-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Equity Update for the Fortnight - July 2018 - I

Aug 11, 2018

5 mins

4 Rating

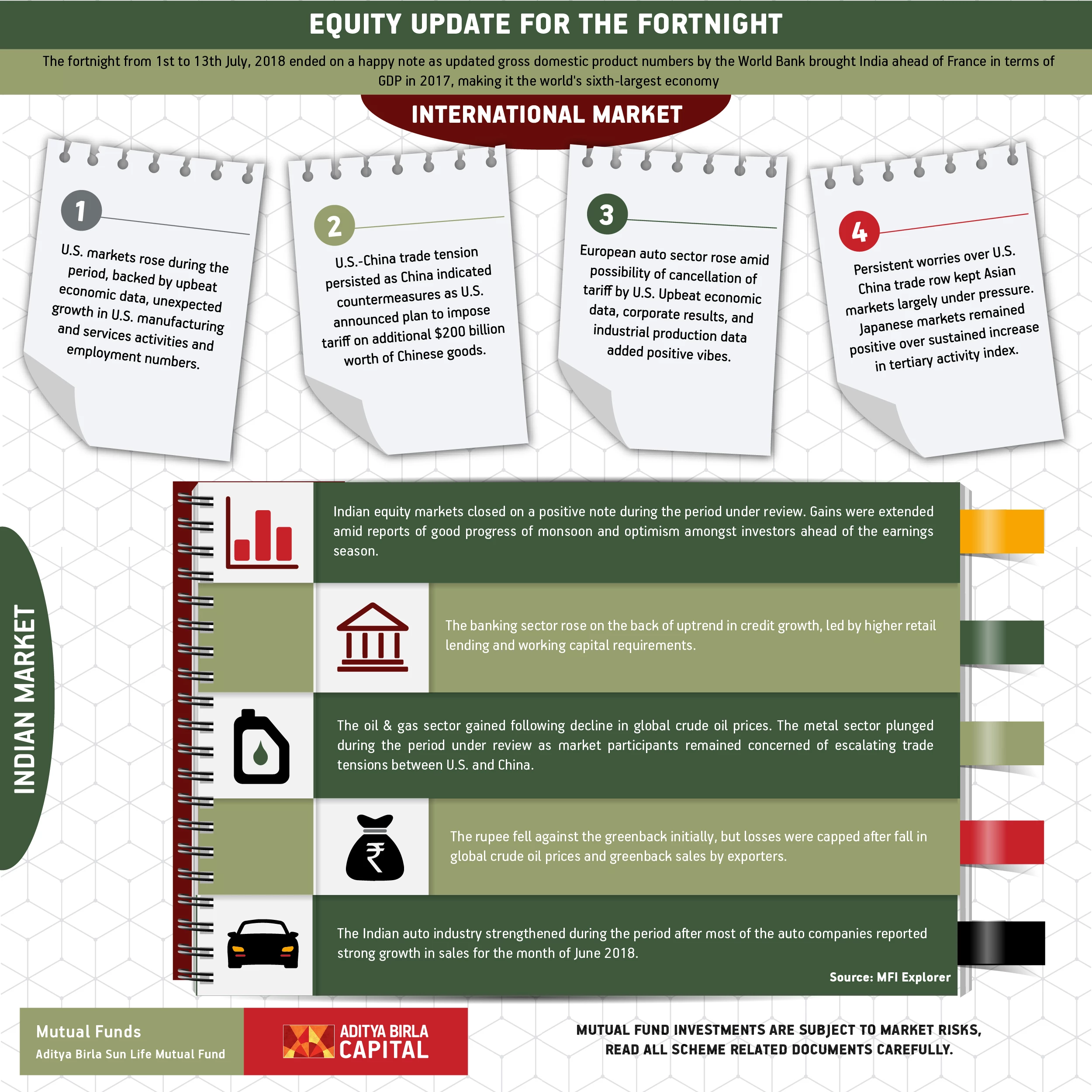

The fortnight from 1st to 13th July, 2018 ended on a happy note as updated gross domestic product numbers by the World Bank brought India ahead of France in terms of GDP in 2017, making it the world's sixth-largest economy

International Market

U.S. markets rose during the period, backed by upbeat economic data, unexpected growth in U.S. manufacturing and services activities and employment numbers.

U.S.-China trade tension persisted as China indicated countermeasures as U.S. announced plan to impose tariff on additional $200 billion worth of Chinese goods.

European auto sector rose amid possibility of cancellation of tariff by U.S. Upbeat economic data, corporate results, and industrial production data added positive vibes.

Persistent worries over U.S. China trade row kept Asian markets largely under pressure. Japanese markets remained positive over sustained increase in tertiary activity index.

Indian Market

Indian equity markets closed on a positive note during the period under review. Gains were extended amid reports of good progress of monsoon and optimism amongst investors ahead of the earnings season.

The banking sector rose on the back of uptrend in credit growth, led by higher retail lending and working capital requirements.

The oil & gas sector gained following decline in global crude oil prices. The metal sector plunged during the period under review as market participants remained concerned of escalating trade tensions between U.S. and China

The Indian auto industry strengthened during the period after most of the auto companies reported strong growth in sales for the month of June 2018.

The rupee fell against the greenback initially, but losses were capped after fall in global crude oil prices and greenback sales by exporters.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000