-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

All you need to know about a Fund of Fund Scheme

Mar 25, 2021

3 mins

5 Rating

Fund of Fund schemes (FoFs) are mutual fund schemes which invest primarily in other schemes of the same mutual fund or other mutual funds. Thus, their performance is driven by the performance of the underlying schemes.

Why one may invest in FOF schemes:

Diversification: These schemes offer fund manager and fund house diversification in addition to asset class diversification in a single basket

Ease of management: Investors can manage their portfolio asset allocation through a single scheme instead of tracking multiple funds.

Professional Expertise: The fund manager proactively finetunes the allocation to different funds based on prevailing market conditions

At the same time, fund of fund schemes may have certain disadvantages.

Higher expense ratio: The total expense ratio for FoFs can be higher as investors can be charged the fees of both underlying fund and the FoF scheme.

Possibility of portfolio overlap: There is a possibility that certain holdings in underlying funds may overlap increase exposure to a particular stock or security.

That being said, FoF schemes offer investors a simple investment solution with an aim to enable investors to professionally diversify their portfolio without the hassles of managing multiple schemes.

Aditya Birla Sun Life Mutual Fund offers one such Fund of Fund scheme which aims to offer investors an easy one-stop option for their portfolio management needs.

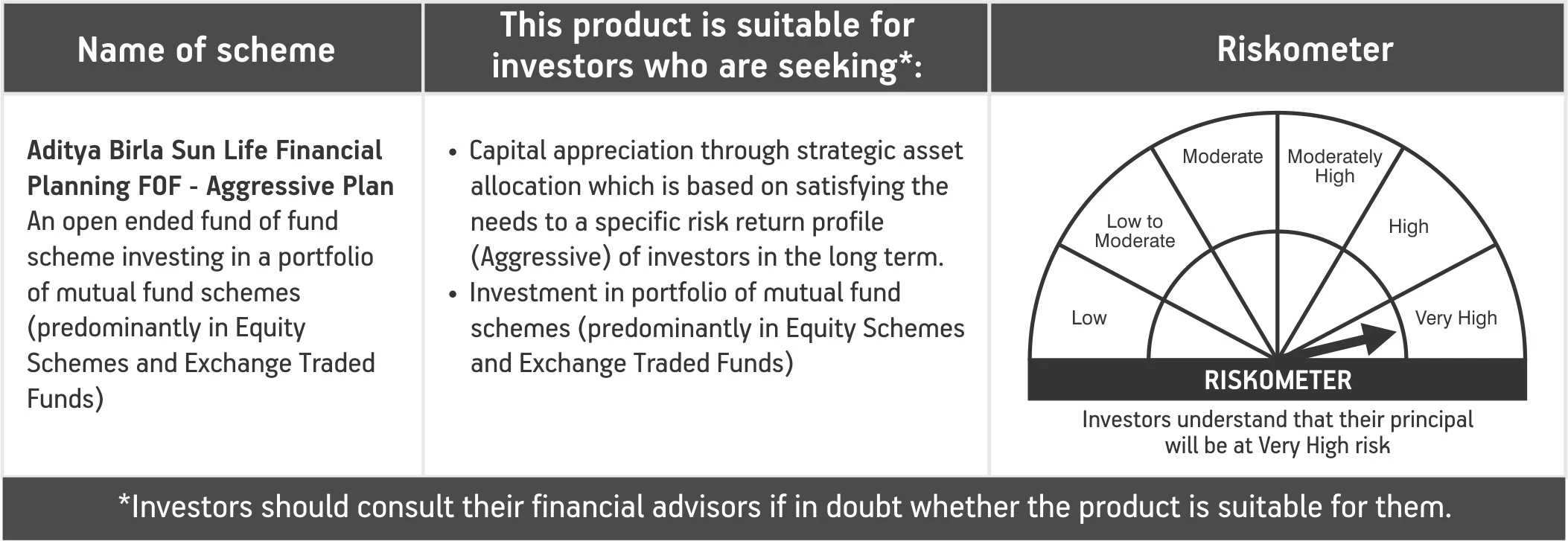

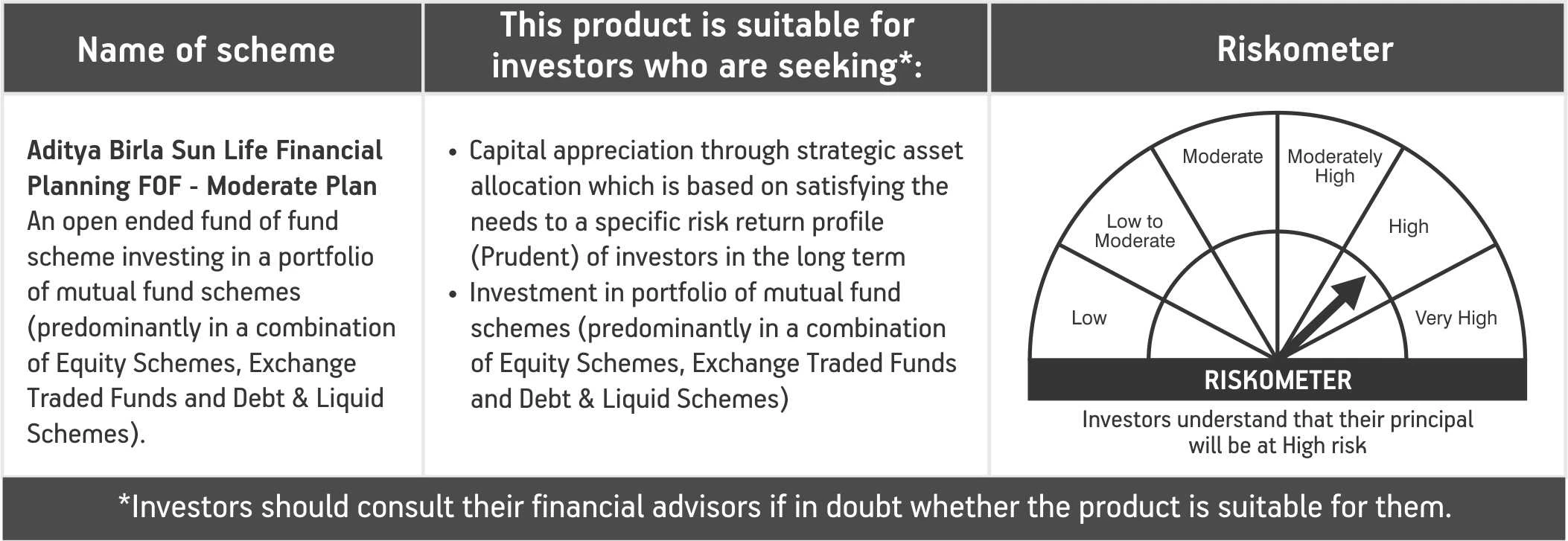

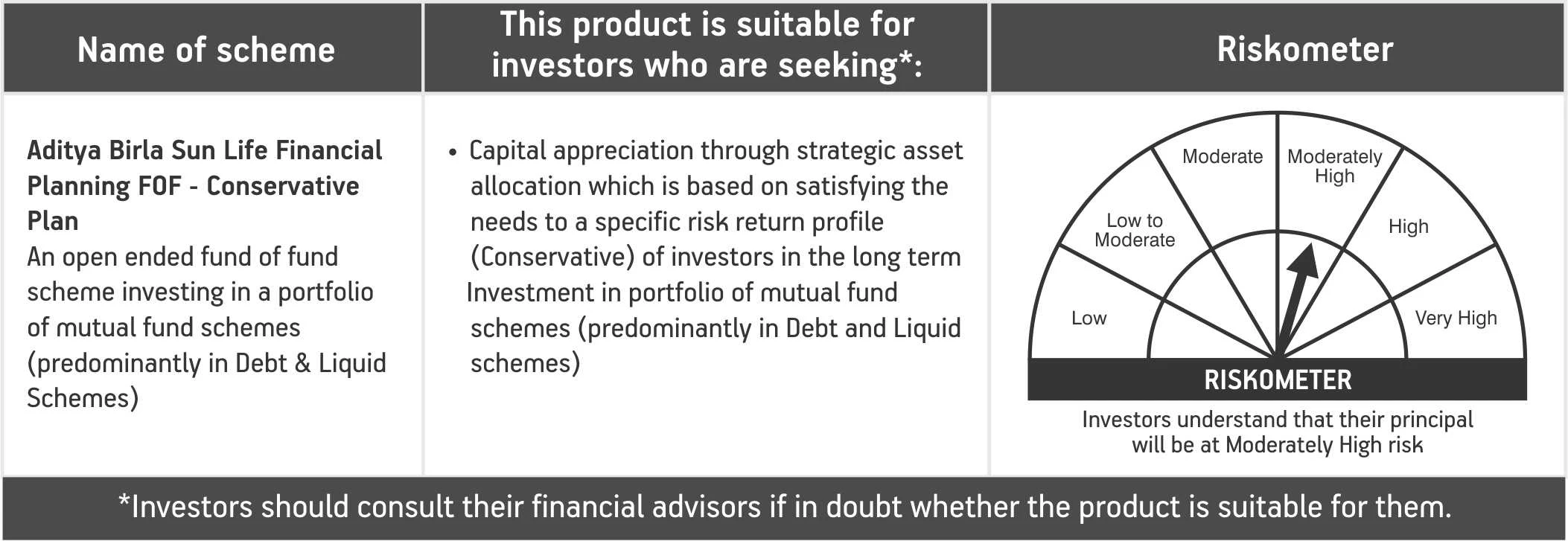

Titled Aditya Birla Sun Life Financial Planning FoF, the open-ended fund of fund scheme invests in a portfolio of mutual fund schemes. The investment objective of the scheme is to generate returns by investing in portfolio of equity schemes, ETFs and debt schemes as per the risk-return profile of investors.

The scheme offers three plans namely Aggressive Plan, Moderate Plan and Conservative Plan to cater to the different risk appetites of investors. Each of these 3 plans has a strategic asset allocation which is based on satisfying the needs of a specific risk-return investor profile:

Aggressive Plan: This plan invests predominantly in equity schemes and and Exchange Traded Funds & could be suitable for investors with very high-risk appetite in the long term.

Moderate Plan: This plan invests in a combination of Equity Schemes, Exchange Traded Funds and Debt & Liquid Schemes.

Conservative Plan: This plan predominately invests in debt and Liquid schemes.

For more information on the scheme, please refer SID/KIM of this scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000