-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight - May 2019 - I

May 25, 2019

4 mins

5 Rating

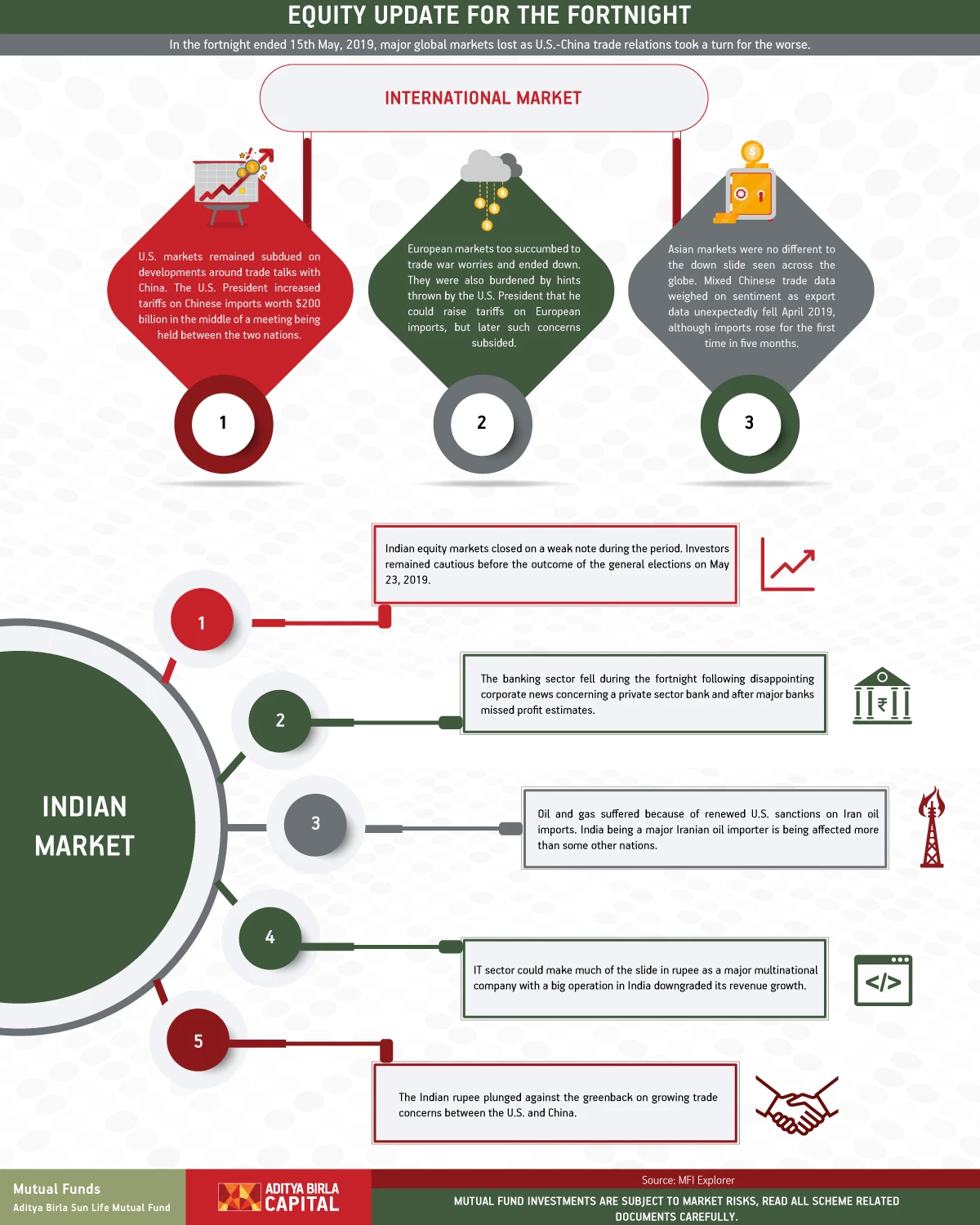

In the fortnight ended 15th May, 2019, major global markets lost as U.S.-China trade relations took a turn for the worse.

International Market

U.S. markets remained subdued on developments around trade talks with China. The U.S. President increased tariffs on Chinese imports worth $200 billion in the middle of a meeting being held between the two nations.

European markets too succumbed to trade war worries and ended down. They were also burdened by hints thrown by the U.S. President that he could raise tariffs on European imports, but later such concerns subsided.

Asian markets were no different to the down slide seen across the globe. Mixed Chinese trade data weighed on sentiment as export data unexpectedly fell April 2019, although imports rose for the first time in five months.

Indian Market

Indian equity markets closed on a weak note during the period. Investors remained cautious before the outcome of the general elections on May 23, 2019.

The banking sector fell during the fortnight following disappointing corporate news concerning a private sector bank and after major banks missed profit estimates.

Oil and gas suffered because of renewed U.S. sanctions on Iran oil imports. India being a major Iranian oil importer is being affected more than some other nations.

IT sector could make much of the slide in rupee as a major multinational company with a big operation in India downgraded its revenue growth.

The Indian rupee plunged against the greenback on growing trade concerns between the U.S. and China.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000