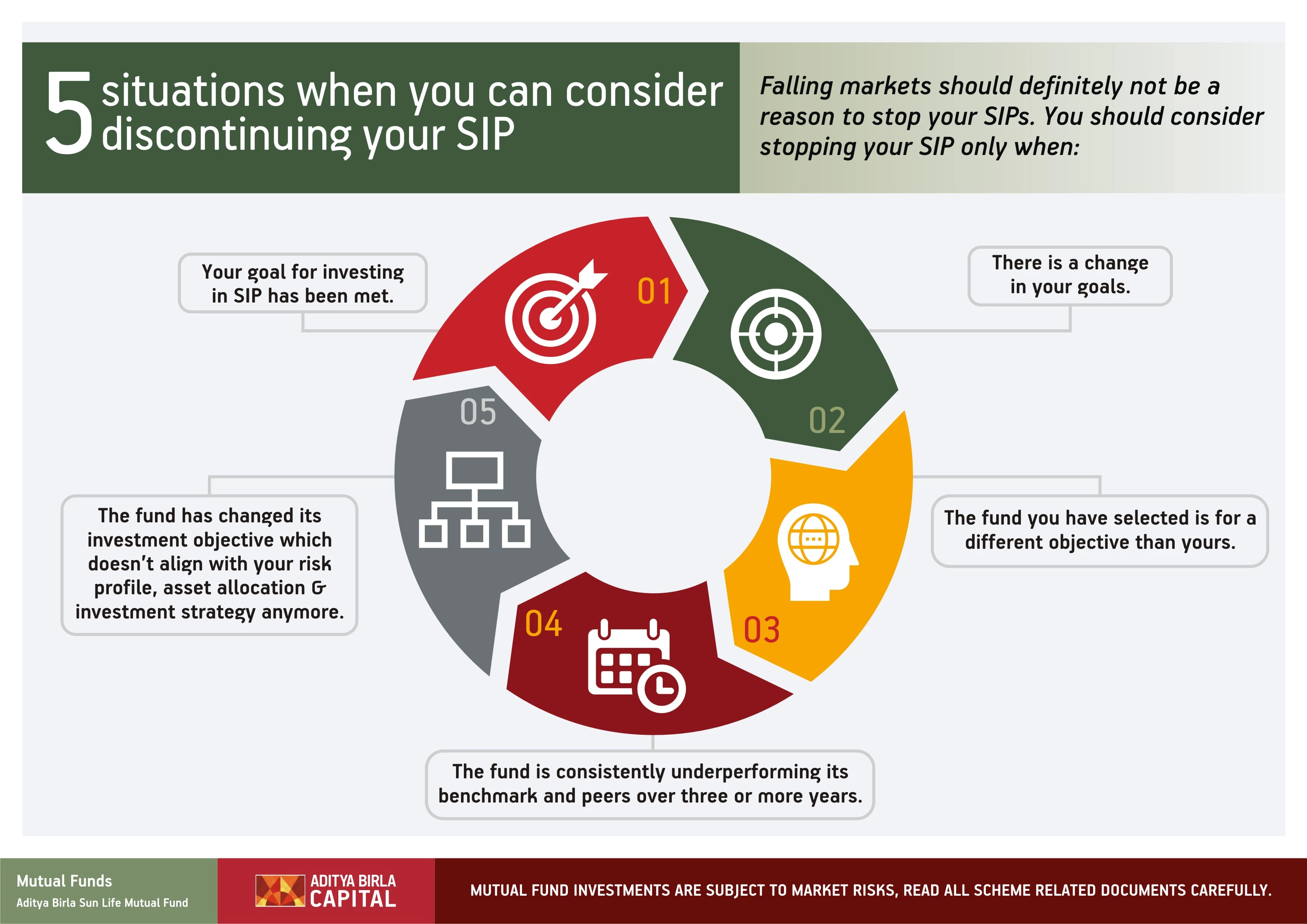

5 Situations When You Can Consider Discontinuing Your SIP

Nov 01, 2018

3 mins

5 Rating

The markets are seeing some ups and downs lately which have got many investors on tenterhooks.

While you may be losing sleep about your decision to invest in an SIP, it’s important to remind yourself one of the important features of SIP - it helps you reduce the risk of timing the market and average costs over time, by buying more units when prices are low and fewer units when prices are high. Hence, in the falling market scenario, you should continue your SIP to accumulate units at lower prices, which will help lower the average cost of your mutual fund investment.

Falling markets should definitely not be a reason to stop your SIPs; in fact it’s an opportunity to invest more.

So when should you stop your SIP?

You should consider stopping your SIP only when:

- Your goal for investing in SIP has been met.

- There is a change in your goals. Everybody invests with a set financial goal in mind. Say, you started an SIP to buy a house 5 years later. However, you change your plans in between since you are relocating abroad. You can then consider stopping your SIP and invest in a way that is in sync with your other/new goals.

- You realize that the fund you have selected is for a different objective from your reason of investing in the fund. There’s a possibility that you may not have fully analyzed the risks associated with the fund or its style of investment at the time of the investment. Just assess the fund properly again and consider stopping the SIP if you feel it won't meet your financial goals.

- You notice that the fund in which you have done SIP is consistently underperforming its benchmark and peers for 3 or more years. However, this can be a little tricky. Sometimes, the underperformance could be just a short-term phase. So, never make this decision in haste. Check if your fund is constantly underperforming and putting your investment at risk. Only then, should you think about discontinuing it.

- There is a change in the investment objective of the fund and the new objective does not align with your risk profile, asset allocation and investment strategy. In such cases, you can consider stopping the SIP and redeeming the accumulated amount from that particular fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000